Preview

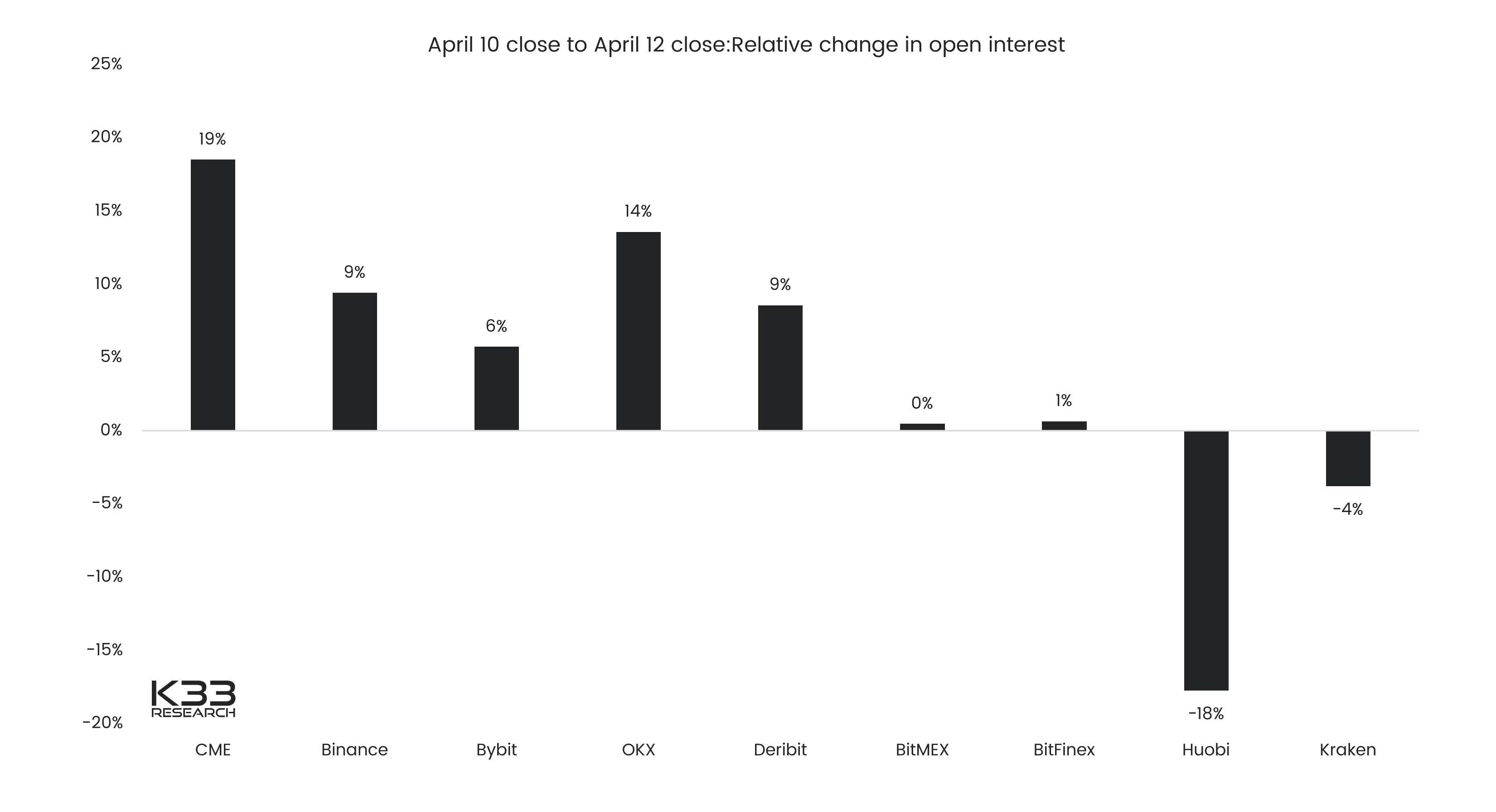

CME and Binance seeing the largest growth in open interest

CME has experienced an open interest growth of 19% since the Monday open and saw the largest increase in open interest among all derivatives venues. Binance has seen a 9% growth in part subdued by a late Monday short squeeze.

Preview

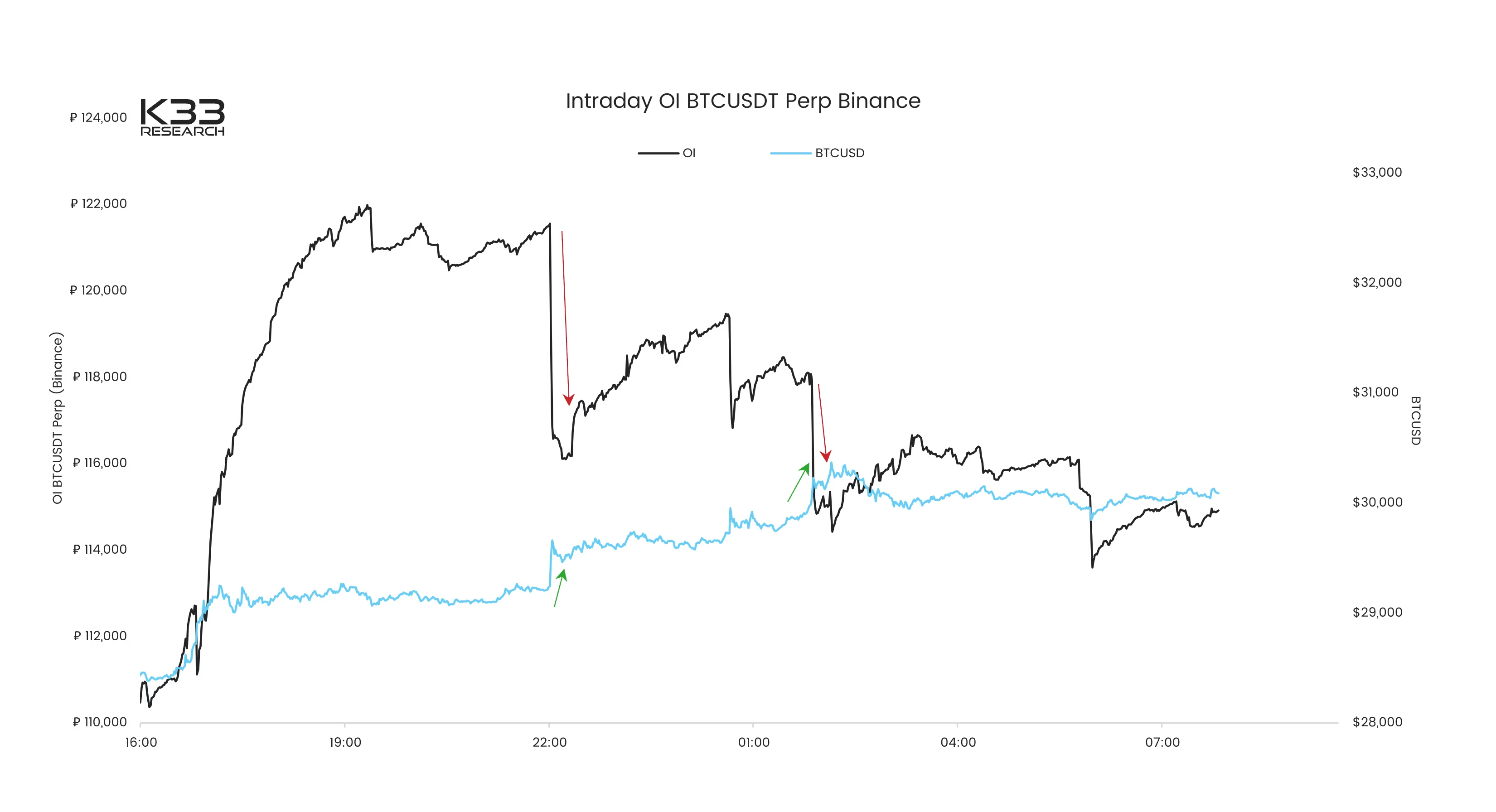

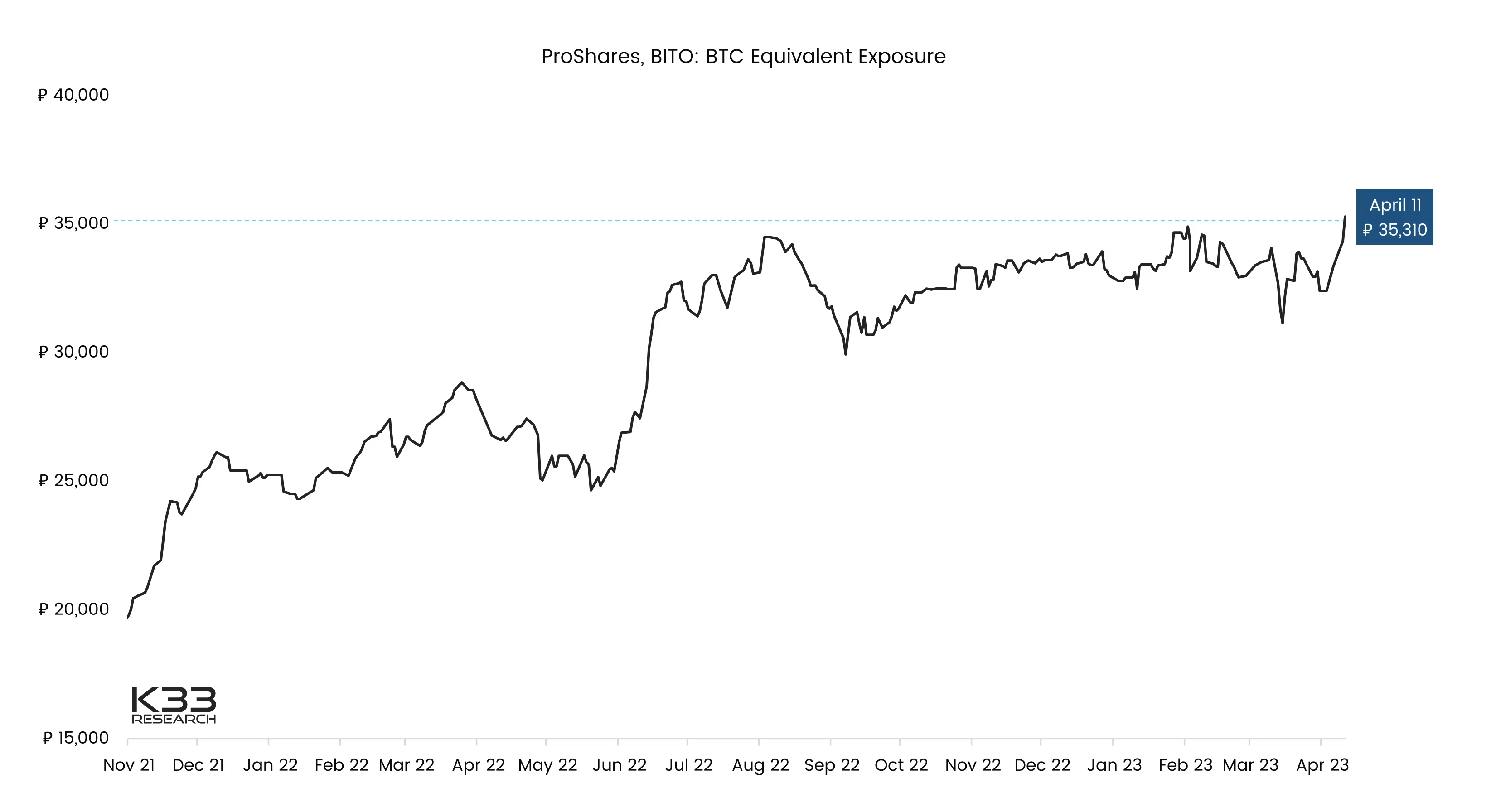

A push ignited by active market participants

Preview

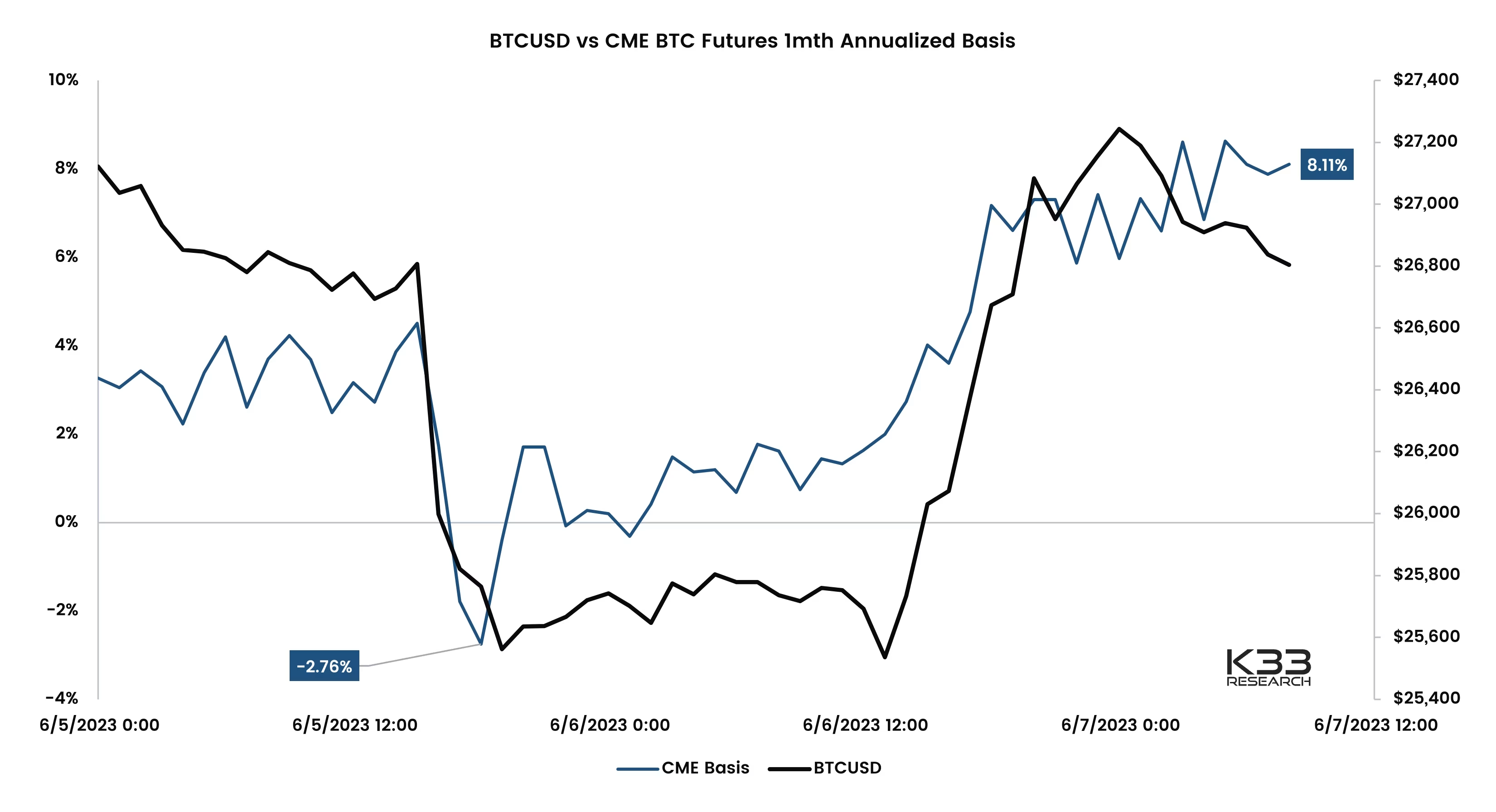

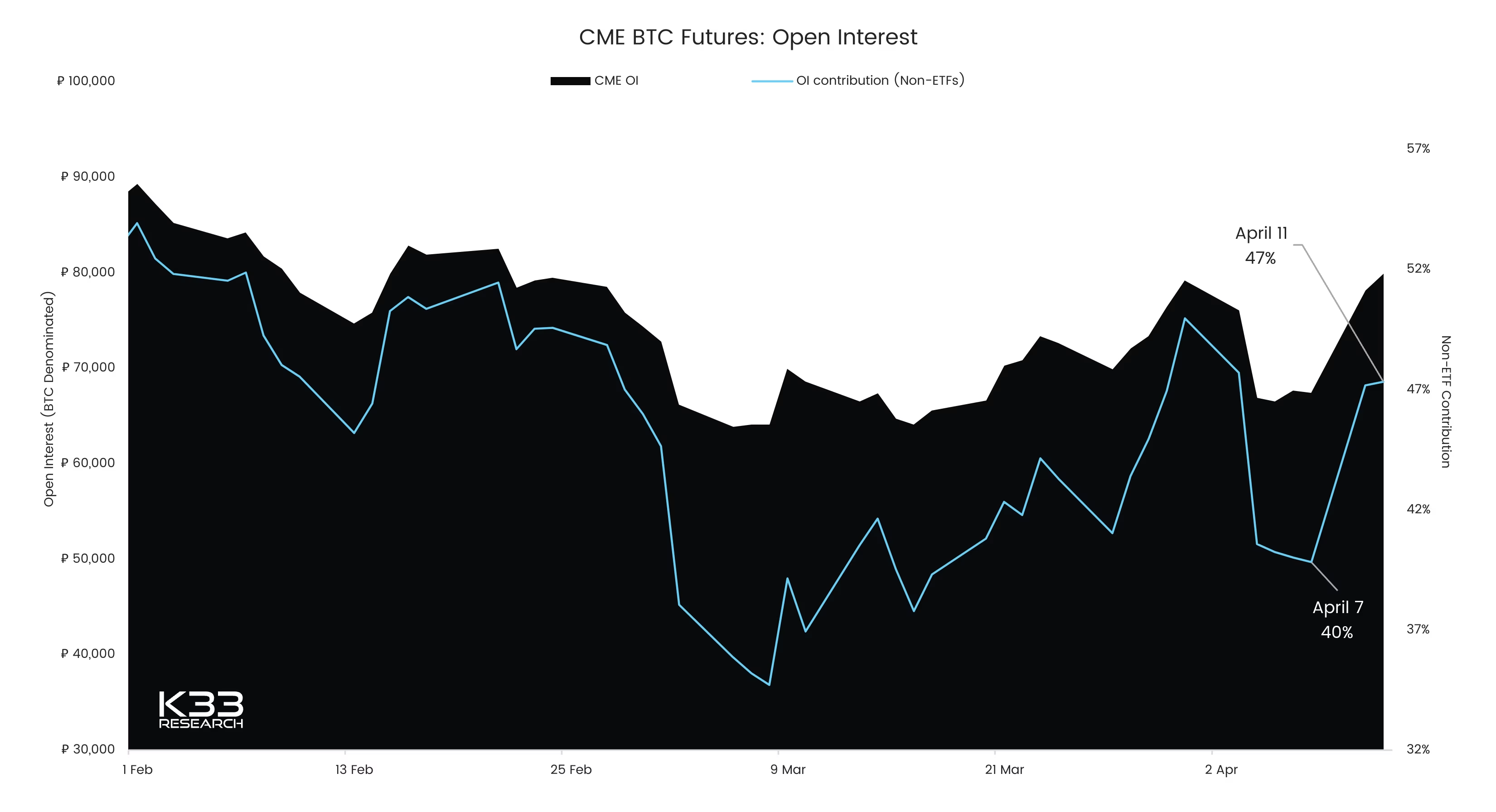

But ETP traders also contribute to the elevated OI

Preview