Interest rates/Policy effects.

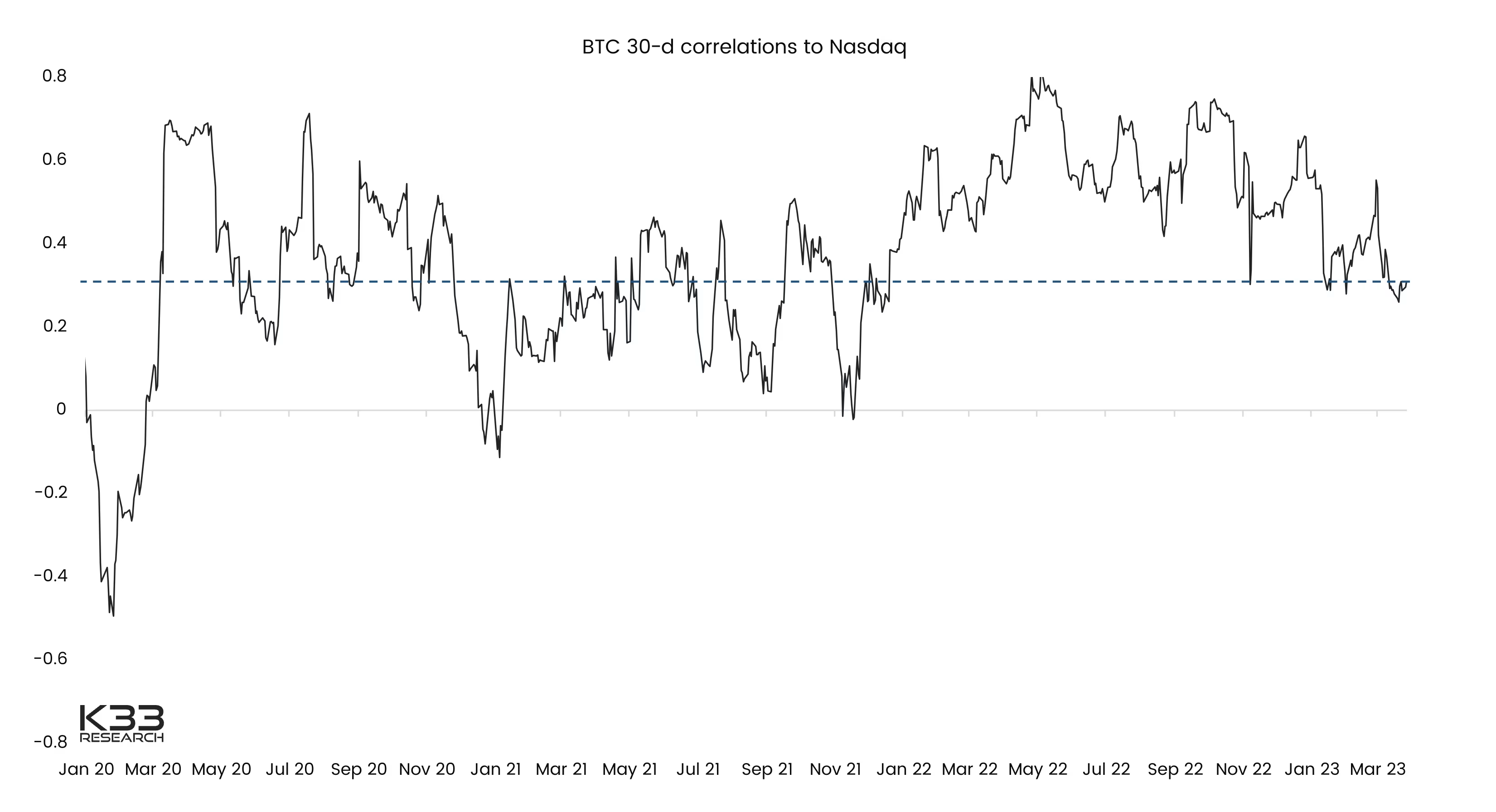

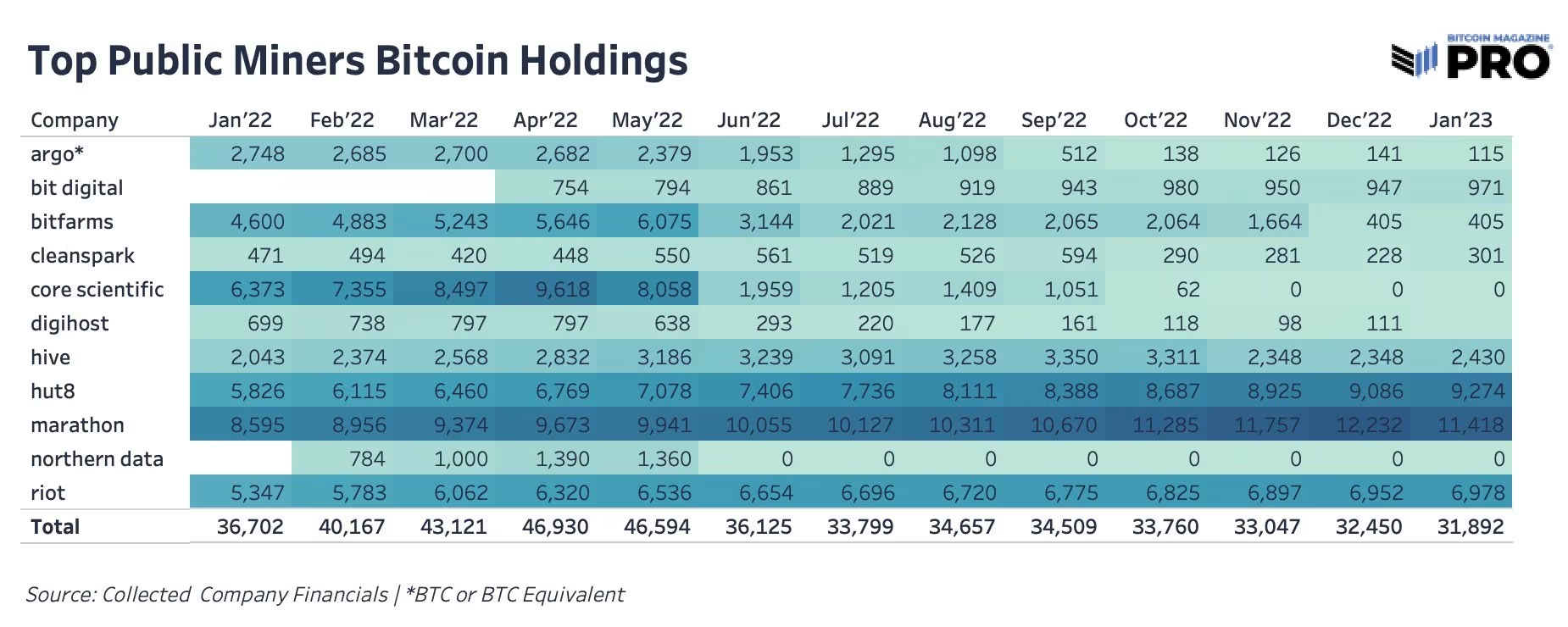

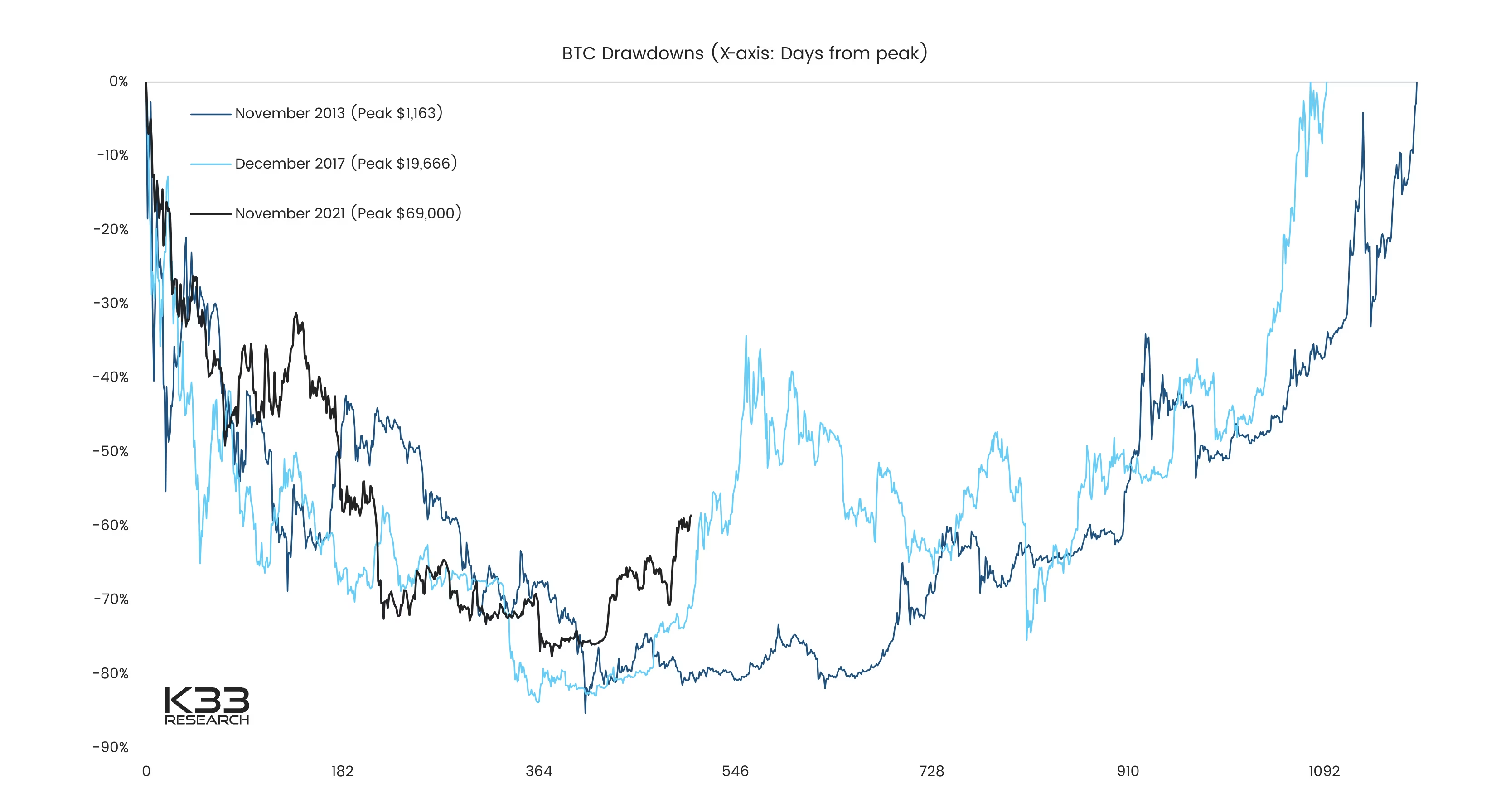

In the zero-interest rate regime of 2020-2021, growth was THE priority. In crypto, the growth focus was perverse. This is the source of the yearlong correlated hangover that was 2022. Public BTC mining companies financed their operations through fiat debt and strived to hold BTC. Rising rates, falling BTC prices, and increasing electricity prices forced miners to sell, leading correlations to grow.

Preview

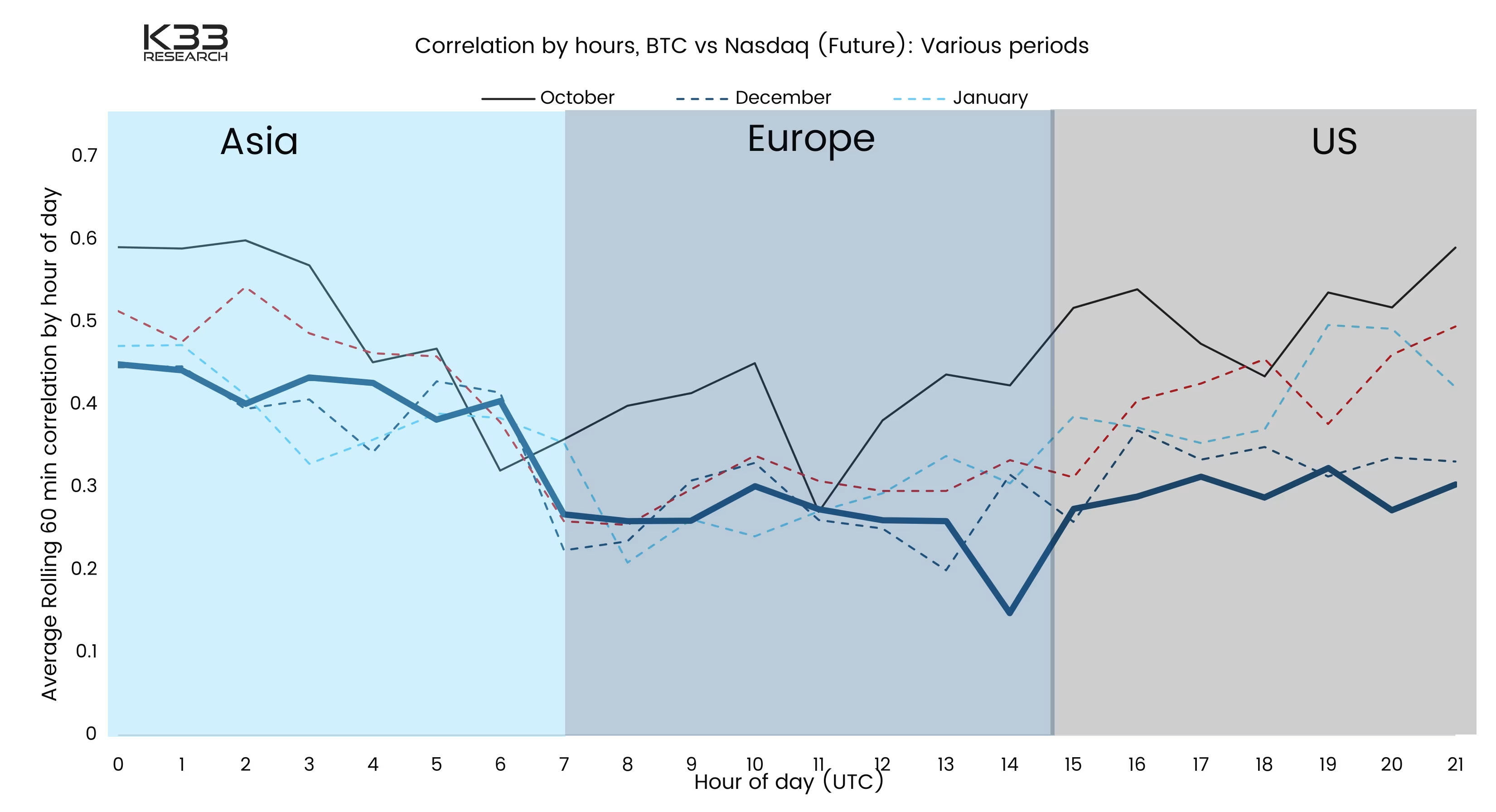

Hedging BTC through Nasdaq and vice versa.

Alameda hedged their totally irresponsible usage of FTX client money through Nasdaq 100. Highly likely that more crypto funds, and traditional funds did the same.

Preview

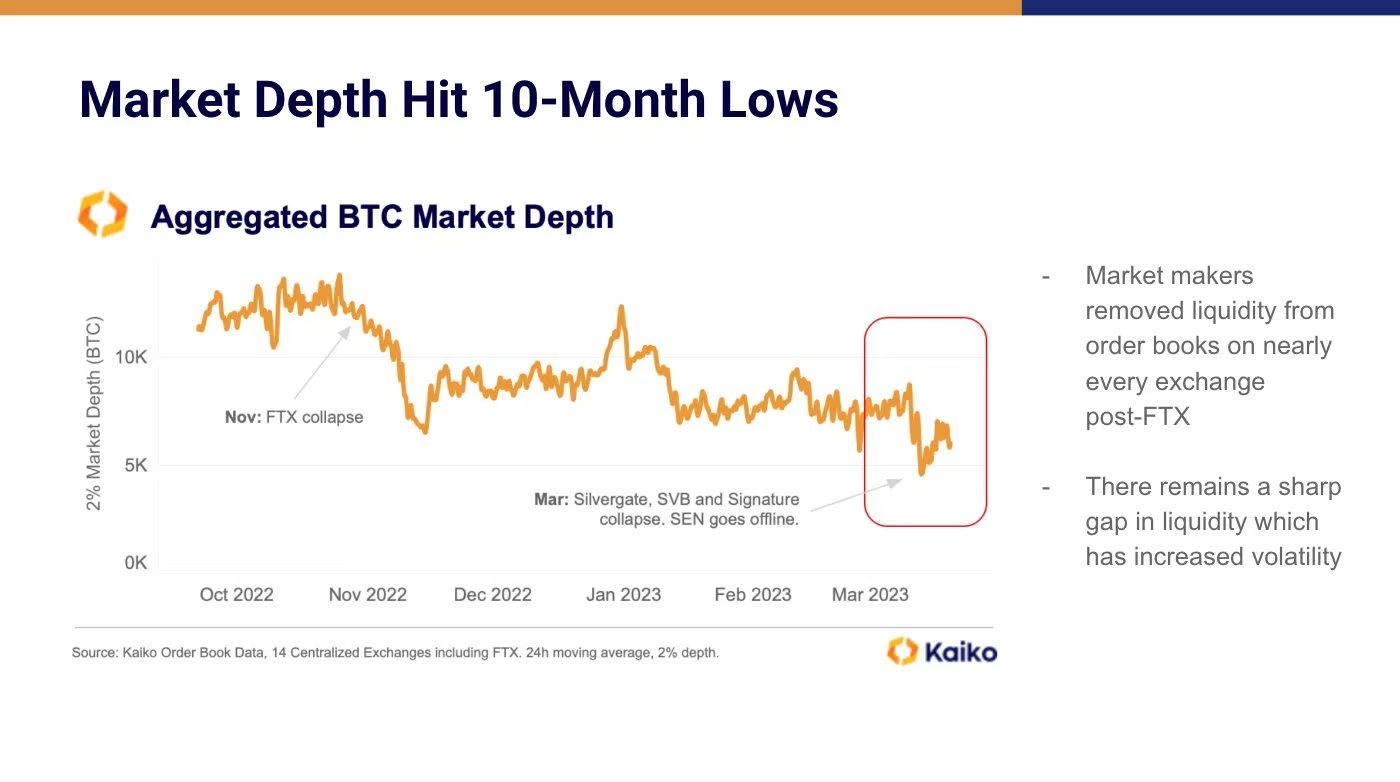

Liquidity

Most market makers saw major losses in the past year and have drastically changed their risk assessment of the market. Funds locked in FTX are the most obvious example.See the Folkvang story in Coindesk.Trust has diminished, leading market makers to be far more cautious about holding large size at any centralized exchange.In sum, less liquidity means that the net buyer and net seller has a net larger impact on the general direction of the market.

Preview

Preview

Preview

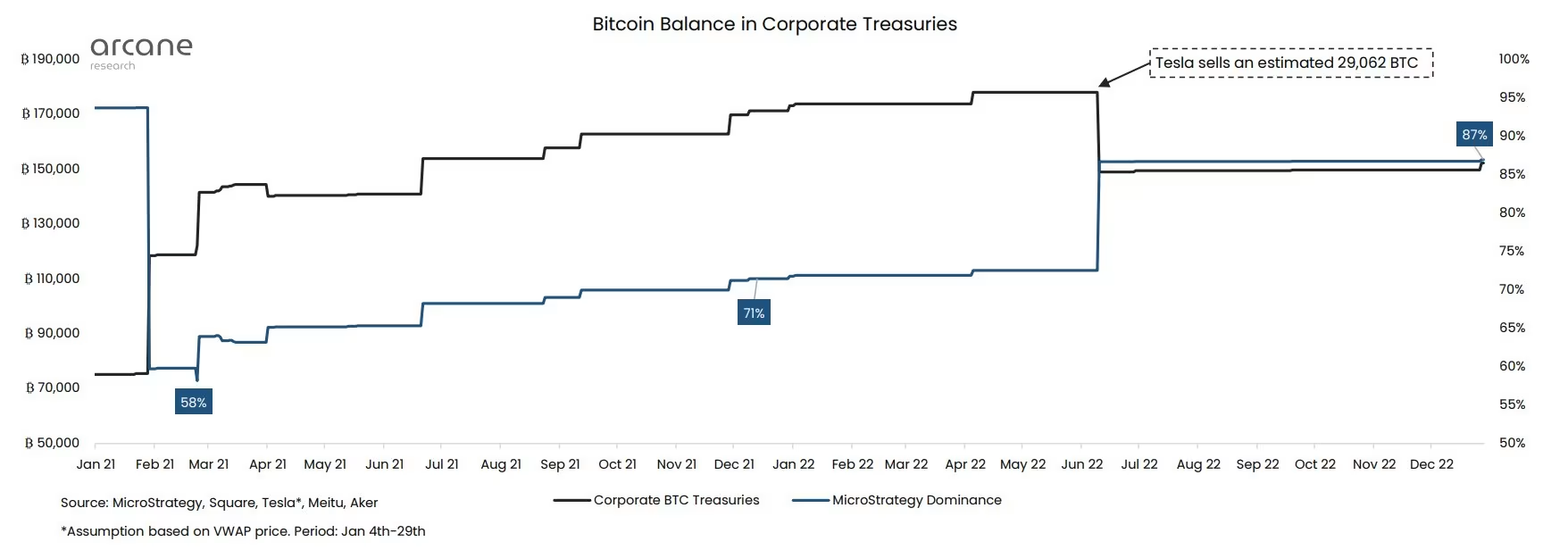

Tesla (Public companies reducing BTC exposure in 2022)

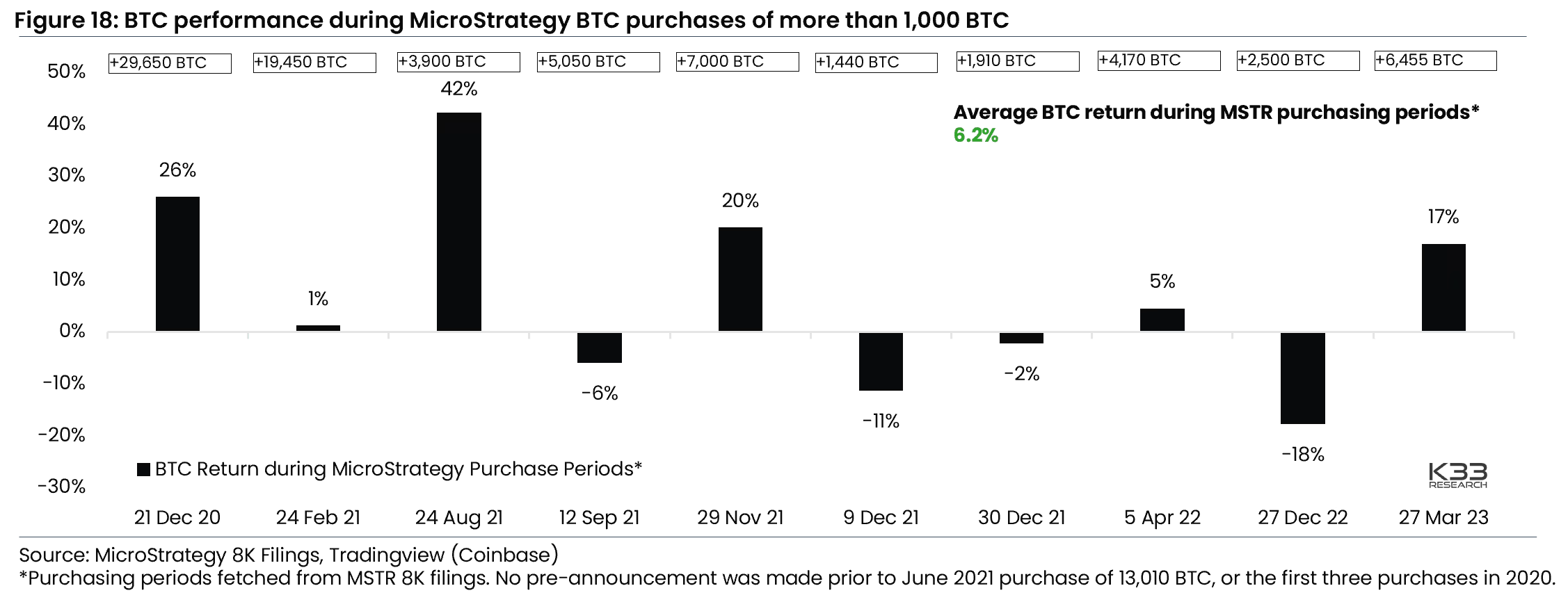

Tesla sold 29k BTC last year. Holds less than 10k BTC. Public miners sold BTC. BTC's natural connection to Nasdaq through companies holding BTC as a corporate treasury asset fell. The only net buyer was Microstrategy.

Preview

The narrative - Global banking turmoil sheds light on risks related to bank deposits.

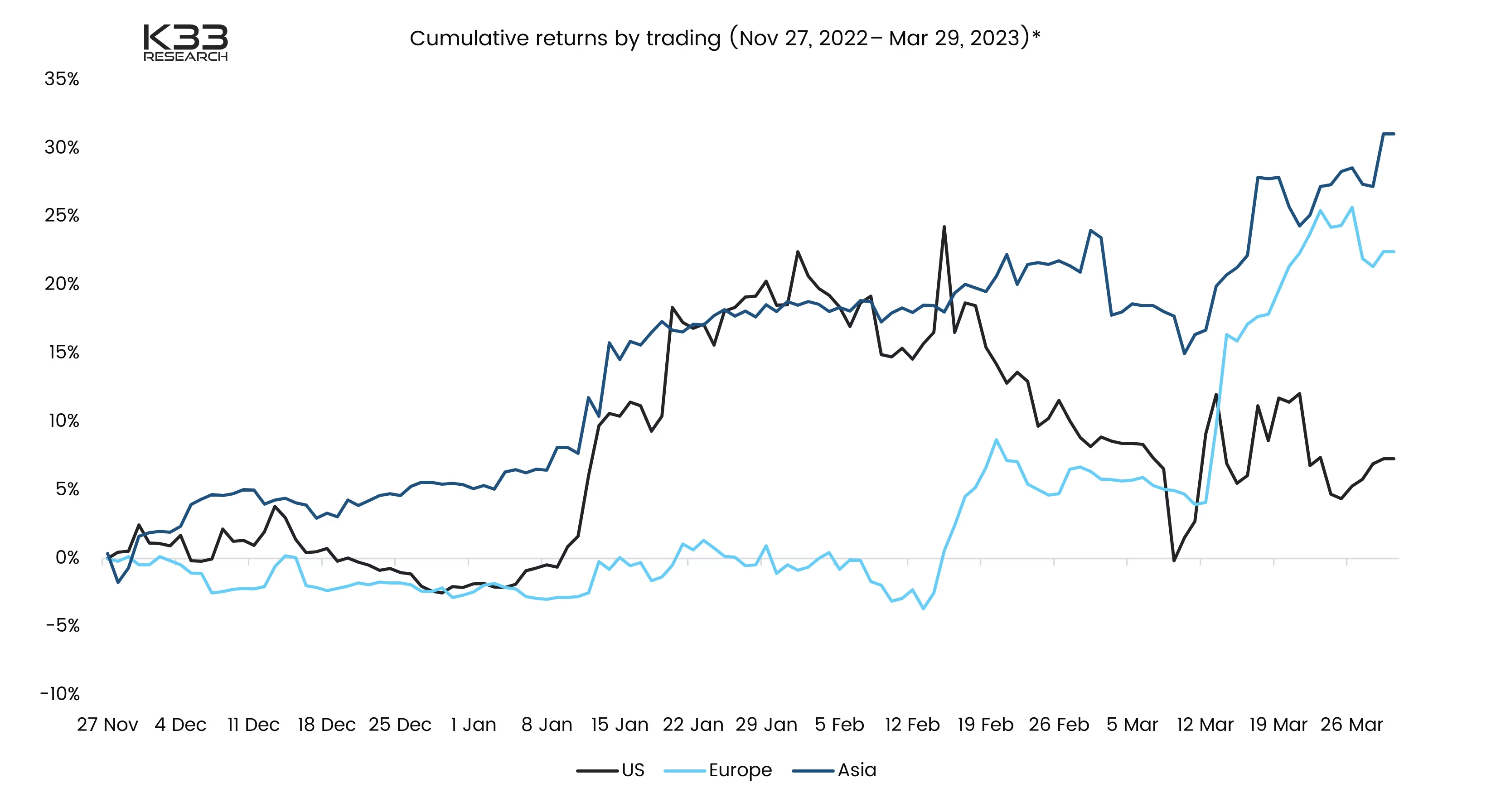

Nasdaq companies and VC companies were severely impacted by SVB. BTC may be custodied independently and bears unique qualities as a SoV in that regard. Looking at granular correlations, BTC has been significantly less correlated to Nasdaq during U.S. hours than earlier this year - and considerably less correlated than during October.

Preview

Preview