Potential arbitrage in case of approval

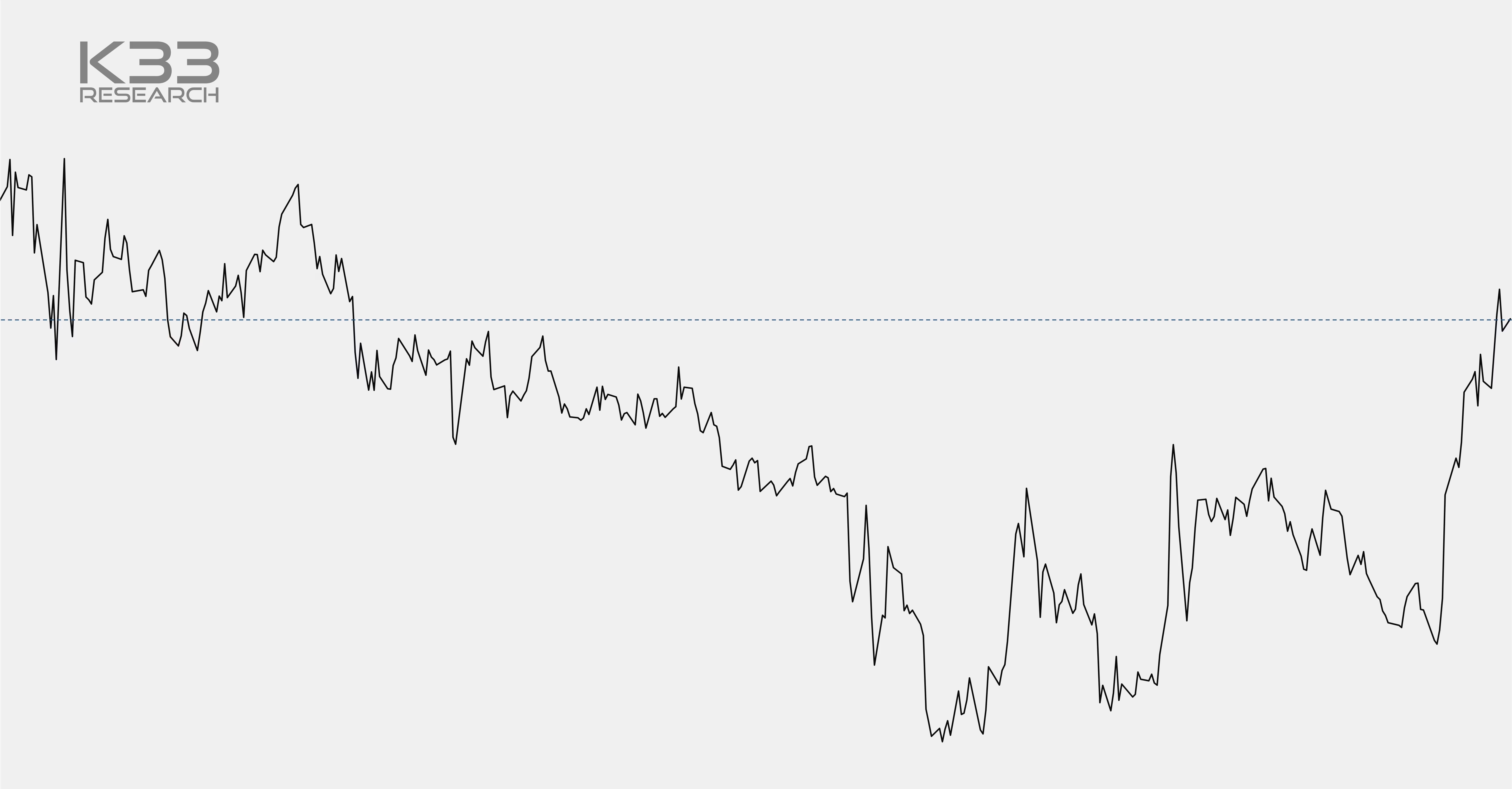

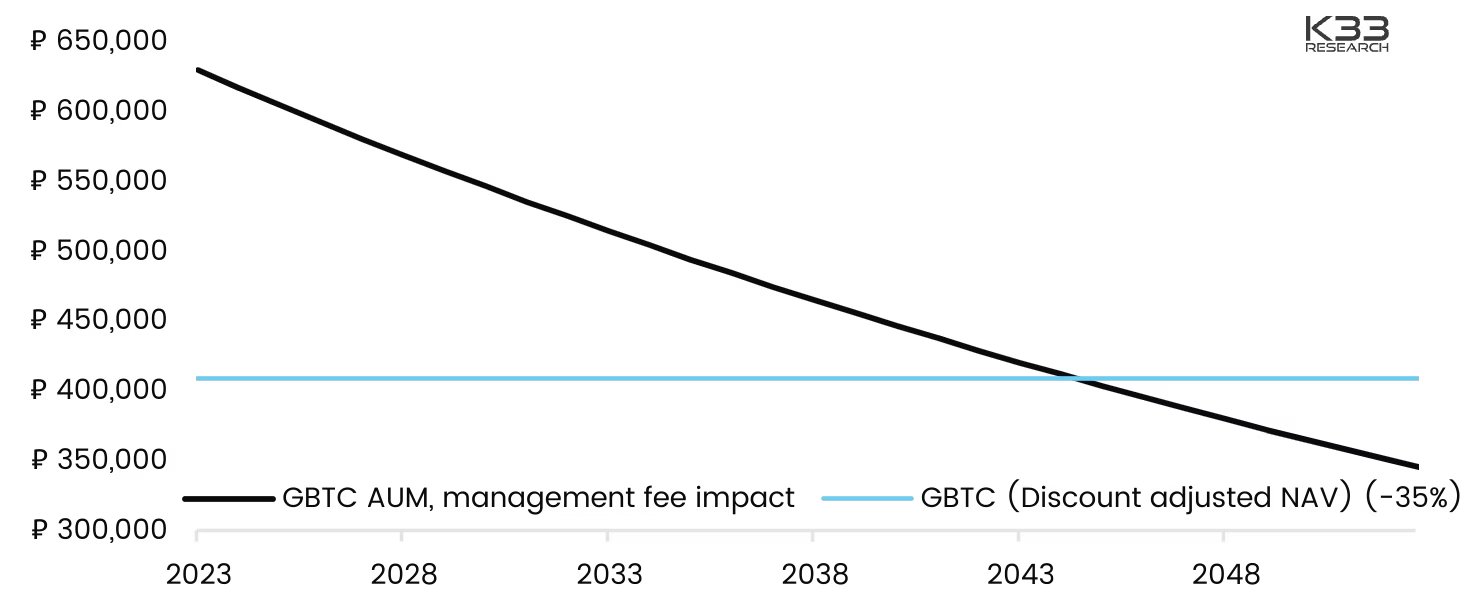

At its current 35% discount, 1/3 of Grayscale’s BTC, 220k BTC, is currently not priced in the market – representing a sizeable arbitrage opportunity in case of conversion down the line. From a pure price perspective, GBTC’s discount prices in that GBTC will remain close-ended until 2044, given GBTC’s annual management fee of 2%. We view it as far more likely that GBTC will get converted to an ETF before 2030 than GBTC remaining close-ended in eternity. This could potentially create a dicey environment in BTC, with traders aiming to utilize the arb by purchasing GBTC and selling/shorting BTC as massive amounts of supply reach the market. Such an event may be hedged by a BTC holder by diversifying parts of the BTC exposure into GBTC. However, any trader considering this trade should be aware of costs affiliated with the trade related to both fees and potentially differing taxation in GBTC vs. BTC. It’s important to note that it only took $100m of volume to narrow GBTC’s discounts from 46% to 35%. More GBTC optimism could reduce the discounts further, and the 220k BTC arb sketched out above may have a less pronounced impact on markets than presented above.

Preview