Bitcoin on-chain summary: Hashrate keeps falling

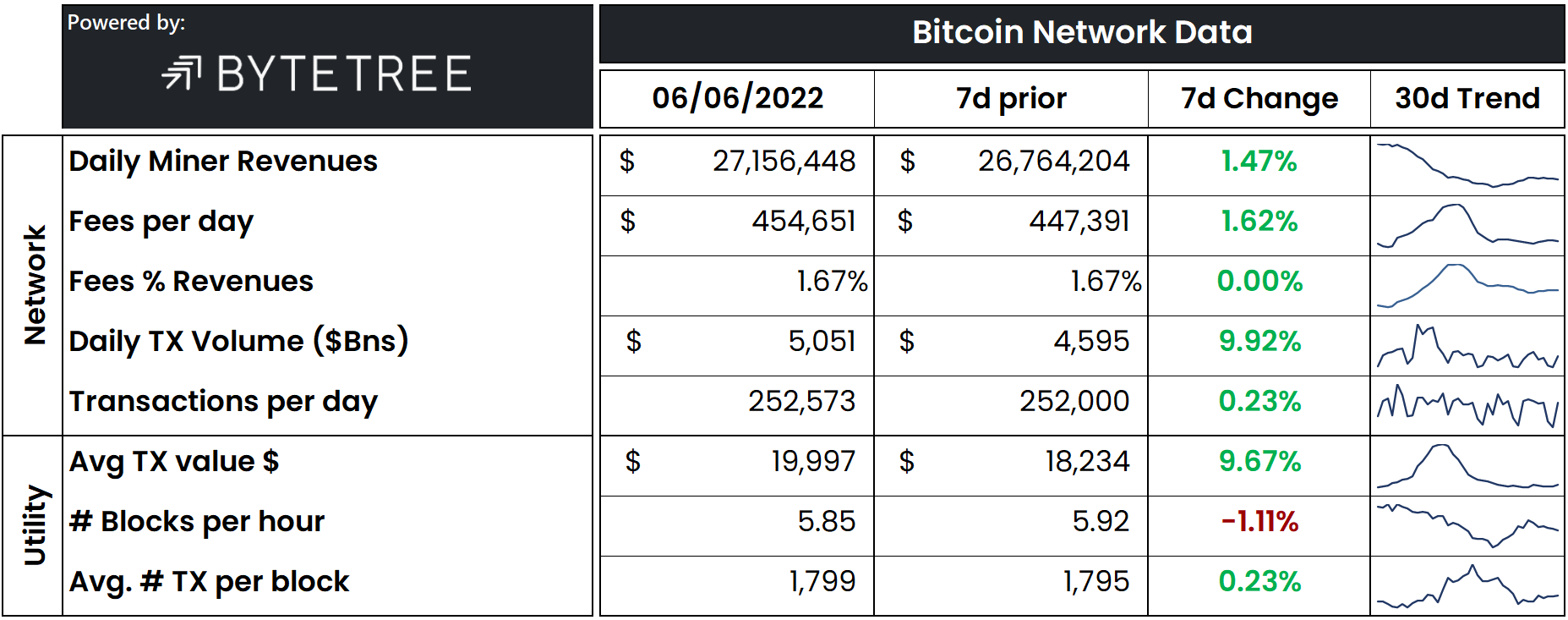

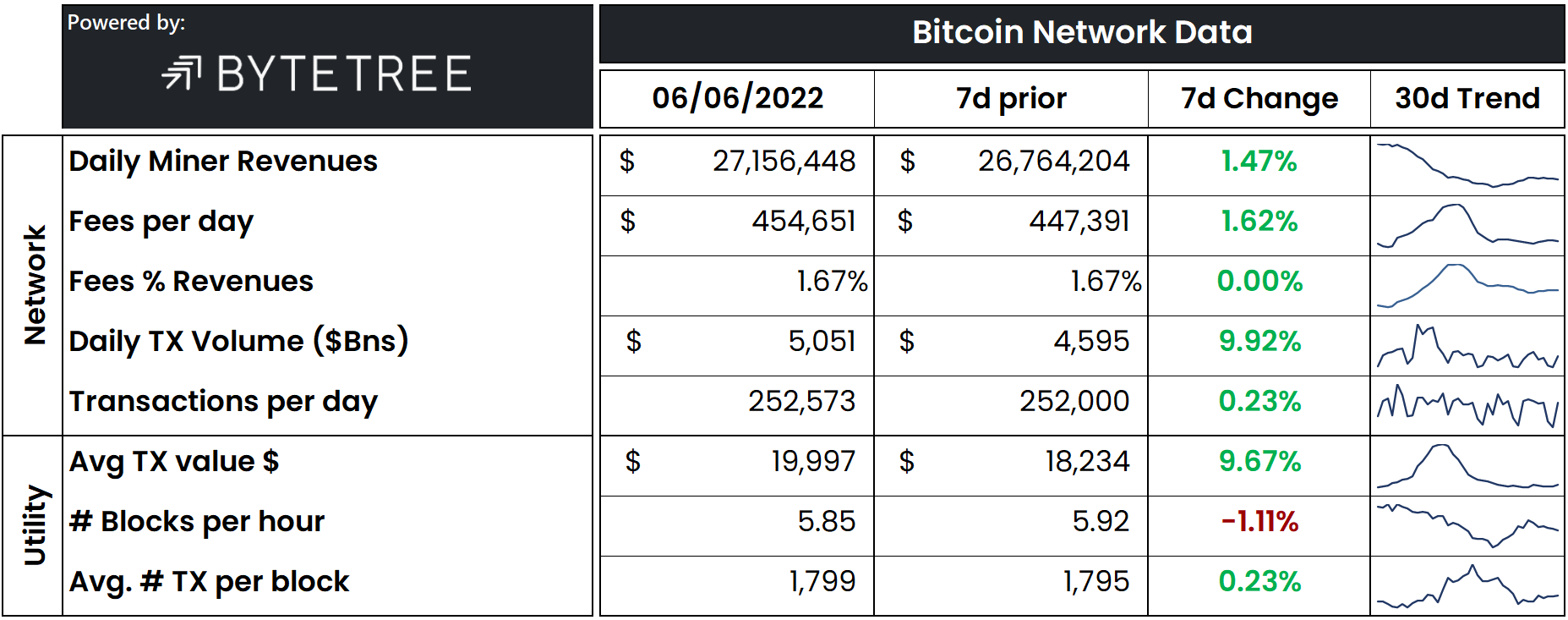

The hashrate keeps falling as some miners are forced to unplug their machines due to the lower profitability of mining.Daily miner revenues continue staying depressed at $27 million as the bitcoin price struggles to maintain the $30,000 level. Comparatively, the week in November when bitcoin hit an all-time high of ~$69,000, miners collectively earned $62 million.In addition to a decreased value of the 6.25 BTC per block subsidy due to the falling price, the daily transaction fees remain meager at only ~$450,000. This amount only makes up 1.7% of miners’ revenues, making miners highly reliant on the block subsidy.The lower miner revenues have forced some miners with the highest bitcoin production costs to unplug their machines, leading to a 10% decrease in the hashrate since the all-time high at the beginning of May. Although they have access to some of the cheapest electricity in the industry, the public mining companies are also under pressure from the decreasing profitability of mining. In this article, I analyze the balance sheets and power costs of some public miners to find out who are best prepared for a prolonged mining bear market.Due to the lower hashrate, the block production rate stays at lower than optimal levels. We will likely see the second downwards difficulty adjustment in a row tomorrow.�

Even though on-chain activity continues to stay muted, Bitcoin’s layer-2 scaling solution, the Lightning Network, continues evolving.