Bitcoin on-chain summary: The hashrate is falling

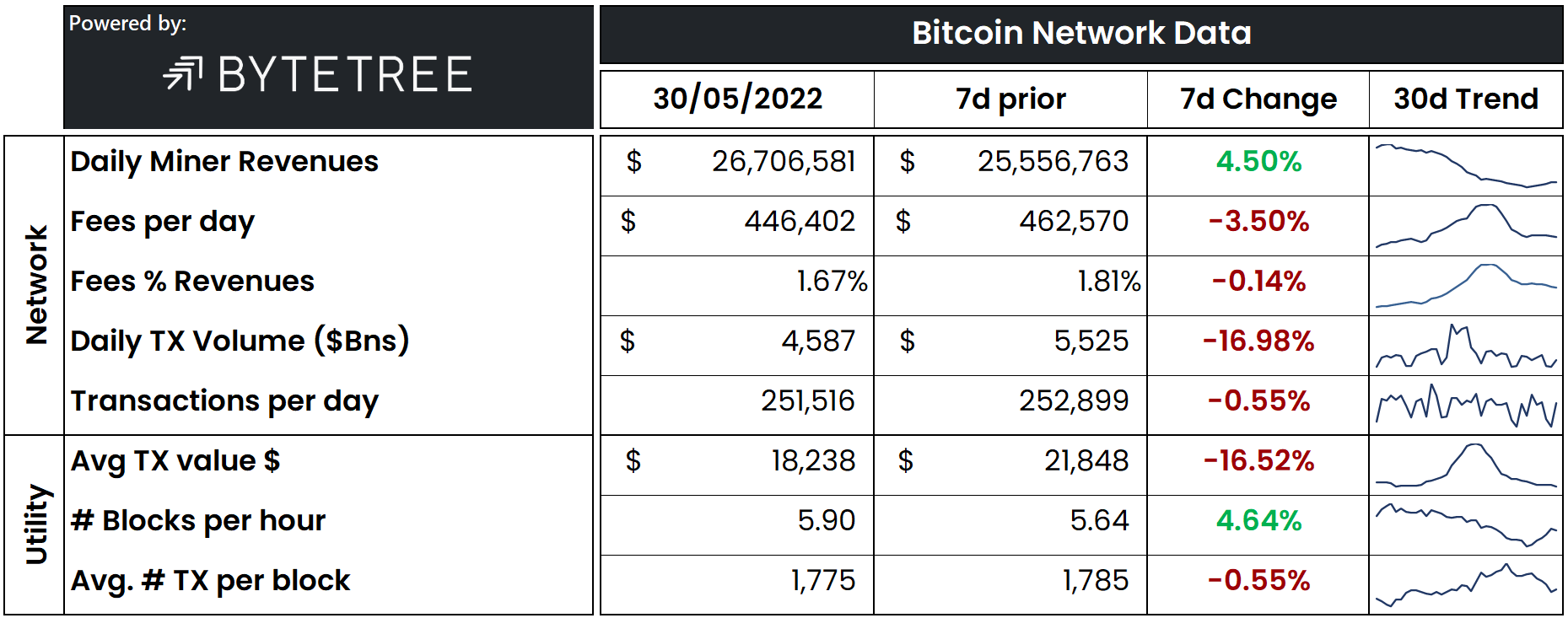

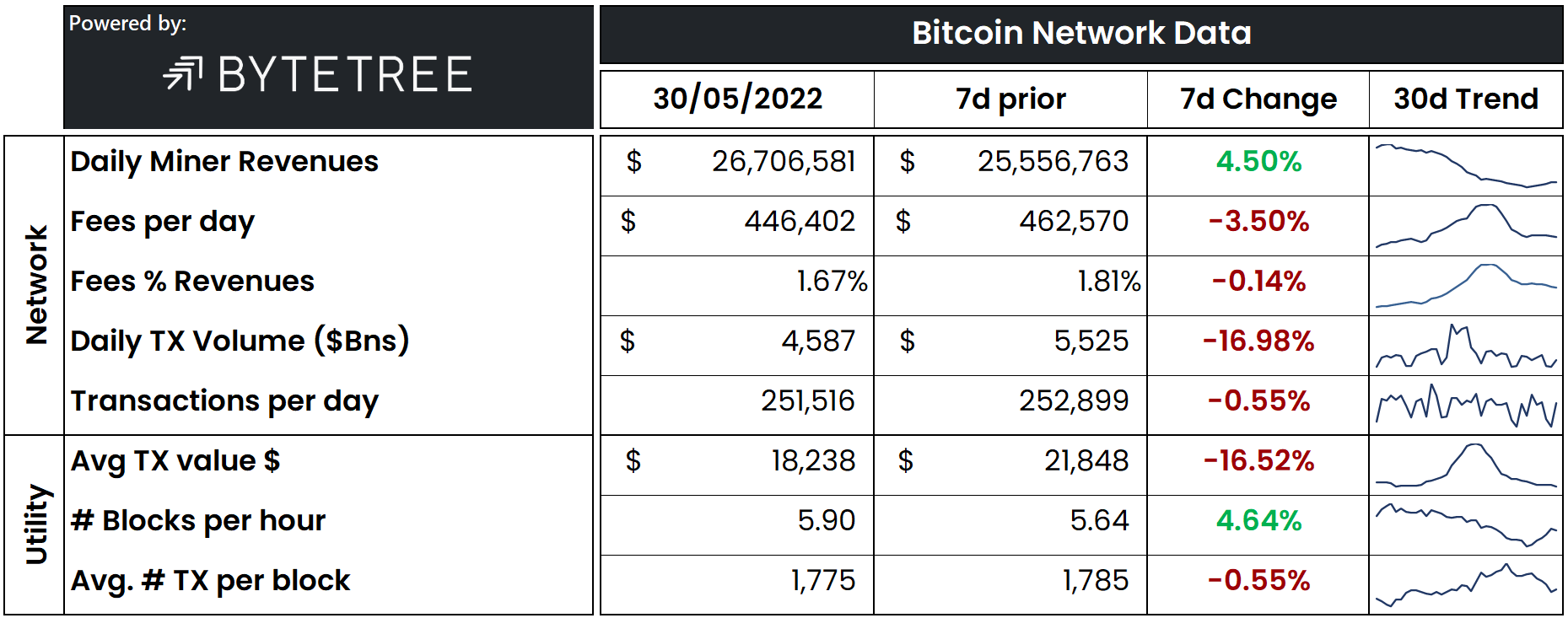

The falling bitcoin price has made mining less profitable, leading to a decreasing hashrate.Daily miner revenues are now sitting at $26.7 million, corresponding to a slight increase from last week. During most of 2021, this number was sitting at more than $40 million.In addition, the hashrate has grown by almost 30% in 2022, meaning that the competition among miners has increased. An increasing number of miners are now competing for decreasing block rewards denominated in USD. This dynamic leads to lower revenues for the individual mining companies, and the public mining companies prepare for a bear market.Even though the hashrate has grown in 2022, the growth stopped at the beginning of May. Since then, the hashrate has decreased, most likely due to the less energy-efficient mining machines being unplugged, as these machines currently run close to the break-even level.The decreasing hashrate has led to a slow block production rate during most of May. In response, Bitcoin reduced its mining difficulty by 4.3% last week, the biggest downwards difficulty adjustment since July 2021.Still, even after the difficulty reduction, the block production rate is 5.9 blocks per hour, which is lower than the target of 6. Therefore, we might see the difficulty being reduced further one week from now, but it's still too early to conclude.Transaction fees have now stabilized at the usual 2022 level around $450k, after being elevated following surging on-chain activity caused by the volatility around the Luna collapse.