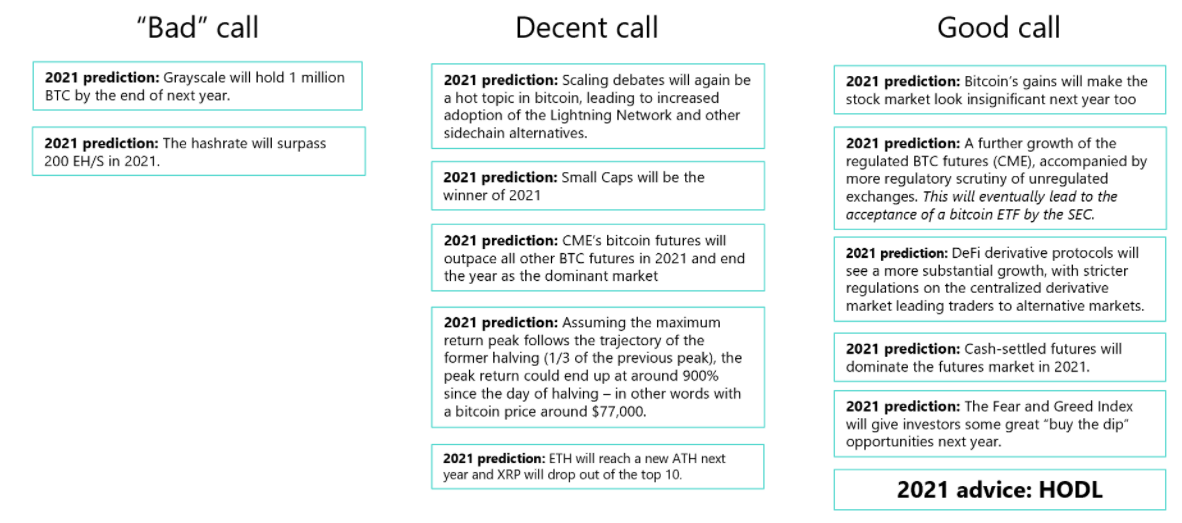

Let’s begin with our worst calls

Grayscale to hold 1 million BTC by the end of 2021

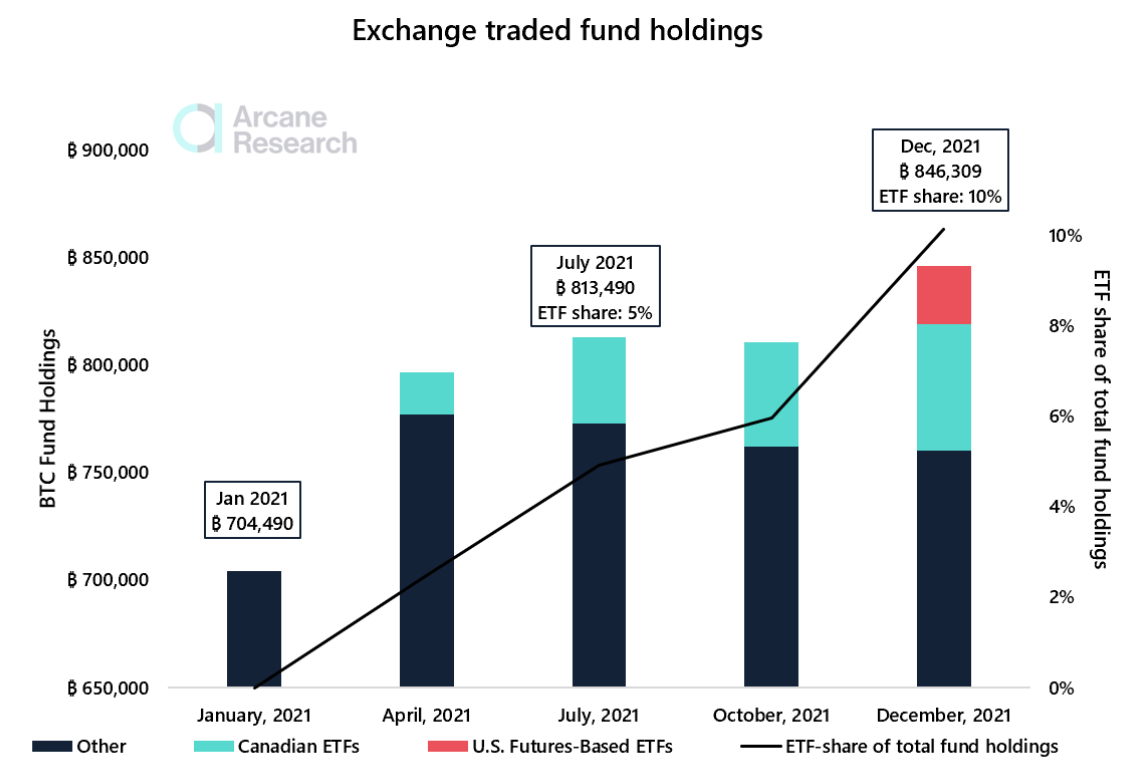

Grayscale saw an inflow of 40,000 BTC in 2021, having peaked at 655,000 BTC in mid-February. So, how did we manage to miss in such an exorbitant manner?What happened? The inflows in H2 2020 and early Q1 2021 were unsustainable. They were driven by the ever-growing popularity of the Grayscale “arb”. Allocating capital in-kind (using bitcoin), redeeming shares six months later, selling these shares at a premium, and repeat. As the fund grew sufficiently in size, this trade got crowded. Premiums turned into discounts as more shares reached the secondary market, and the discounts never returned to premiums. With GBTC currently trading at a sharp discount, investors are naturally disincentivized to conduct the same trade. These discounts have impacted GBTC holders. GBTC has seen 4% gains YTD, while bitcoin, the underlying asset the shares are supposed to track, has seen 52% gains YTD.In addition to being an overcrowded trade, the Grayscale stagnation was also caused by the entrance of new investment vehicles. This year, Canadian and Brazilian ETFs went live, in addition to European ETPs with active redemption programs. We also saw the SEC approval of several futures-based bitcoin ETFs.

Preview

Hashrate to surpass 200 EH/S in 2021

This was one of our more conservative estimates last year. Little did we know that China would cause havoc in the mining industry, creating blistering opportunities for miners abroad while dramatically altering the mining scene. Hashrate has more or less recovered from the ban, and we expect the hashrate to continue its upwards trajectory onwards. A huge influx of mining equipment will be delivered throughout the upcoming year, and the hashrate is likely to surge.Moving on over to our decent calls

Lightning and sidechain adoption increases due to scaling debates

While 2021 was a breakthrough year for the Lightning Network in the backdrop of El Salvador’s adoption of BTC as legal tender, scaling debates was not a core explanation for the growth. Actually, the LN adoption began accelerating once on-chain fees dwindled in bitcoin as SegWit adoption rose further, and on-chain activity declined. The mempool was congested in early 2021 but has been relatively empty in the latter part of the year.The scaling issue has been far more prevalent on smart contract platforms. The massive growth of DeFi and NFTs put Ethereum under pressure, leading to surging fees, creating fruitful grounds for layer-1 competitors and the adoption of layer-2 services on Ethereum to prosper. Arbitrum and Optimism saw strong growth, and TVL in optimistic rollups and ZK rollups has seen a 1317% growth from July 1st till Dec 22nd.Small Caps to be the winner of 2021

We track the Bletchley indexes; these are purely bundled by market cap, with monthly rebalancing based on performance. Strong altcoins ranked 40-70 by market cap last year has grown out of the Small Caps Index. Solana quickly went from small-cap to mid-cap, followed by DOGE, Luna, Matic, and AVAX. Throughout the year, the strength of these coins contributed to ballooning the Mid Caps Index to win 2021. However, while small caps did not win the year, the altcoin strength in 2021 contributed to the index seeing 400% gains. Not bad.CME’s futures to outpace all other futures in 2021, ending the year as the dominant market

According to most academic research, CME dominates the price discovery in bitcoin. However, it has not become the most dominant futures market in terms of size. Binance’s futures market has thrived this year, accompanied by strong growth in FTX, as well as temporary bursts of over-eager Bybit traders.The futures-based ETFs contributed to strengthening the CME futures’ position in the market, but let there be no doubt, in terms of adoption, speculation, and activity, Binance dominates.The importance of CME in terms of price discovery should not be underestimated, though. Earlier this year, we published a research paper illustrating that CME traders seem more informed and influential in bitcoins price discovery, particularly when contrasting their relatively low importance before COVID.Bitcoin to top at around $77,000

Let’s face it. Yearly price targets are stupid. We did a naïve estimation assuming less pronounced price surges and more muted tops over time due to bitcoin maturing as an asset with a growing market cap. Our estimation was not too far off. The $69,000 top in 2021 rhymes well with the state of the crypto market this year, with memecoins having prospered like never before. Embrace the meme!ETH to reach a new ATH, and XRP to drop out of the top 10

ETH did indeed reach a new all-time high. But, as we wrap up 2021, XRP is still figuring in the top 10, despite all its regulatory issues throughout the year. The conviction of the XRPArmy remains strong, and XRP has outperformed BTC by a staggering 179% this year. Welp!And now, let’s have a look at our great calls!

Bitcoin’s gains will make the stock market look insignificant

Bitcoin has outperformed the Dow Jones by 44% in 2021 and Nasdaq by 35%. Not bad at all.Regulation and CME dominance will lead to the SEC accepting an ETF

The SEC approved ETFs this year, but not the spot-based ETFs we were hoping for. Canada was ahead of the curve, approving ETFs already back in February, and European ETPs were also approved.Meanwhile, regulatory clampdowns have escalated this year, particularly with Binance facing legal pressure in Japan, Ontario, Cayman, the U.K., and Thailand this summer.DeFi derivative protocols will see substantial growth as regulation leads traders there

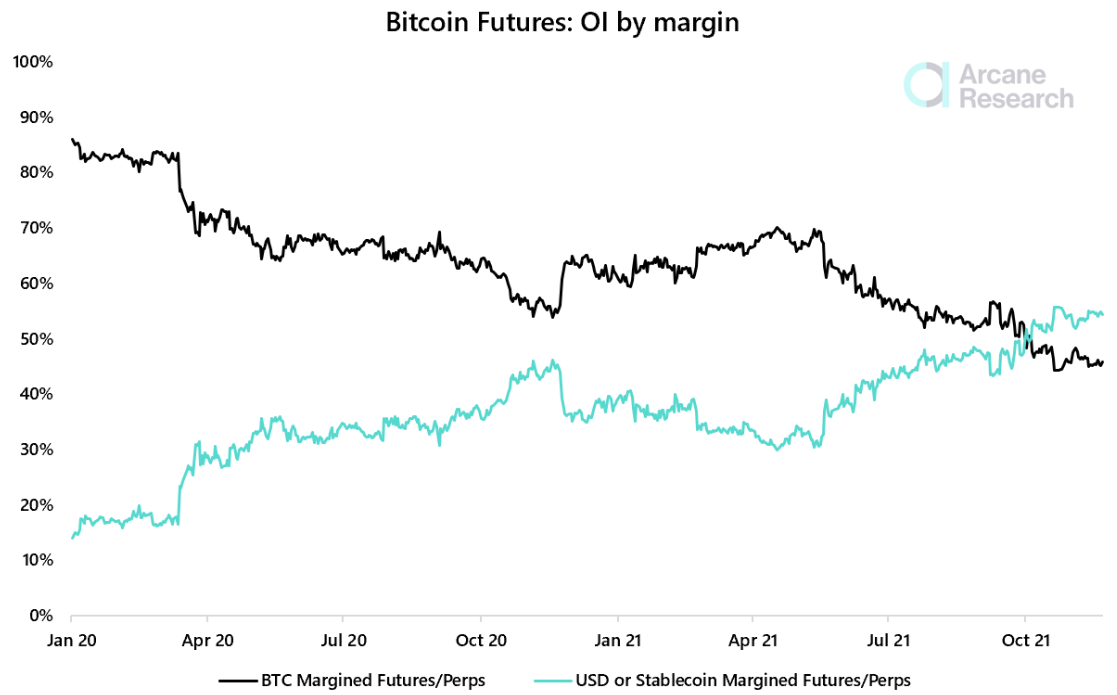

Both Perpetual Protocol and dYdX have seen strong growth this year. Perpetual Protocol’s daily trading volume fluctuates around $40 to $100 million, while the daily trading volume on dYdX averages above $1 billion after seeing a surge in volume in the aftermath of the launch of the dYdX token and the China ban in September.Cash-margined futures to dominate open interest

Preview