Preview

Stablecoins absorbing a growing share of the crypto market

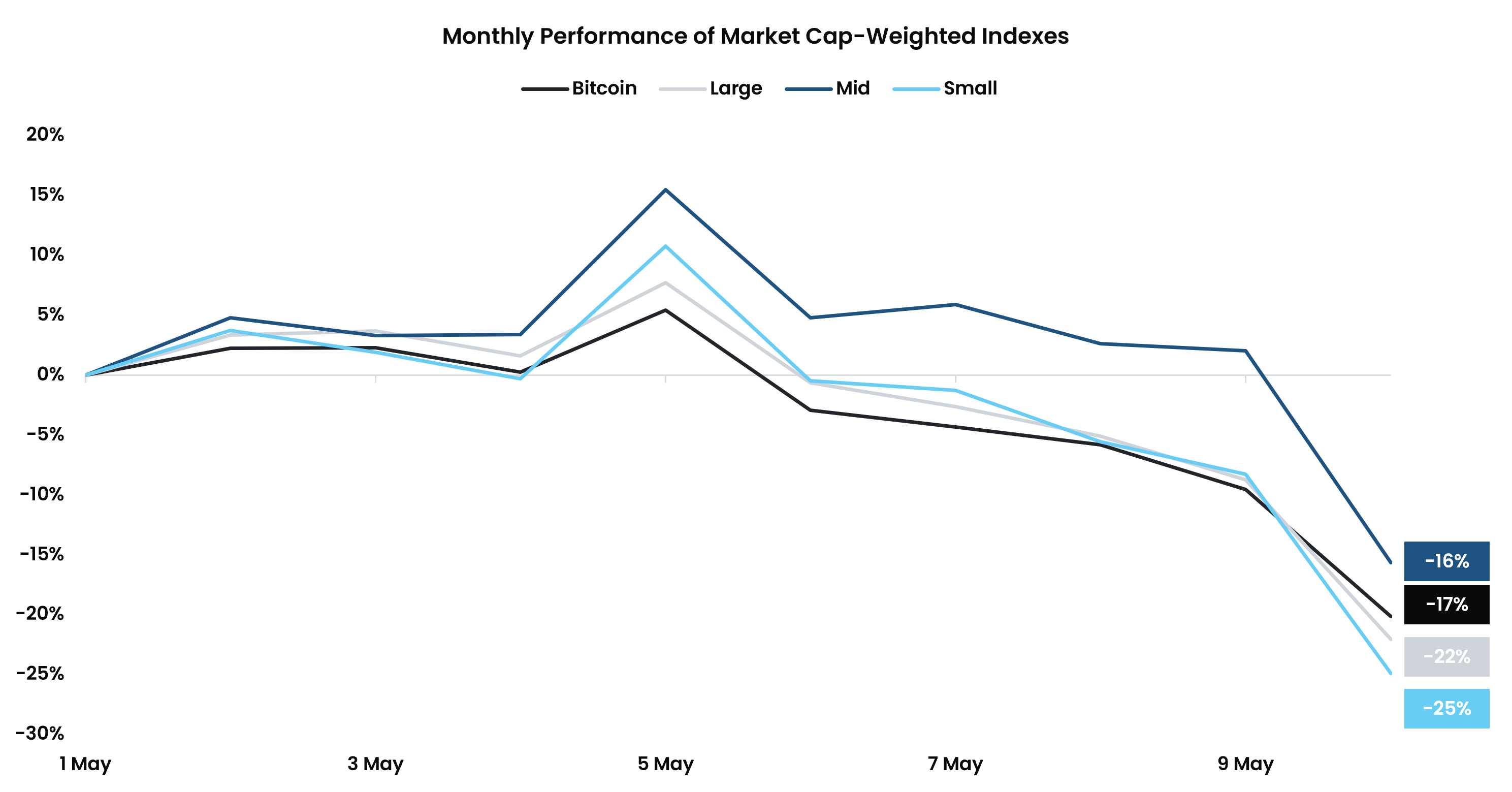

Stablecoin dominance continues to grow in the crypto market.All indexes continue to move in tandem with bitcoin as correlations remain elevated in the crypto market.

Preview

Preview

Highest daily bitcoin spot volume since December 4th

On Monday we saw $13 billion worth of bitcoin changing hands in the spot market. This is the highest daily spot volume observed since December 4th, 2021. The volume surge is especially interesting considering the dwindling spot volumes we have seen during the latest month, as April saw the lowest bitcoin spot volumes since last summer. The recent uptick in volatility seems to have woken up traders. It will be interesting to see if the volumes will continue increasing or if Monday’s surge was simply an anomaly caused by the de-pegging of UST.

Preview

Sharp uptick in bitcoin’s volatility

Volatility has returned to the market after months of tight consolidation in bitcoin. Yesterday saw the largest daily percentage loss in bitcoin since May 19th, 2021, of 11.6%. Bitcoin has since recovered 5% from yesterday's close. This price action has caused both the 7-day and 30-day volatility to surge after a monotonous month in April.

Preview