The Bitcoin blockchain is waking to life

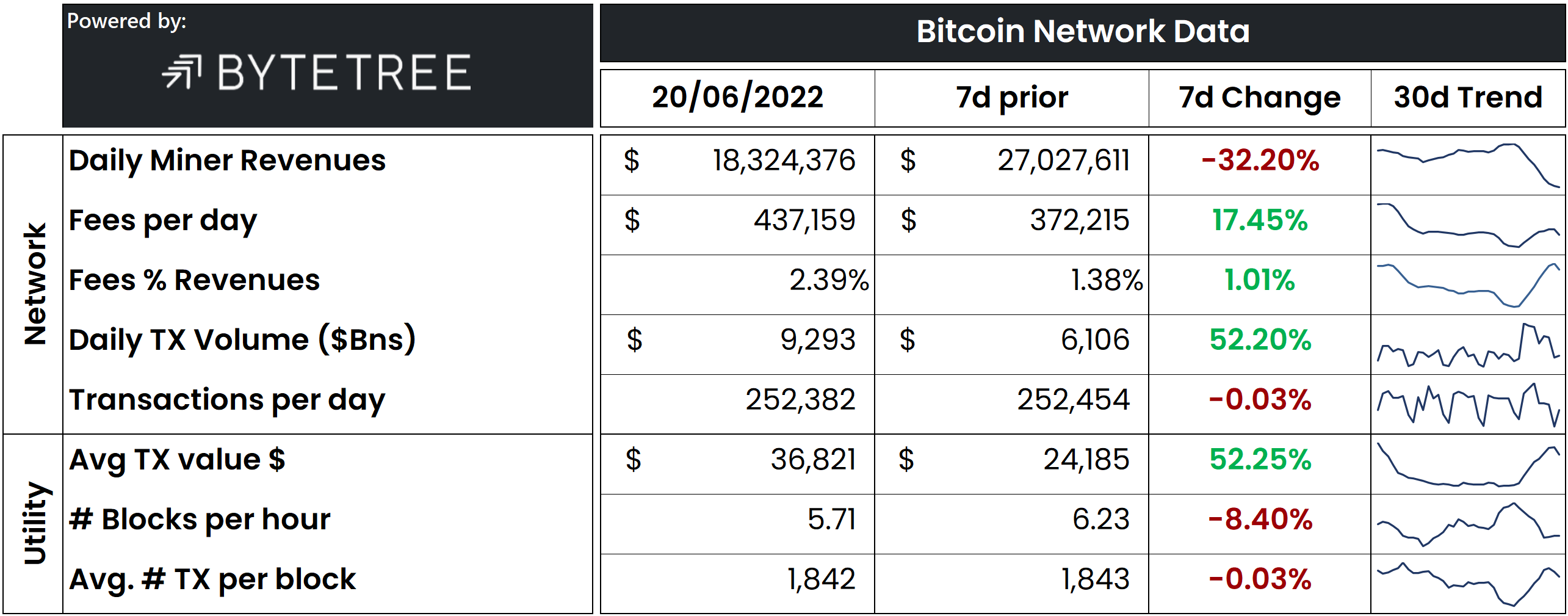

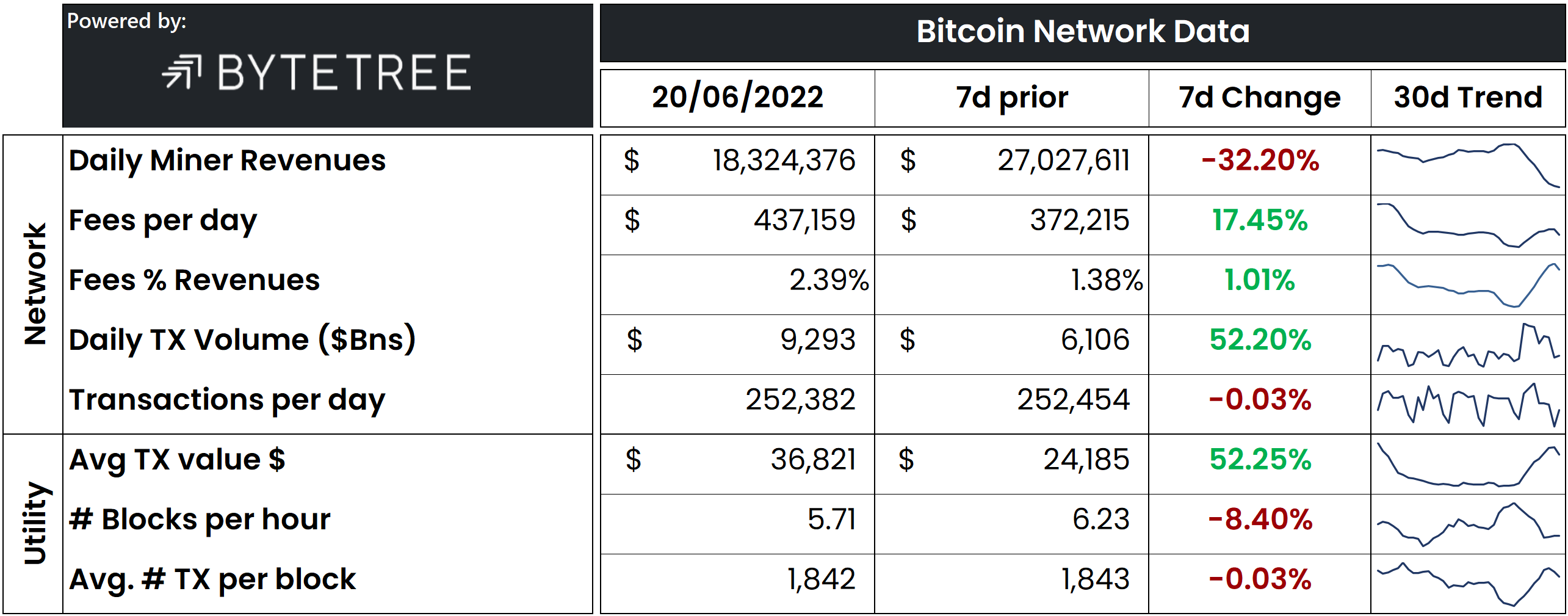

We see a massive increase in Bitcoin’s on-chain activity as large holders liquidate parts of their bitcoin holdings.Daily miner revenues continue plummeting due to the falling bitcoin price. They are now sitting at $18 million, down 32% from the $27 million seven days ago.Although miner revenues are falling, the transaction fees increase by 17% and are now $440k. The fees’ share of the miner revenue is 2.4%, the highest since July 2021.The increase in transaction fees is caused by a 52% surge in the daily transaction volume, which is now at $9.2 billion. We have seen high spot volumes lately, leading many to transfer coins to exchanges. We also see several big players selling their coins, for example, the biggest publicly traded mining companies.As usual, we don’t see a significant change in the number of daily transactions as the 250k is close to Bitcoin’s maximum on-chain capacity.The plummeting mining profitability has led to a sharp drop in the hashrate, as miners with higher electricity prices and less energy-efficient machines unplug their machines. Luckily for miners, they will get a highly welcomed estimated 1.9% reduction in the mining difficulty on Wednesday.