Main drivers of the Grayscale premiums:

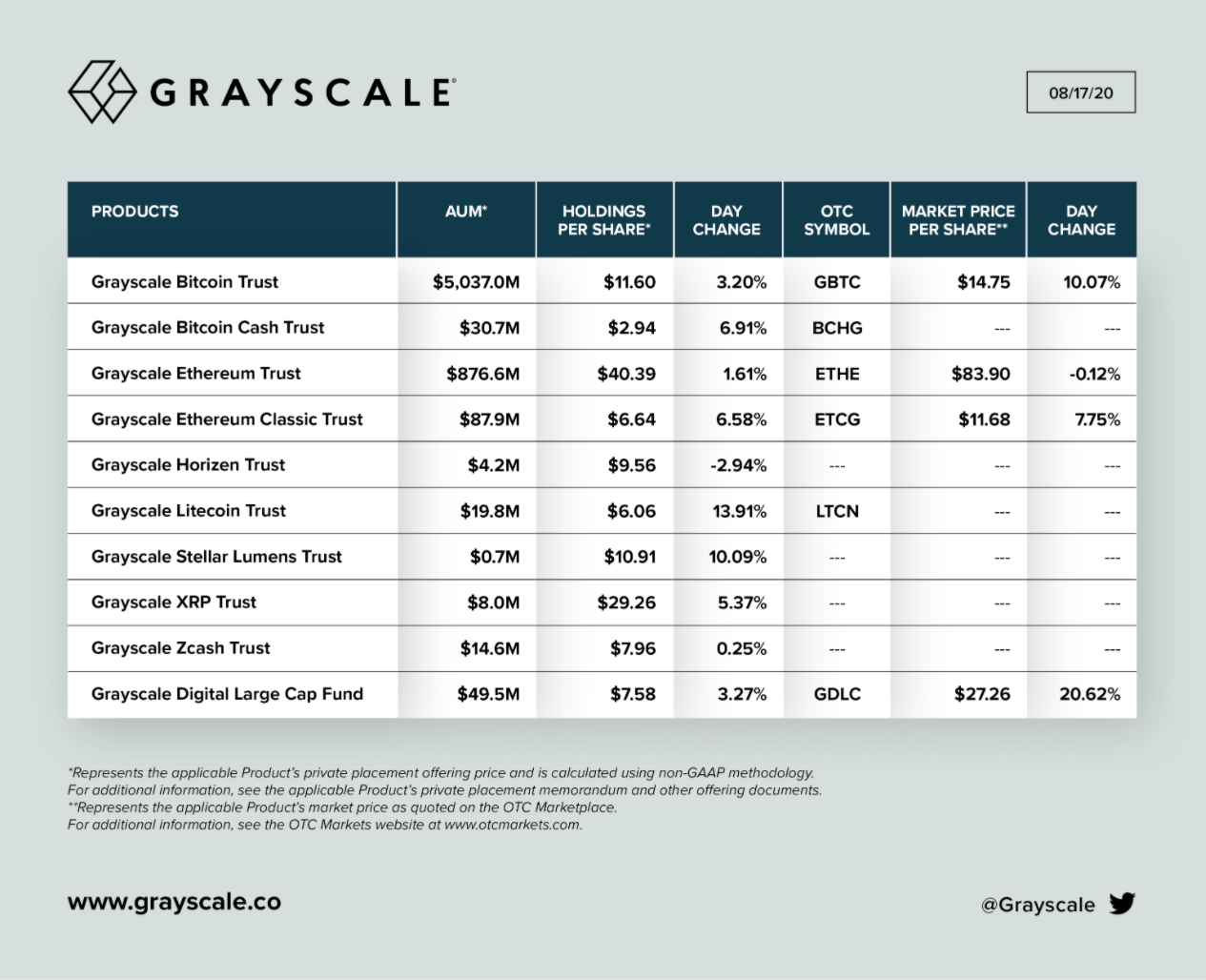

1. Investors buying directly into the trust seek compensation for the lockup period. 2. High retail demand for crypto exposure through 401k savings, with few other options. 3. Investors might be unaware of the premium.Current NAV and share price of various Grayscale Products

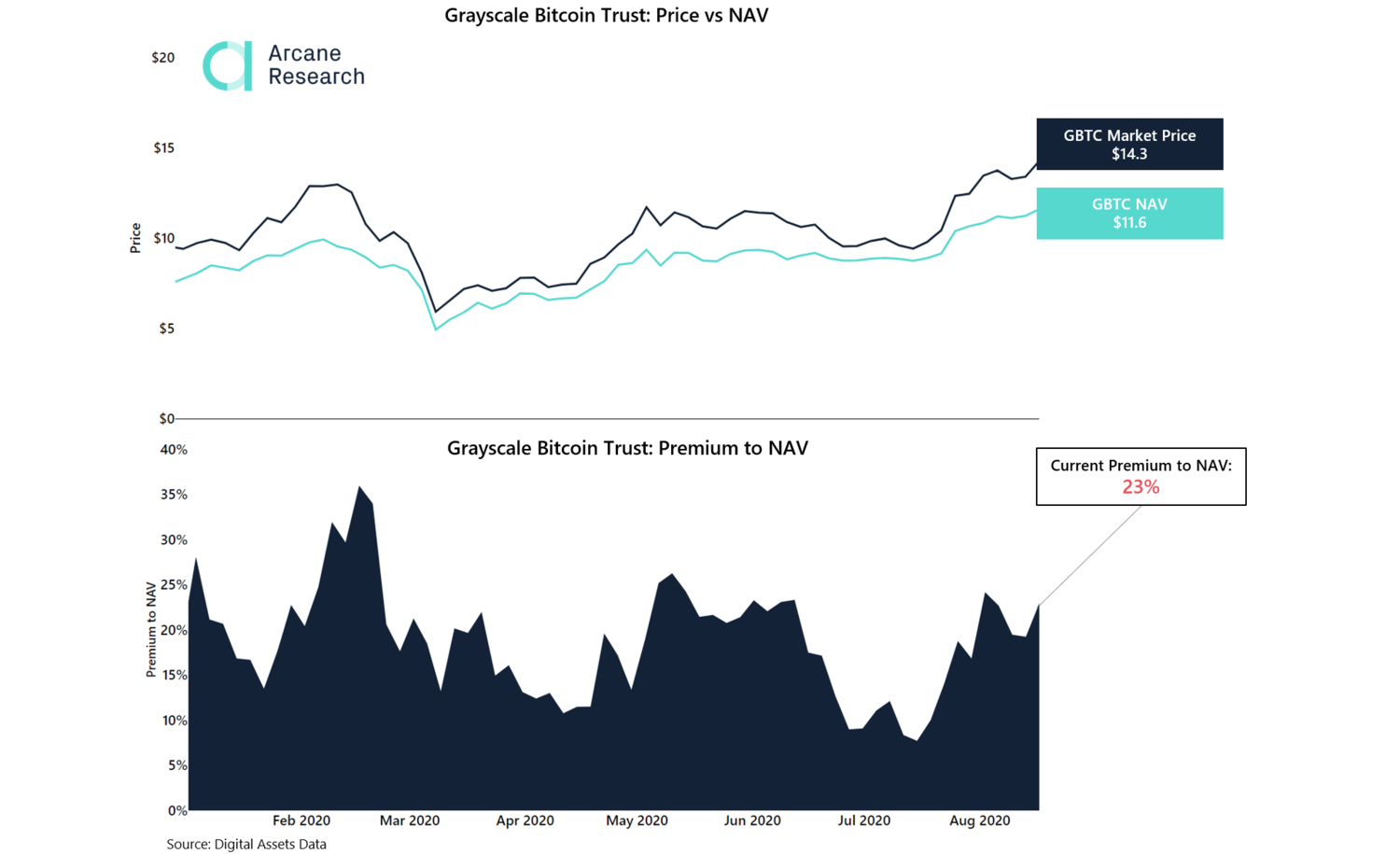

This week, the Grayscale's Litecoin (LTCN) and the Bitcoin Cash (BCHG) trusts went public. Other publicly traded Grayscale products are the Bitcoin Trust (GBTC), the Ethereum Trust (ETHE), the Ethereum Classic Trust (ETC ) and the Grayscale Digital Large Cap Fund (GDLC). We will now look at the current NAV, share price and premium of GBTC, ETHE, LTCN and BCHG.The Grayscale Bitcoin Trust

Preview

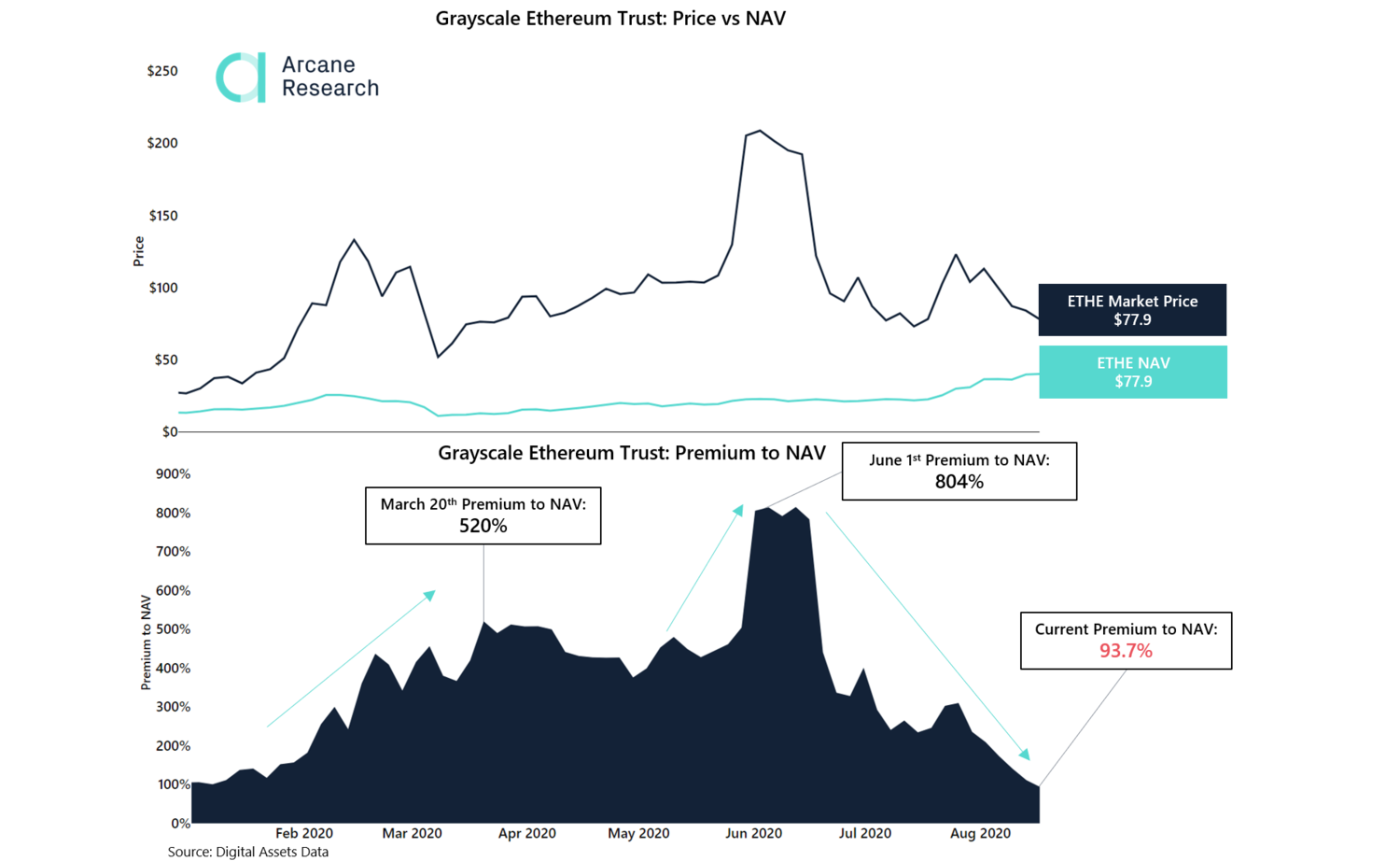

The Grayscale Ethereum Trust

Preview

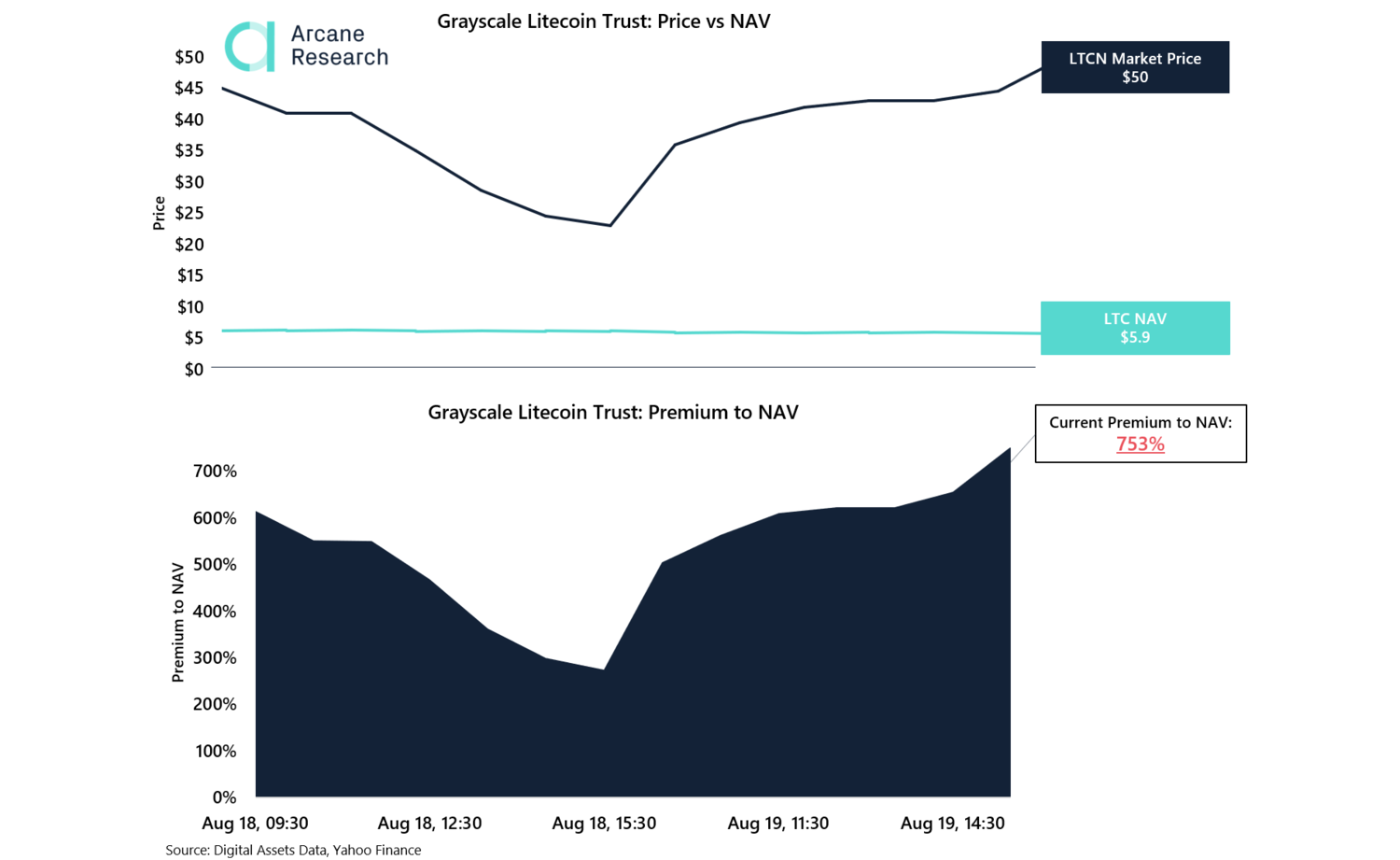

The Grayscale Litecoin Trust

Preview

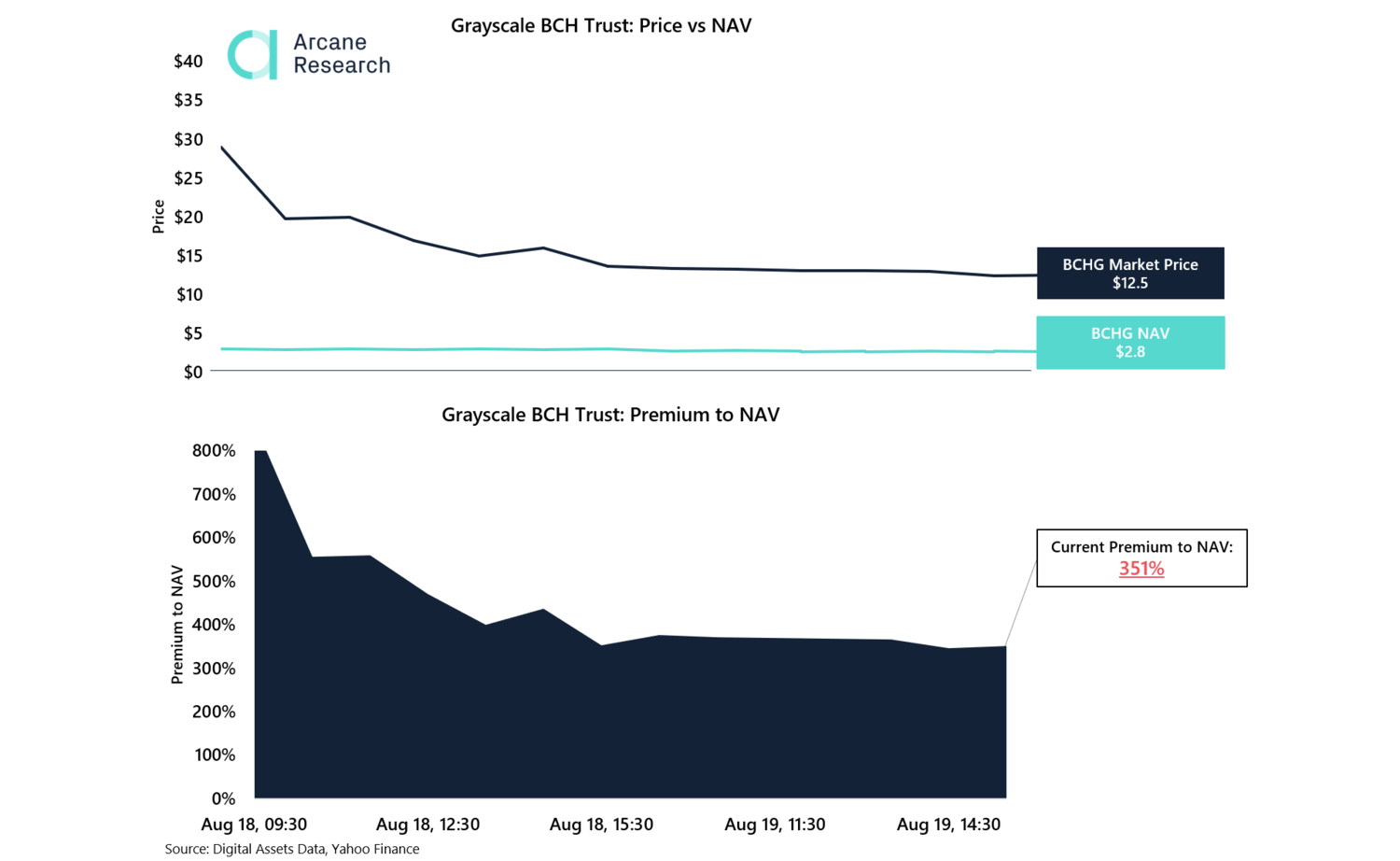

The Grayscale Bitcoin Cash Trust

Preview