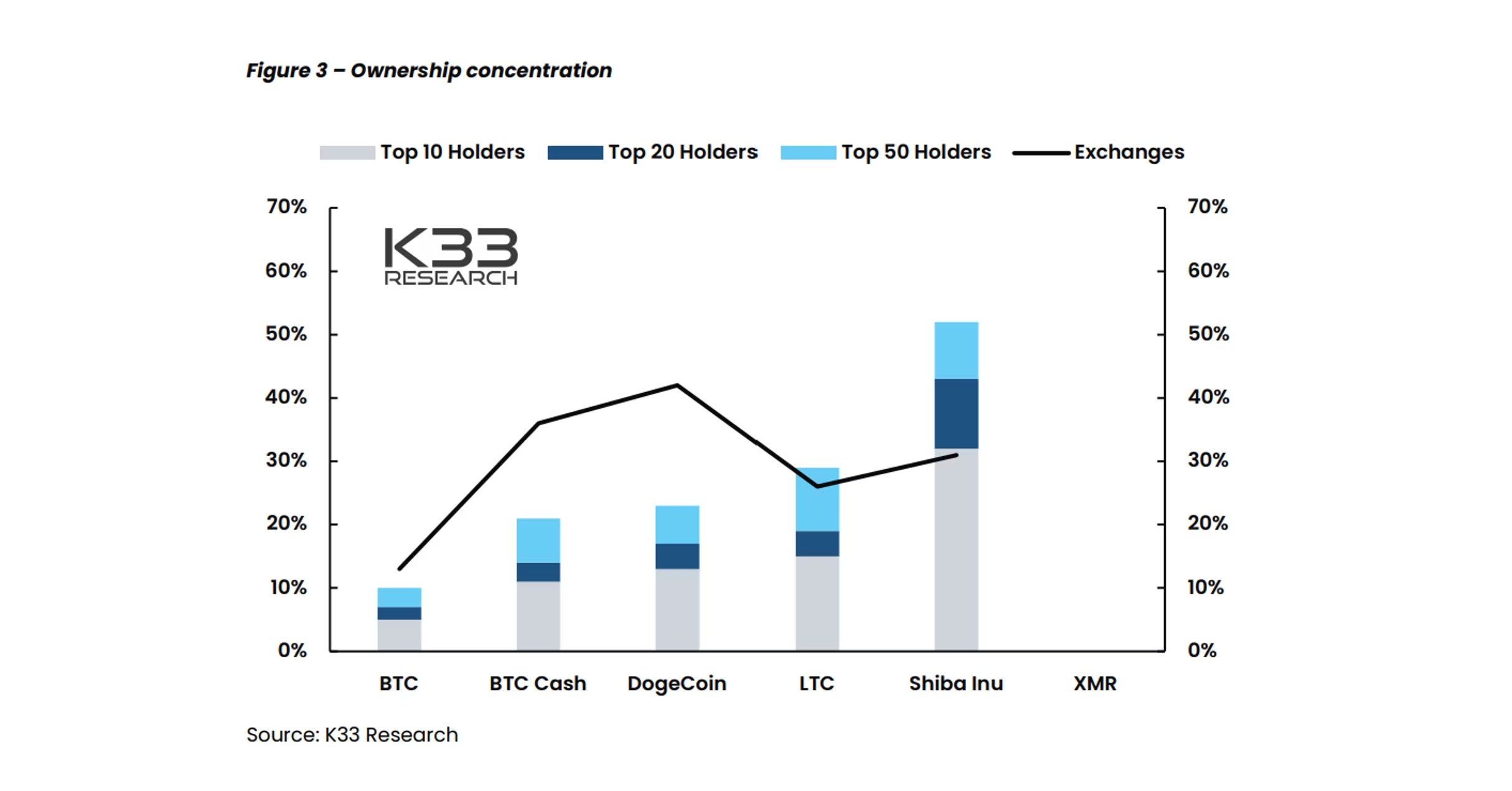

Payment tokens: Bitcoin ownership the most spread

Most payment tokens are organically distributed through mining with no pre-allocations. But no allocations don't equate to spread ownership. The issuance schedules are massively frontloaded - early adopters will, in practice, get huge allocations.

Preview

In Short

Always assess the token ownership concentration when you buy cryptocurrency.

The figure above lists the percentage of tokens held on exchanges and the share of tokens held by the top 50 addresses (excluding exchanges). Bitcoin has the lowest ownership concentration of all the tokens by a substantial margin. Bitcoin Cash, Litecoin, and Dogecoin appear to have similar distributions, while Shiba Inu tokens are highly concentrated, as noted earlier. The privacy features of Monero prevent us from obtaining similar statistics for XMR. XMR is, relative to most other coins, used frequently as a medium of exchange, and hence we believe the supply to be fairly spread out. We view owning tokens with a high ownership concentration as riskier than when tokens are distributed widely. With substantial ownership concentration, single points have more influence on the selling pressure in the market. Most huge bags are allocated and not bought, meaning we believe they are more likely to sell into increased demand or dumped on the market at once.