A new all-time highlg...

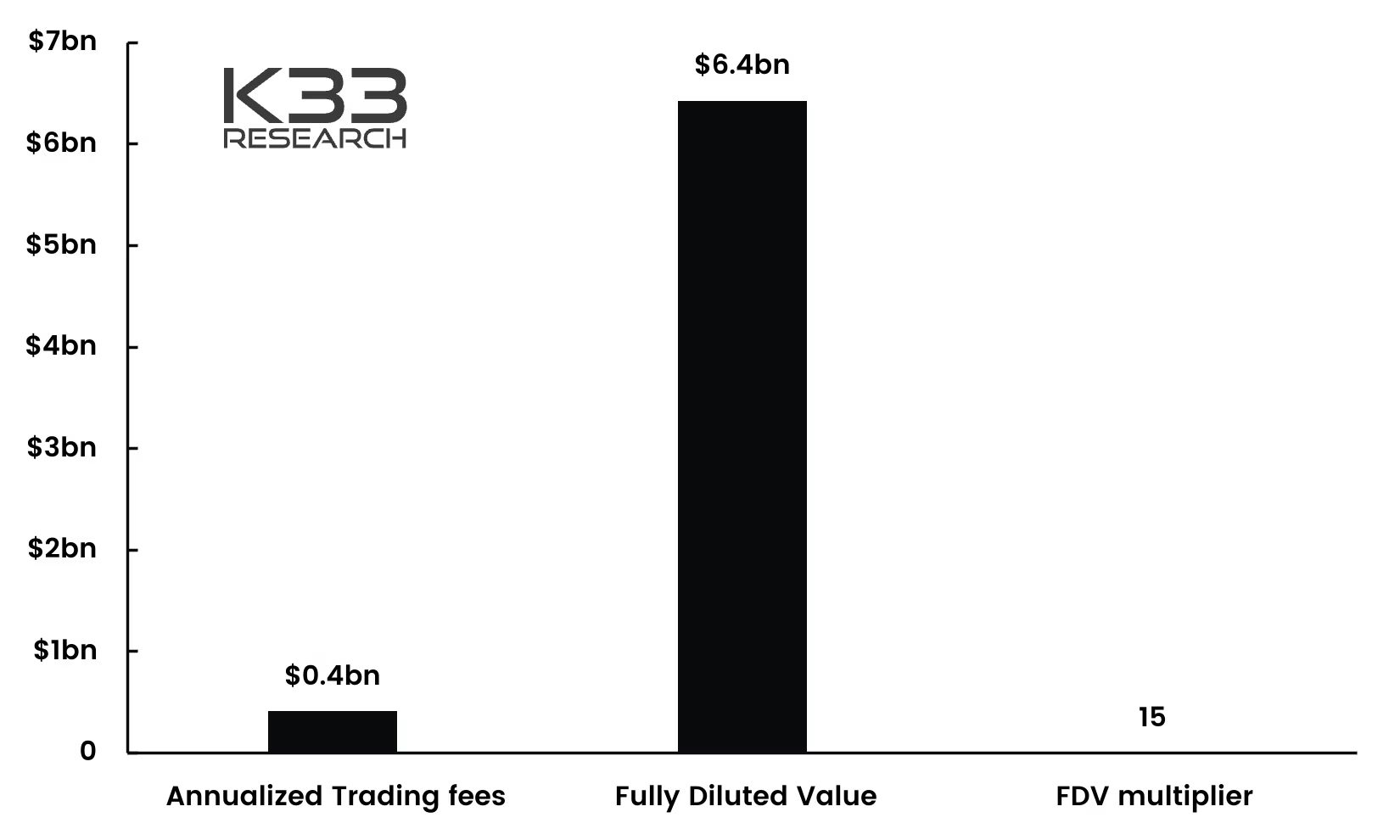

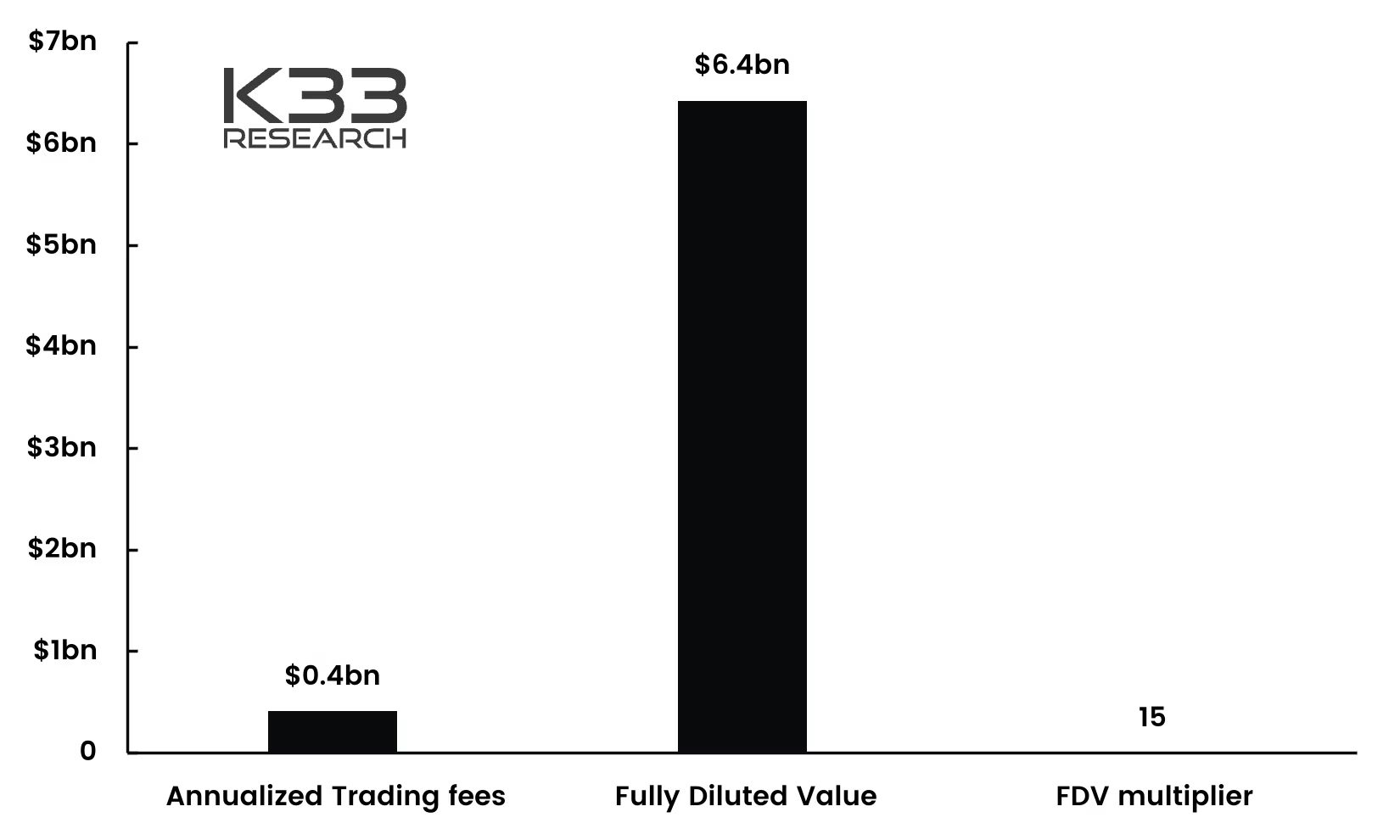

Bitcoin reaches new heights, U.S. spot ether ETF decisions were predictably postponed, and a controversial bitcoin miner survey has been stopped. Also, we discuss Uniswap's fee switch proposal and give you a quick primer on the new stablecoin USDe.

lg...more