What is the Maker token?

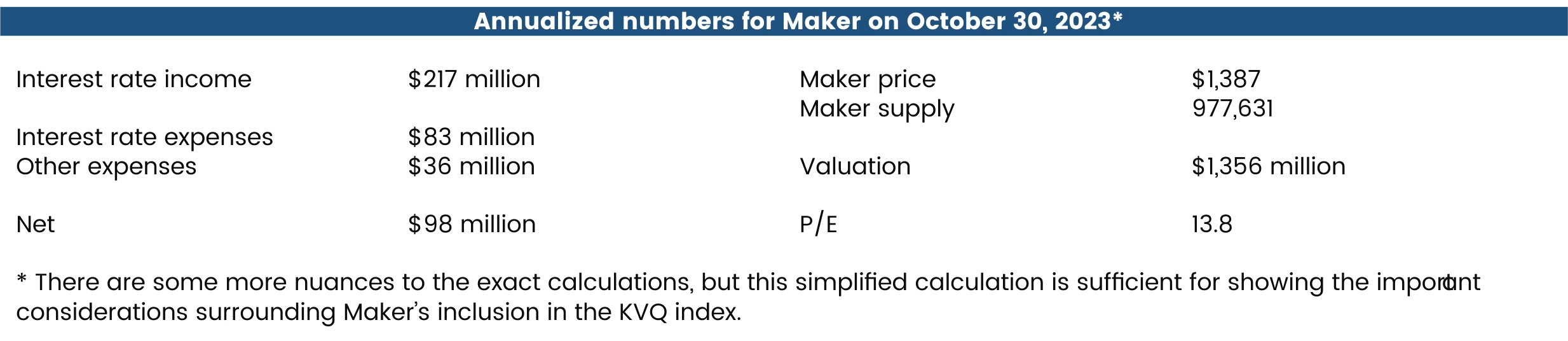

Maker is the governance token of the MakerDAO. The Maker DAO again controls the Maker Protocol. Governance rights in and of themselves are difficult to value, but the Maker token derives undisputable value from the combination of interest income in the protocol and the automatic use of this interest income to buy and burn the Maker token.The Maker DAO has one main source of income, interest rate income on DAI issuance. Furthermore, the Maker DAO has two main sources of expenses, interest rates on DAI deposits, and developer and other community costs. The net difference between income and expenses is added to Maker DAO’s surplus buffer. When the surplus buffer exceeds $50 million, the overshooting surplus buffer is used to buy and burn Maker tokens. This means that, over time, the net profit of the protocol will be used to buy and burn Maker tokens.Assessing the Maker token’s price

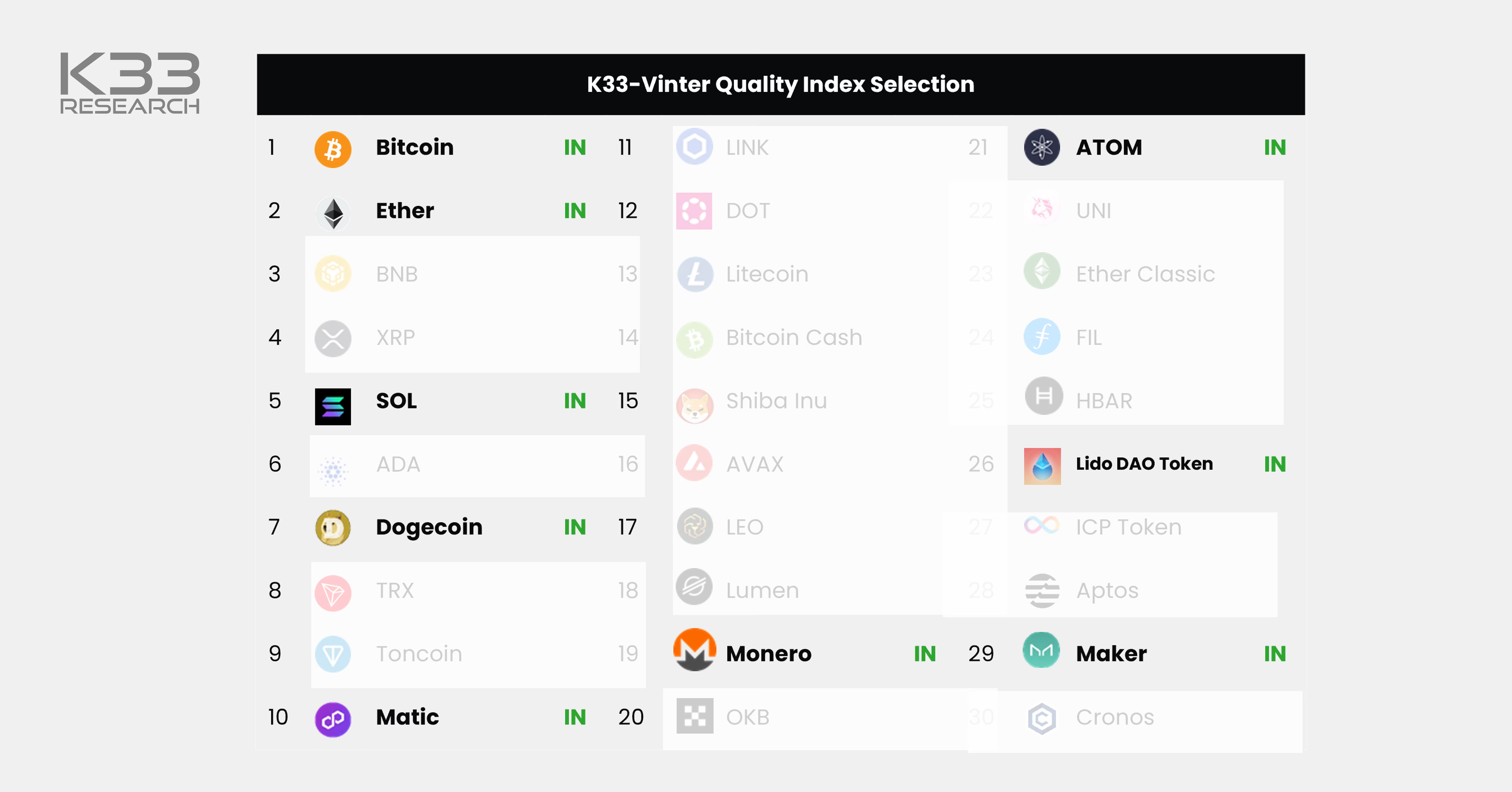

Simplifying a bit, the Maker token can be valued using a discounted cash flow (DCF) analysis of the Maker protocol’s net profits. DCF analysis is highly sensitive to the discount rate, and it’s in no way evident what is the appropriate discount rate for the Maker token. Still, by evaluating current price-earnings ratios and evaluating the sustainability of the current profits, we can gauge whether the Maker DAO token is severely overvalued – which would have to be the case for the Maker token to not be included in the KVQ index.

Preview