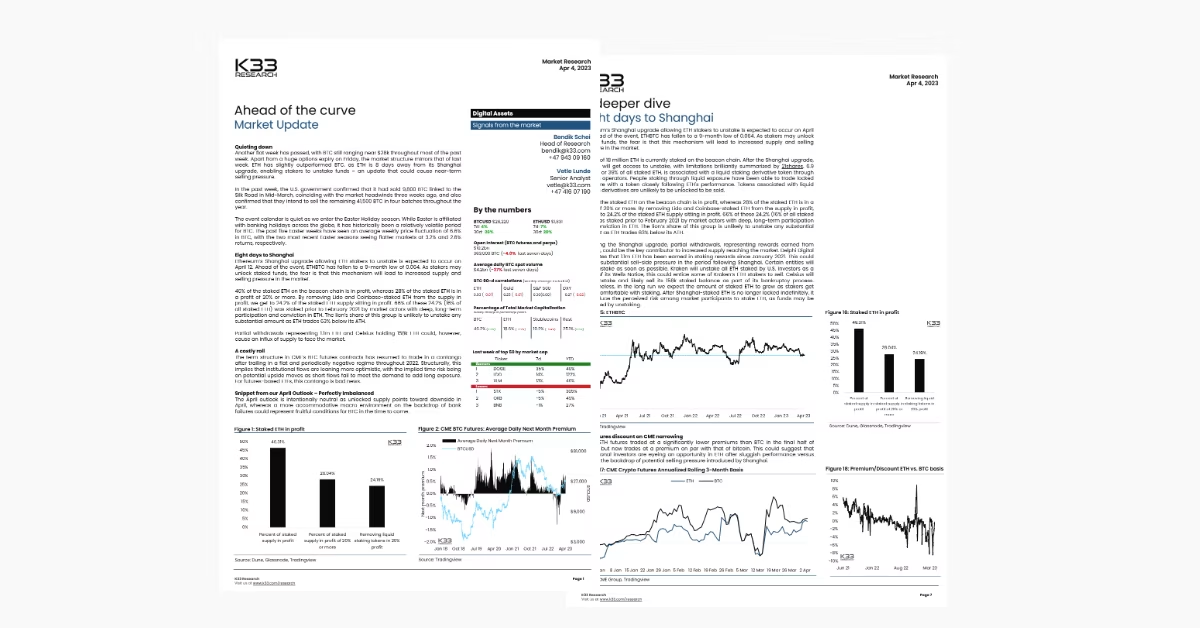

Eight days to Shanghai

How much selling pressure may the Shanghai upgrade realistically bring to the market?

Preview

In Short

This report contains our outlook on April, where we argue that increased sell-side supply could lead to a slowdown after a very strong March. We also examine how the current CME contango may impact futures-based BTC ETFs in the future, in addition to typical Easter effects on the crypto market.

Takeaways

- Bitcoin still consolidates at $28k

- Trading volumes down 37% in the past week

- CME's basis falls below 5%

- 46% of all staked ETH is in profit

- Easter volatility has been typical in the past five years in BTC