- If others were to enter the ecosystem, the early holders must profit by selling tokens to new entrants.

- Or if they simply hold, they will have theoretical paper value when the tokens appreciate in value.

No block reward and a highly concentrated LUNA supply gave all power to the early holders

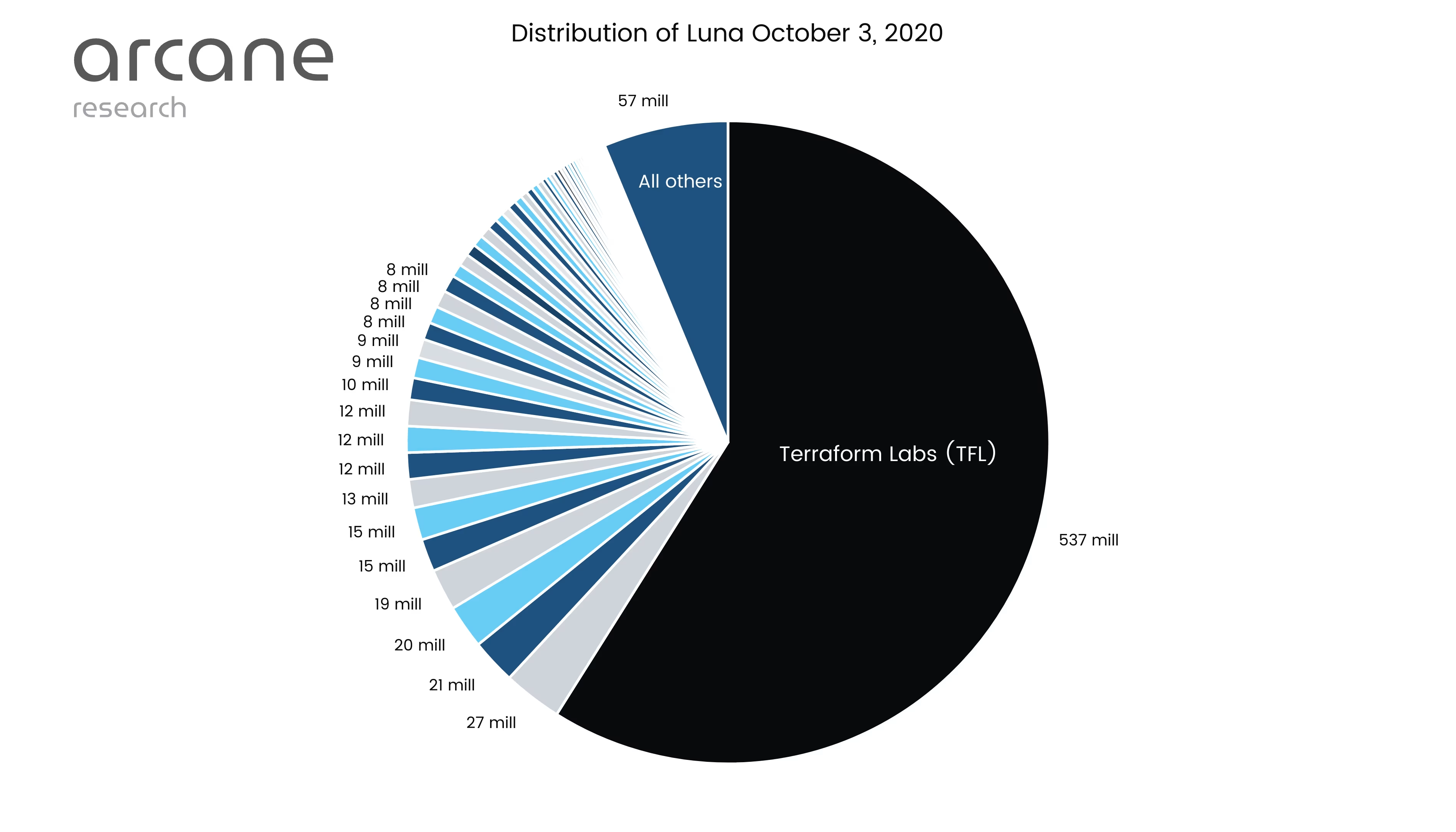

The early distribution of the later valuable tokens was very concentrated, as witnessed by the early distribution of LUNA tokens.Distribution of Luna tokens on October 3rd, 2020.

Preview

Terra blockchain data shows that wallets connected to Terraform Labs and the large early LUNA holders have made tremendous profits

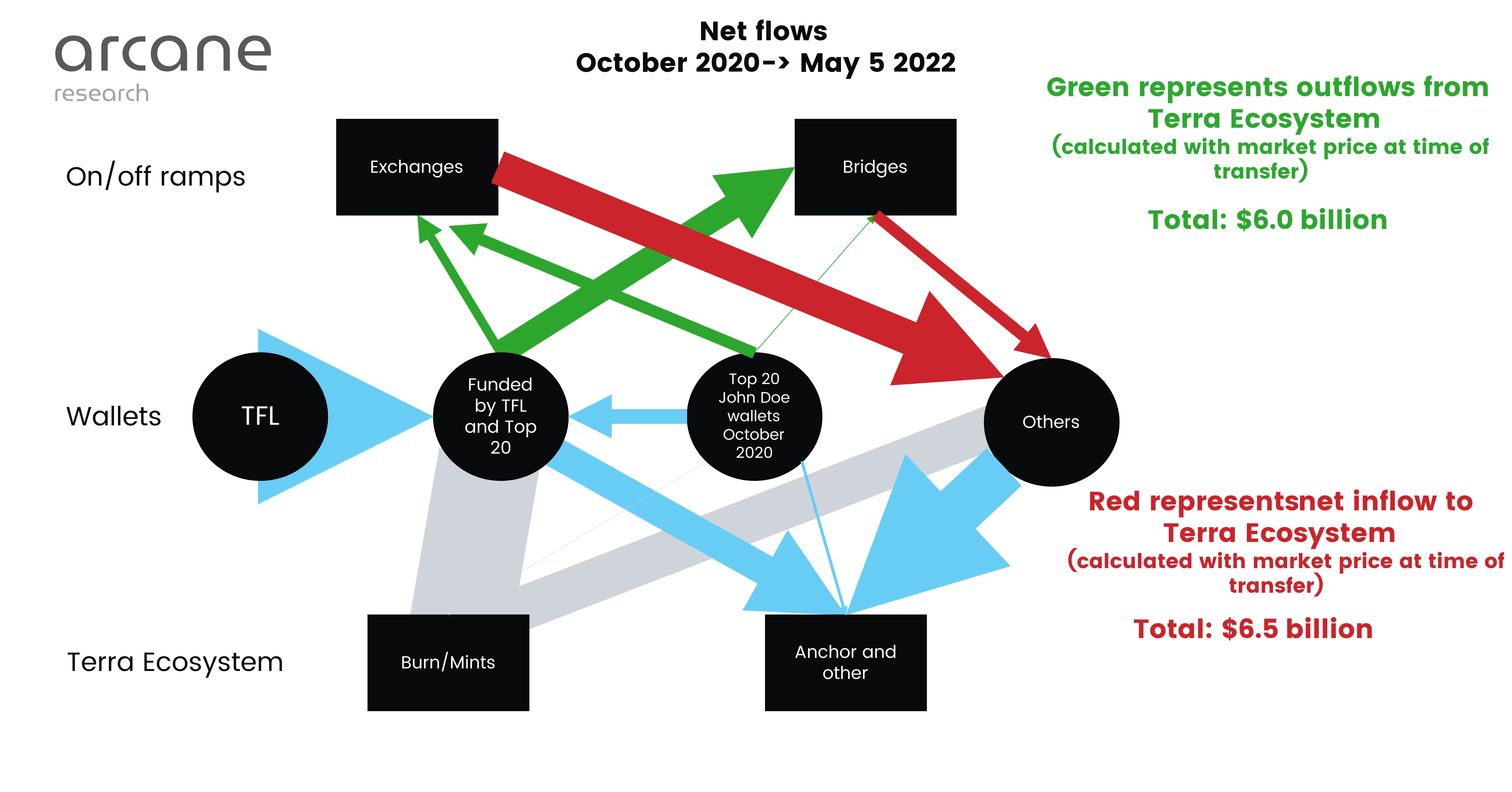

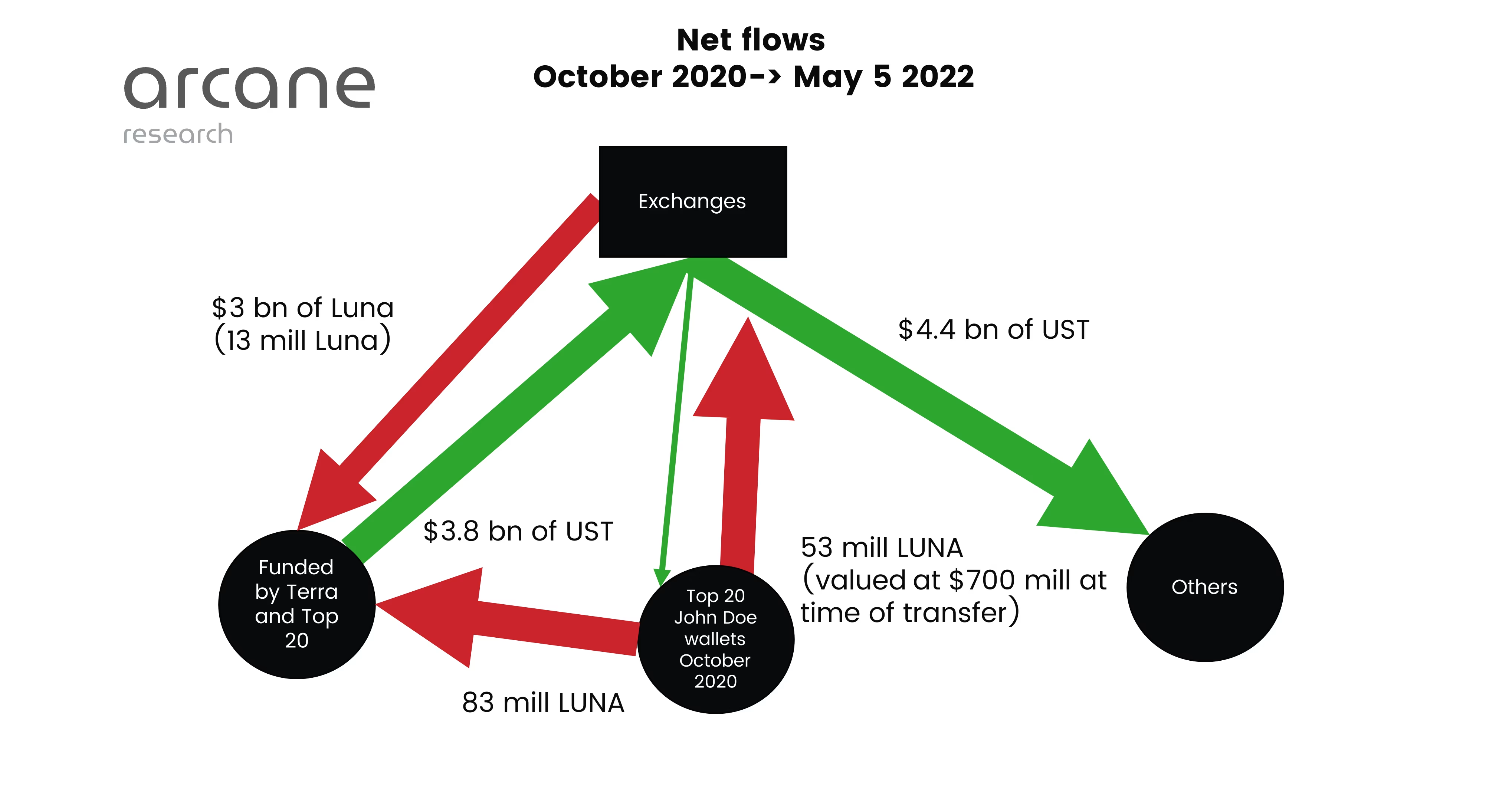

I have analyzed the value flows in the Terra Ecosystem with a particular emphasis on the use of the exit gates via bridges or centralized exchanges. To avoid obscuring the picture, I have only accounted for transactions up to May 5th, some days before the downfall.The analysis reveals that sets of John Doe wallets interacting closely in clusters have massive net outflows from the Terra ecosystem to bridges and centralized exchanges. The common denominator among the clusters is that one or more wallets in the cluster received significant transfers from Terraform Labs wallets or the largest John Doe wallets as of October 3rd, 2020 (referred to as early John Doe wallets hereon).The set of John Doe wallets in the clusters obviously put great trust in one another, sending straight-up transactions of millions of dollars frequently between themselves. In total, there are close to 3,000 wallets in the clusters. And many of the clusters have received funding from more than one of the Terraform Labs wallets and the early John Doe wallets.Net outflows of $6 billion

From October 2020 to May 5th, 2022, the clusters have net outflows of $6 billion to exchanges and through bridges (flow value calculated by using market prices at the time of transfer). In contrast, all the other hundreds of thousands of wallets have a net inflow of $6.5 billion.Net flows in the Terra ecosystem, evaluated at market prices at the time of transfers.

Preview

Preview