Pushed to extremes: A remarkably unremarkable market state

Trading volumes at 2.5 year lows and uniquely cheap vol

Preview

In Short

In this week's market update, we explore the implications of Tether's announced BTC purchases, a potential resurgence of BTC's portfolio diversification narrative, peculiarly priced options, and early signals of positive institutional flows in BTC.

Takeaways

- Five consecutive Tuesdays of BTC at $27k

- Lowest recorded 7-day average volume since December 2020

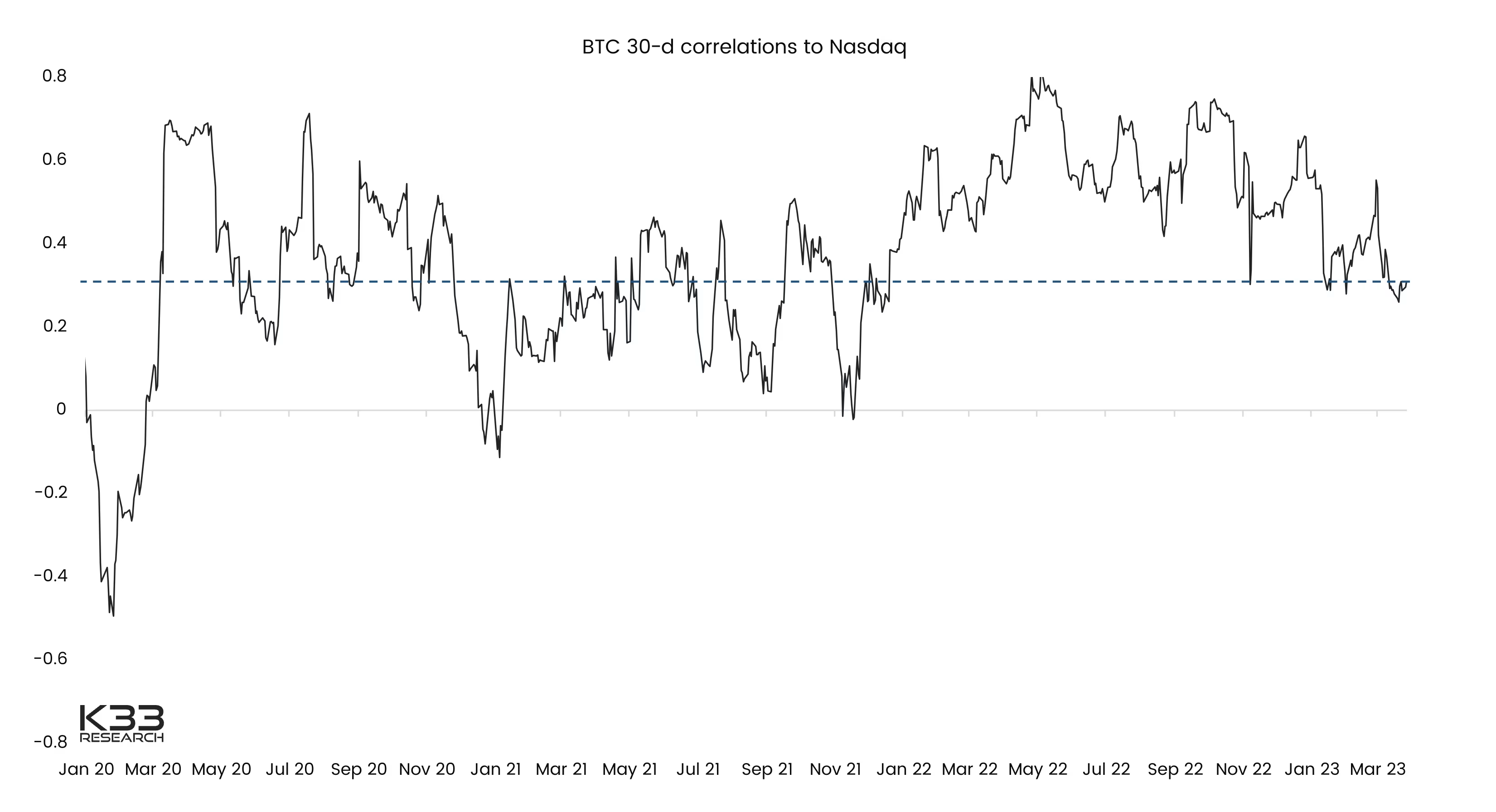

- Correlation to Nasdaq at 17-month low

- Tether to buy 6% of the daily BTC issuance?