The quality filter must include subjective analysis

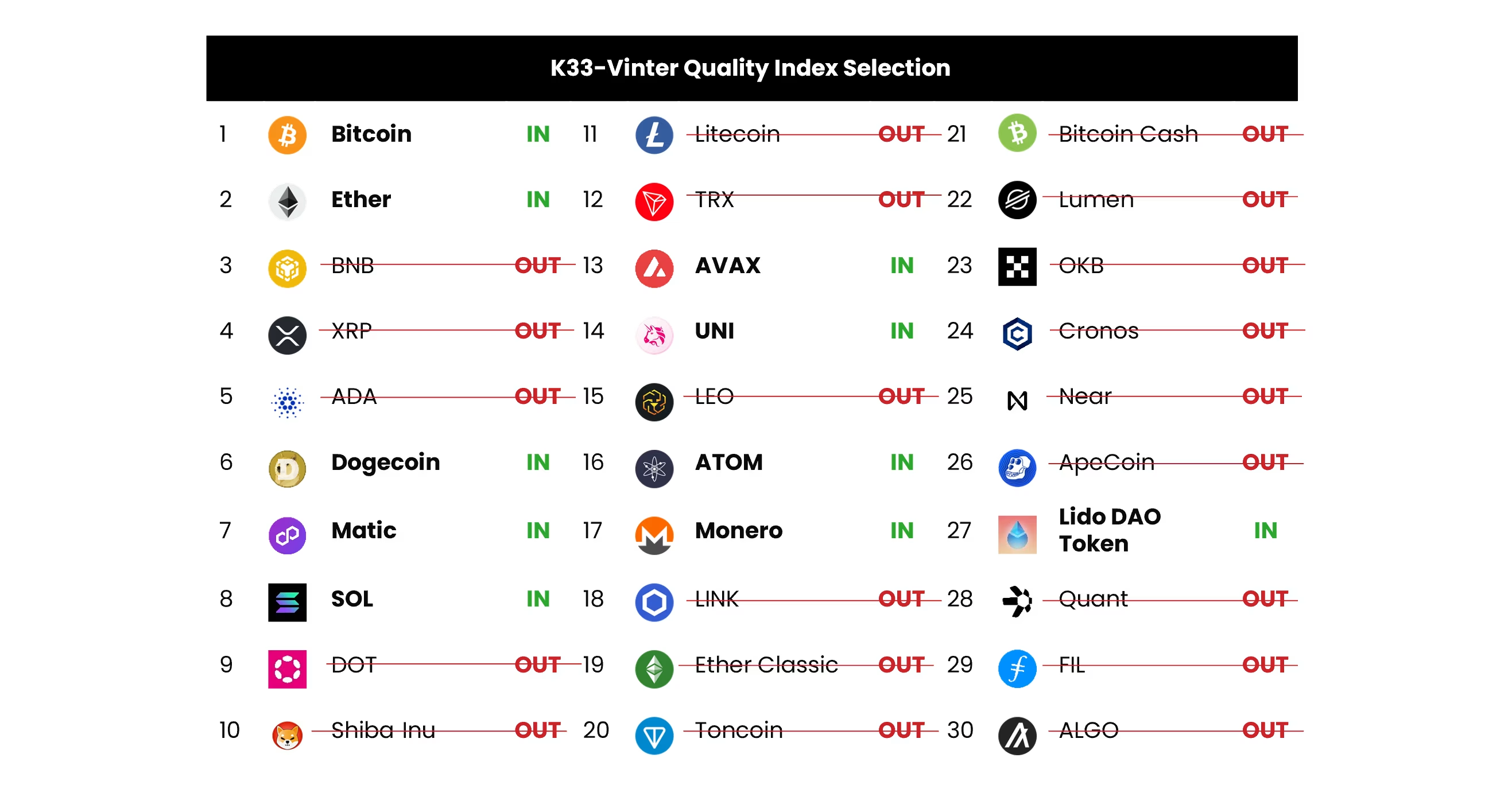

The selection assessments should not be considered a universal truth, and others could provide compelling adverse arguments to our selections. Contrary to traditional finance, all the "bank" 's data are there for all to see in crypto. However, in most cases, you won't know, in the strictest sense, whose data or what you are looking at. By looking at the blockchain data itself, it's impossible to evaluate what's "real" volume or "fake" volume, whether 1000 addresses are really just one guy or a thousand, etc. To make sense of the blockchain data, you must therefore make inferences from outside knowledge in combination with what the blockchain tells you. To assess whether a token should be included in the "K33 Vinter Quality Index," we use a combination of standardized metrics and our specialist knowledge.A good stock portfolio will not, by definition, include good companies but rather good investments, i.e., companies with a low price compared to the fair price. Crypto markets are still immature, and at the current time, there are no well-established pricing models like the discounted cash flow model in traditional valuation of stocks. We believe many tokens' prices will eventually go close to zero. At the moment, the K33 Vinter Quality Index is mainly about excluding the tokens with a low probability of keeping value long-term. As our work on- and understanding of token prices expand, the index will be updated accordingly.The Quality Filter

1. CategoriesCategories regroup and enable the comparison of assets having similar purposes. Each asset in the top 30 by market capitalization belongs to one of these categories:- Smart Contract

- Payment

- DeFi

- Inter-Blockchain Communication

- Centralized Exchange

- Money Infrastructure

- Specialized Utility

- Community

- Gimmick