Arguments in favor of an ETF approval

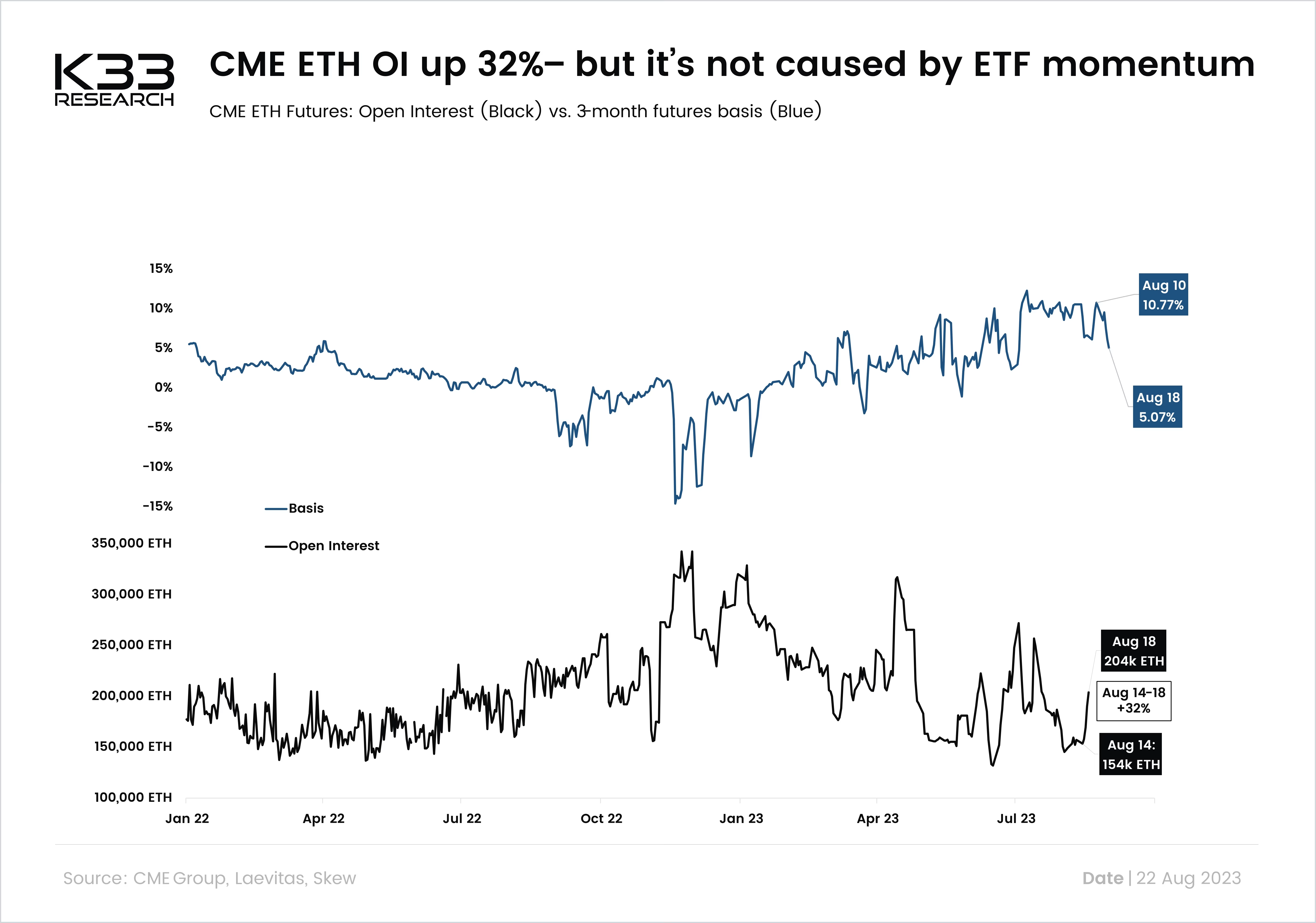

- CME’s ETH futures market has now been live for 2.5 years. Lack of liquidity and a nascent CME market were cited as the main reasons for ETH ETF withdrawals in 2021.

- Access to ETH exposure through regulated venues has improved since 2021 with the launch of EDX and ETH Options on CME.

- Longevity and relevancy of Ethereum in the crypto market – a long history as the second largest cryptocurrency.

Arguments against an ETF approval

- Compared to BTC, ETH is more challenging to classify as either a commodity or a security. Both the ICO and staking dynamics could lead an approval harder to attain.

- On multiple occasions, Gensler has been quoted as saying that more or less all crypto assets apart from BTC are securities. However, he also explicitly stated that ETH is not a security in 2018.

- The ongoing SEC vs. Coinbase lawsuit related to offering staking as a service.

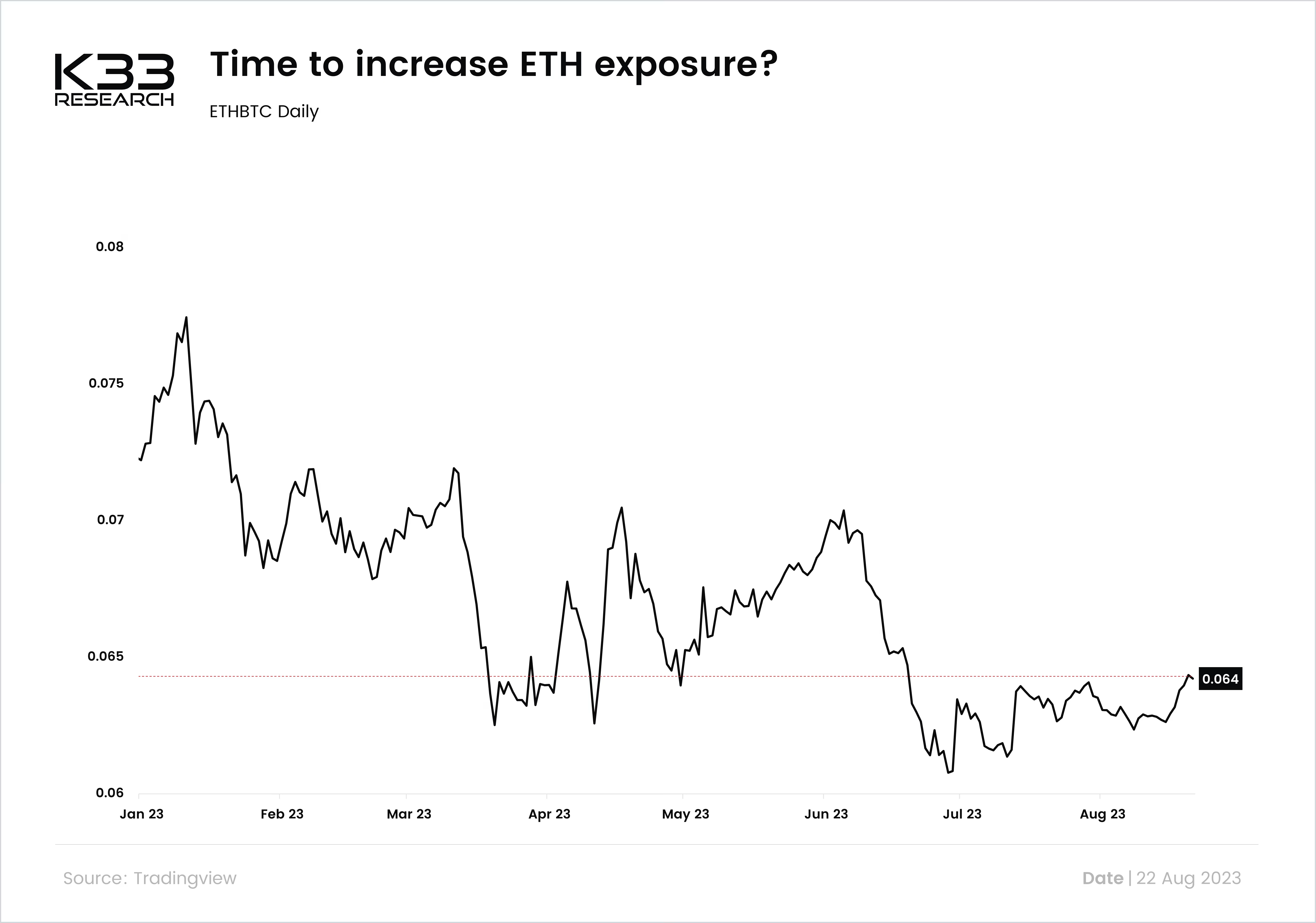

CME ETH OI up 32% in one week – but it’s not caused by ETF momentum

Preview