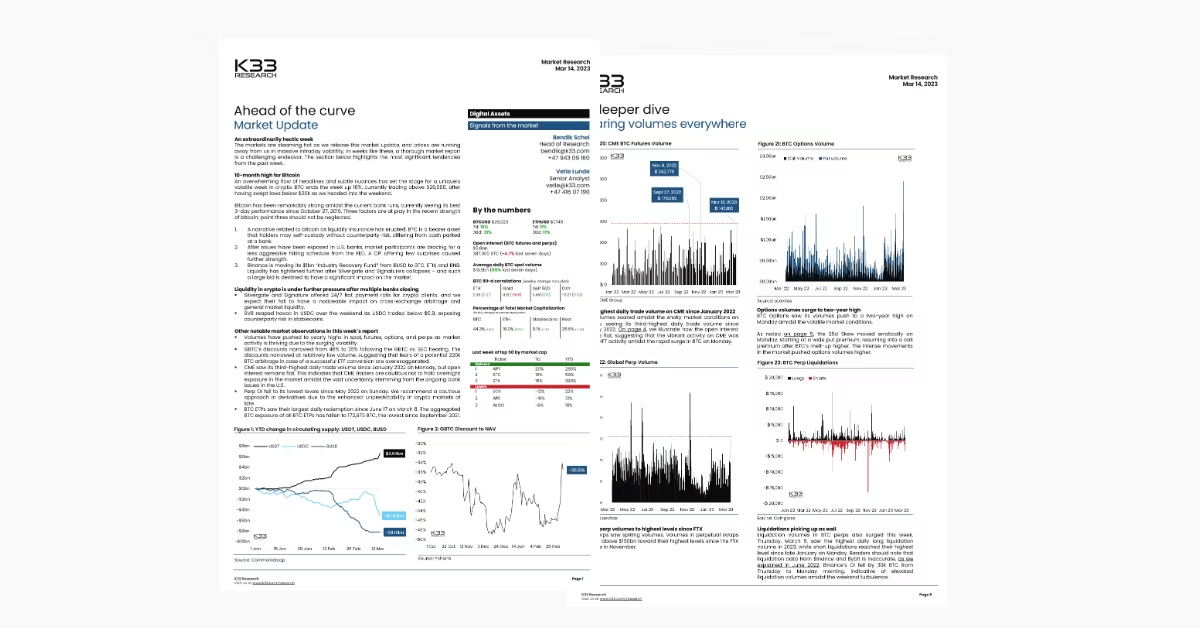

Bitcoin to 10-month highs after an extraordinarily busy week

Bank runs, surging volumes and extreme volatility

Preview

In Short

In this report, we examine the implications of the U.S. banking turbulence on BTC. Lately, we see signs of institutional traders being cautious about holding overnight exposure in BTC.While the appealing narrative of BTC's bearer asset trait could be a significant source of BTC's recent strength, we also believe Binance to play a significant role amidst tightening liquidity.

Takeaways

- BTC sees its strongest 3-day performance since October 27, 2019

- Silvergate and Signature closings to have significant implications for crypto market liquidity

- CME futures trading at a discount to spot

- Volumes surging to yearly highs

- Largest ETP redemption since June 2022

- GBTC discounts narrows after oral hearing

An extraordinarily hectic week

The markets are steaming hot as we release this market update, and prices are running away from us in massive intraday volatility. In weeks like these, a thorough market report is a challenging endeavor. The section below highlights the most significant tendencies from the past week.

10-month high for Bitcoin