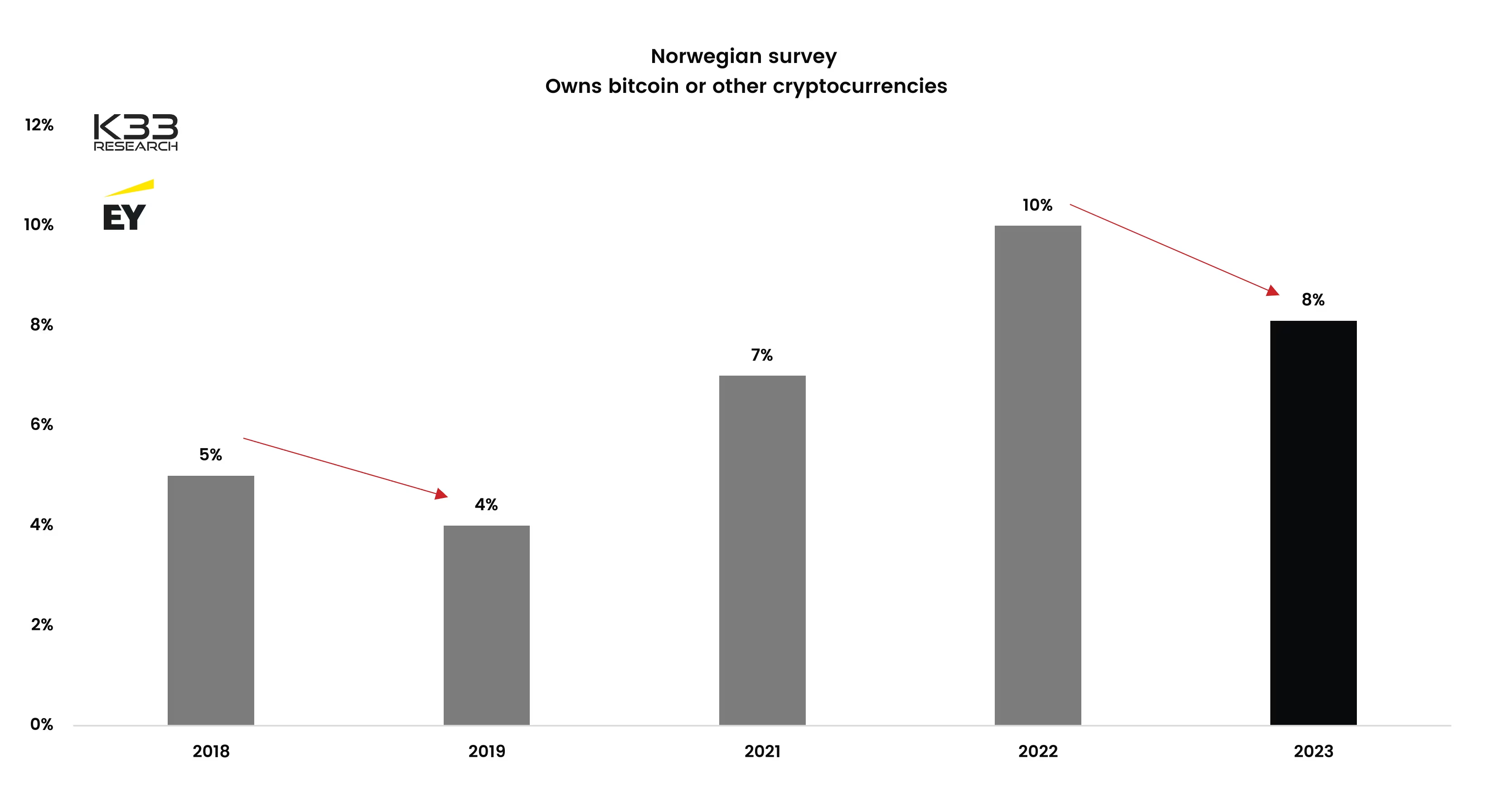

8 percent of all Norwegian adults own crypto

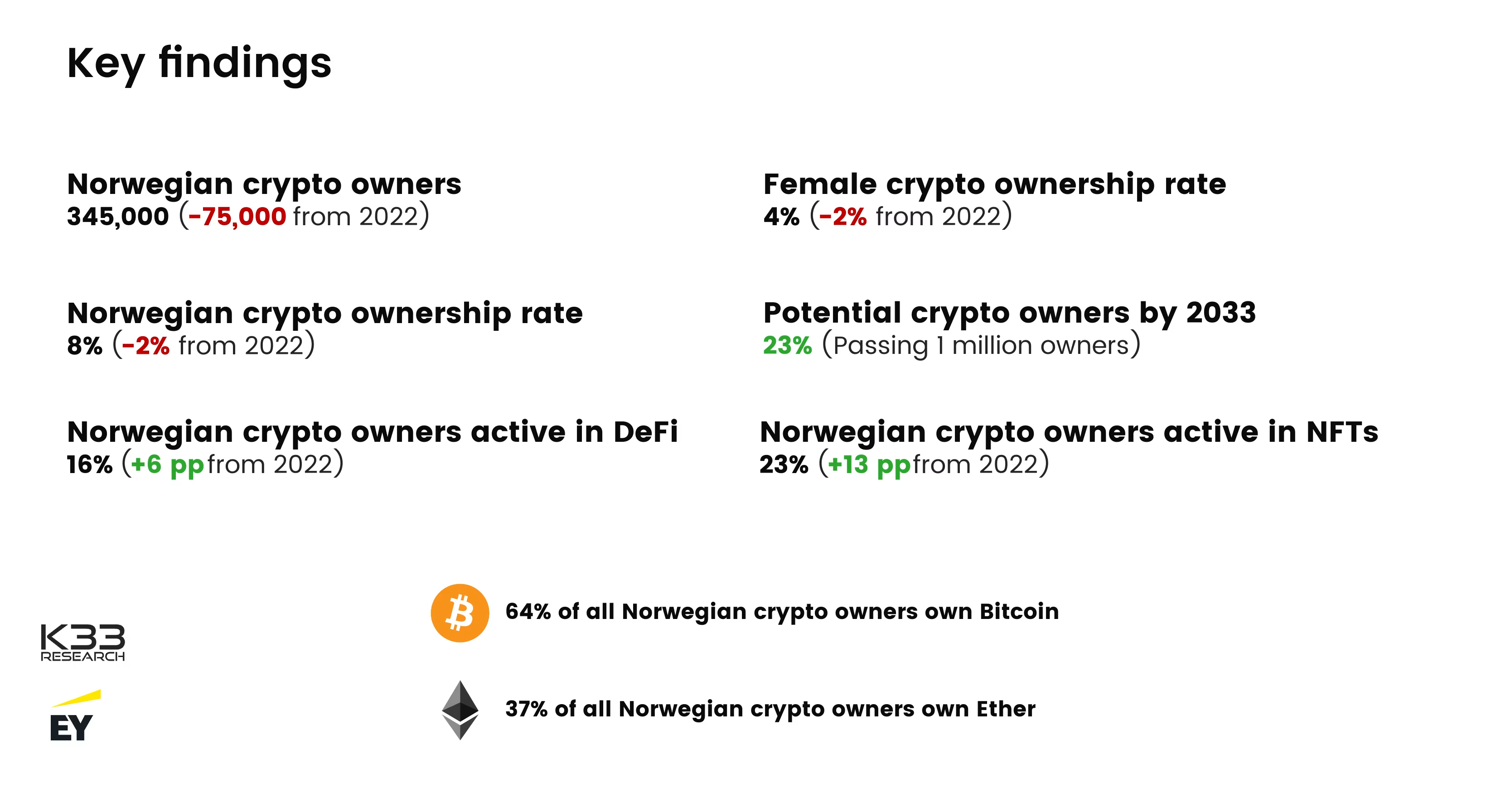

Oslo, April 21, 2023: A nationwide survey conducted by EY and K33 Research reveals that 8 percent of the adult population in Norway own cryptocurrency, down from 10 percent in 2022. This article present parts of our recent Norwegian Crypto Adoption survey. The full report can be accessed here.

Preview

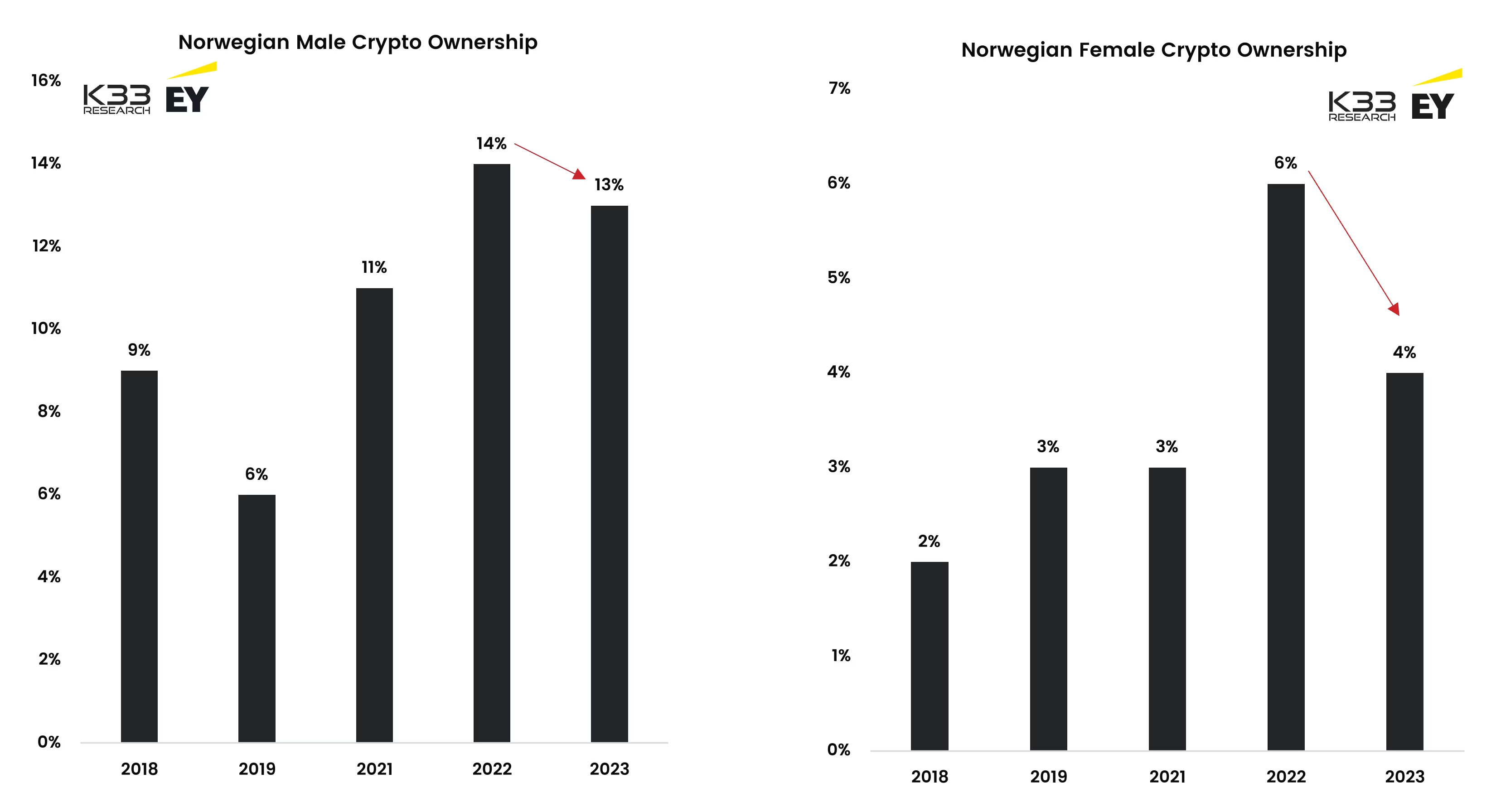

Widening gender gap

Preview

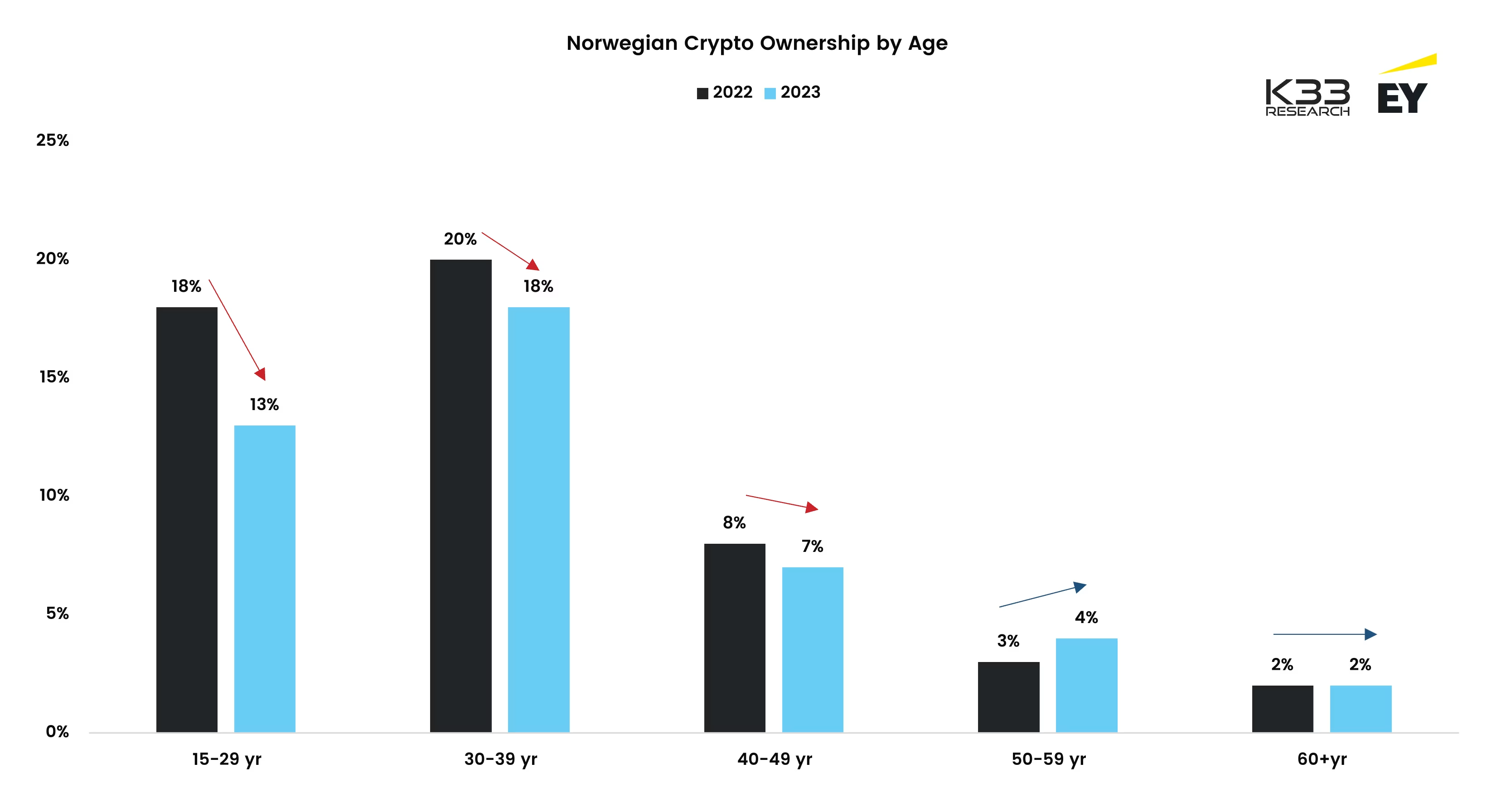

Young owners dominate and are the most active in the market

Preview

Preview

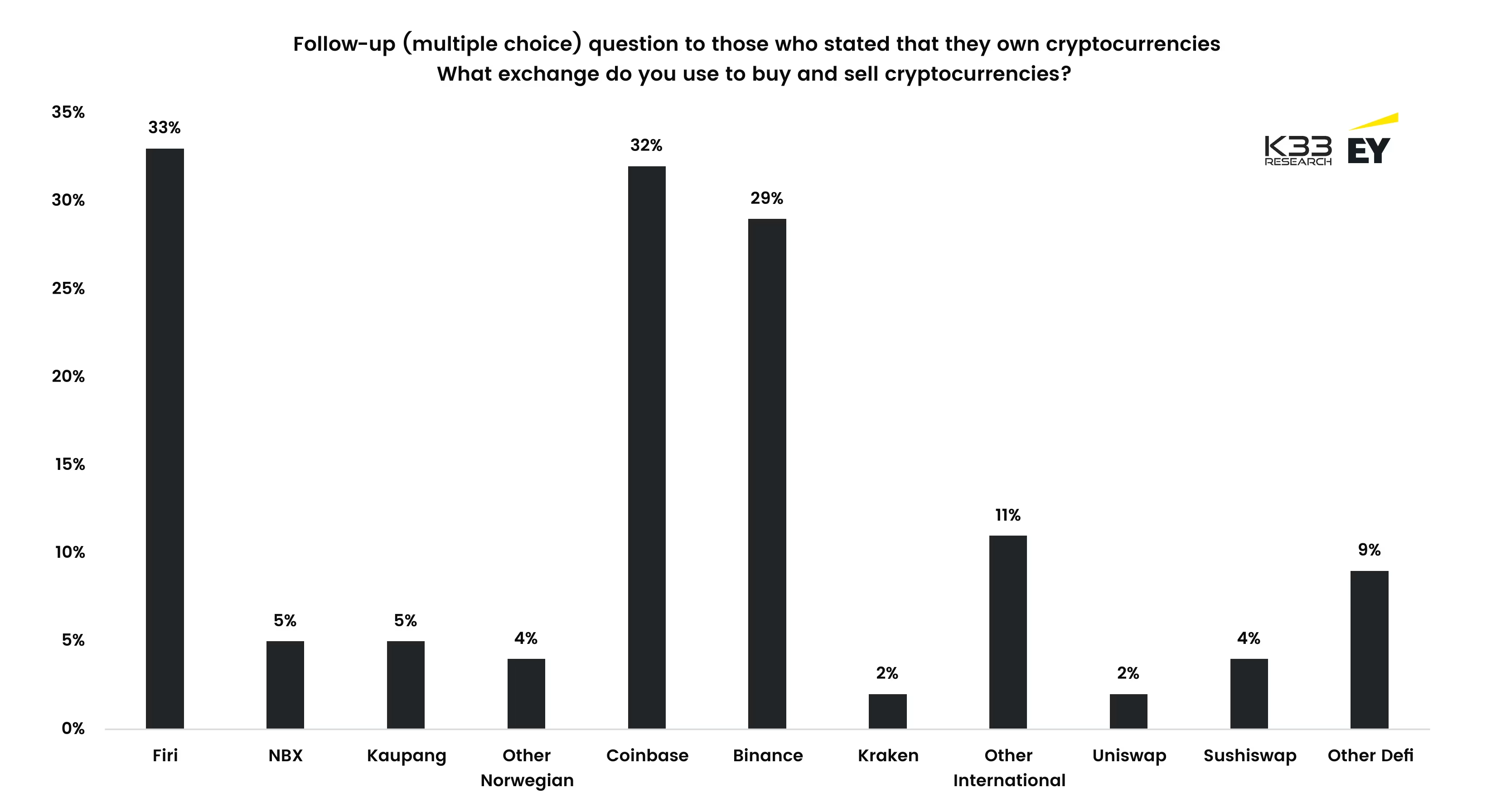

Firi, Coinbase and Binance dominate the Norwegian crypto market

Preview

Decline in Norwegian cryptocurrency ownership, but increasing number of advanced users

The decline in Norway is as expected given that it has been a turbulent year for cryptocurrencies in general. However, we are seeing that both Norwegian and international users and institutional players are becoming increasingly advanced in the use of cryptocurrencies and are preparing for long-term growth," said Magnus Jones, Nordic Blockchain and Innovation Leader at EY.He sees that mechanisms such as decentralized finance and the use of other types of crypto assets such as NFTs are on the rise. Combined with greater regulatory predictability, this could lead to long-term growth, but there is still expected to be a high degree of volatility in the crypto market. The nationwide survey conducted by EY and K33 Research shows a reduction in Norwegian cryptocurrency owners by 75,000 individuals in the last year, and EY and K33 Research estimate that 345,000 Norwegians owned cryptocurrency in March 2023.

2022 was a very turbulent year in the cryptocurrency market where the market fell 65% and several major market players went bankrupt at the expense of both Norwegian and foreign retail investors. The collapse of trust as well as the broad market decline have probably been a major contributor to the significant reduction over the past year," said Vetle Lunde, Senior Analyst at K33 Research.The decline in Norwegian cryptocurrency activity is far from unique. The report finds that global cryptocurrency activity has been significantly declining in 2023, and that the 17% decline in Norwegian crypto web traffic is less significant than the decline observed in the most central nations in the market, best exemplified by the 33% decline in the United States during the same period.

An increasing number of advanced users

Norwegians are increasingly using more advanced mechanisms in cryptocurrency such as decentralized finance (DeFi), including decentralized exchange platforms. The survey shows that 16% of all cryptocurrency owners report having used DeFi products. This is a 20% increase from last year, and 15% of all trading from Norway is conducted on decentralized exchange platforms. NFTs (Non-Fungible Tokens) are also rapidly emerging. The survey shows a growth of 100% from last year, and it is estimated that 23% of all Norwegian cryptocurrency owners have one or more NFTs.We clearly see that users are becoming more advanced, and that both private and professional actors are using NFTs as value objects in decentralized finance. In addition, NFTs are now being used to a much greater extent to verify digital objects and ownership in video games and Metaverse platforms. Many large international companies such as Adidas, Nike, and Gucci are also offering NFT products, contributing to growth and expanded use cases," says Jones.

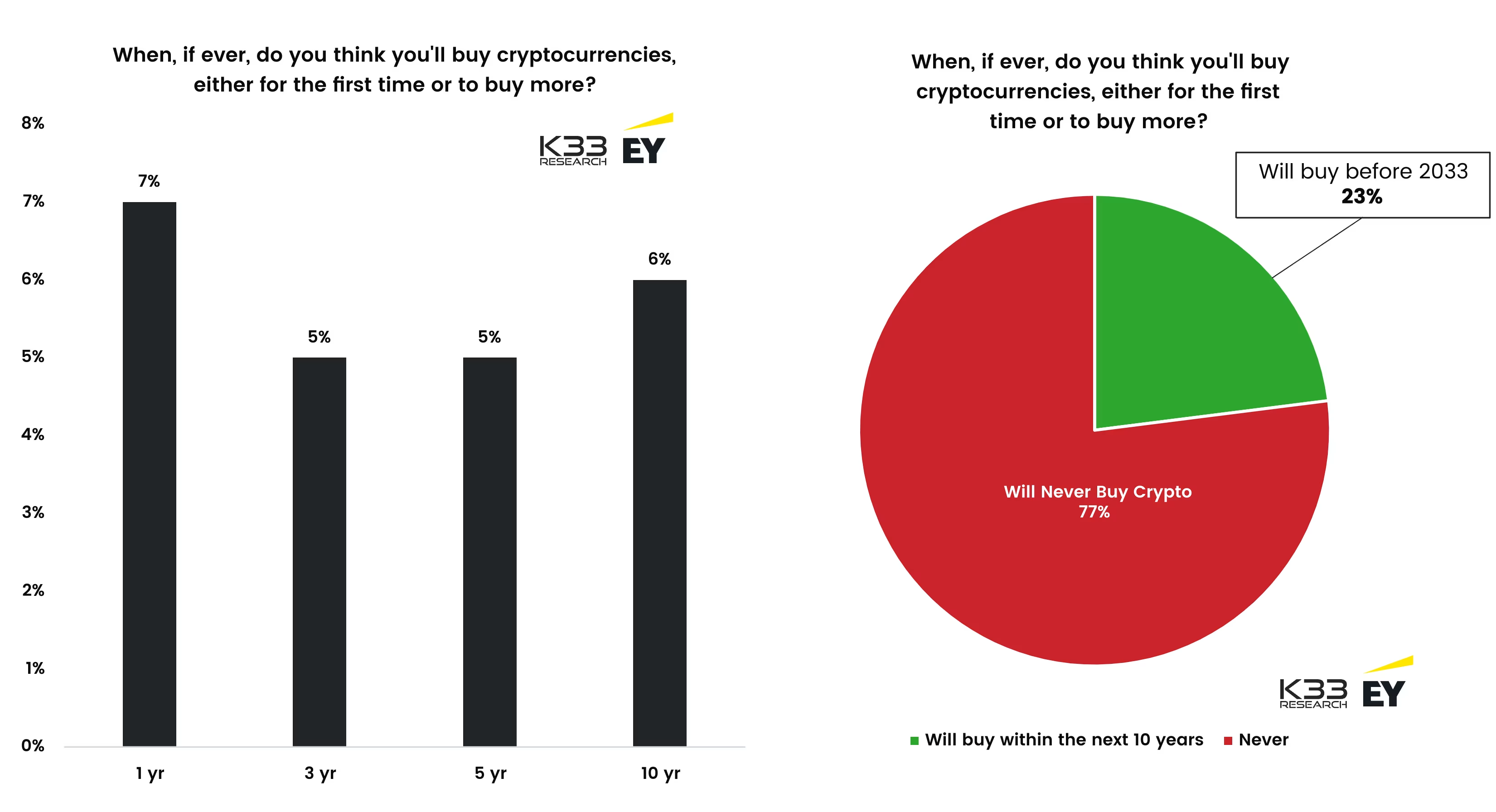

Could there be 1 million Norwegian crypto owners by 2033?

A continuing trend that provides grounds for optimism is the ongoing predominance of young owners. The demographic divide in cryptocurrency ownership is a global trend, and is particularly prominent in Norway. More young Norwegians still own cryptocurrency than stocks, and our survey indicates that 23% of the Norwegian population, equivalent to 1 million Norwegians, anticipate buying cryptocurrency over the next decade, says Lunde.He refers to the fact that the age group of 15 to 39 is particularly interested in investing in cryptocurrency, with as many as 245,000 Norwegians under the age of 40 owning cryptocurrency. In comparison, AksjeNorge estimated in the fourth quarter of 2022 that 207,000 Norwegians under 40 owned stocks.

It is interesting to note that young Norwegians seemingly have a much more active investment strategy in crypto than in stocks. Norwegian stock ownership is on a steadily rising trend among young investors, while the same segment tends to act in the crypto market through more short-term lenses. However, the long-term trend is clear, ownership of crypto among young people has increased by 22.5% since spring 2021 and more than doubled since 2019. The proportion of older Norwegians with crypto exposure has been far more stable over the past three years, indicating clear differences in how young Norwegians and older adults behave in the crypto market, concludes Lunde.

Regulatory certainty

The cryptocurrency market has generally been characterized by a lack of regulatory framework and predictability. This has affected both private investors as well as institutional ones. It is expected that the EU will adopt the so-called MiCA (Markets in Crypto Assets) regulation during 2023, which will lead to a much greater degree of predictability for investors and providers of crypto-related products and services.Our Norwegian and international clients have been preparing for several years to be able to offer crypto-related products and services. When MiCA is implemented, the legal and financial regulatory frameworks will become far more predictable, and we see this as a factor that could lead to further growth in the market in the long term, says Jones.He also notes that users have generally understood that the myth that cryptocurrency is anonymous is not true. Cryptocurrency is pseudo-anonymous and traceable. The report shows that an increasing number of Norwegians are reporting and paying taxes on cryptocurrency. For the tax year 2021, 42,781 Norwegians reported crypto assets in their tax returns, compared to 15,251 the year before. However, not everyone reports, as it is estimated that there were around 420,000 Norwegians who held cryptocurrency in the tax year 2021. Both Lunde and Jones acknowledge that the cryptocurrency market will continue to be volatile in the years to come. However, they believe that increased institutional interest, better regulatory predictability, and a younger generation that prefers cryptocurrencies over stocks will lead to an expected future growth in the market. About EY EY has the largest and most prominent consulting team in Norway dedicated to blockchain and cryptocurrency, with nearly 30 professionals working on tax and regulatory challenges, corporate structures, smart contract reviews, sustainability, investigations, accounting, and auditing. Additionally, we work closely with our Global Blockchain Team, which has more than 300 blockchain developers and 14 offices dedicated solely to blockchain development. EY Norway assists companies worldwide and has been awarded Blockchain Law Firm of the Year in Europe for two consecutive years. About K33 Research K33 Research is an analysis company that covers the cryptocurrency sector. Their goal is to demystify cryptocurrency by uncovering industry developments through data-driven and objective analysis. K33 Research conducts consulting assignments, in-depth analyses of emerging sectors, and weekly market reports on behalf of clients worldwide. Their clients include some of the largest international crypto companies, and the company has an international audience that includes readers from both traditional financial institutions and banks. For more information and inquiries related to the survey, please contact: Magnus Jones, Nordic Blockchain and Innovation Lead at EY, Email: magnus.jones@no.ey.com Phone: +47 922 22 345 Vetle Lunde, Senior Analyst at K33 Research, Email: vetle@k33.com Phone: +47 416 07 190 The entire survey can be accessed here: [link to document]