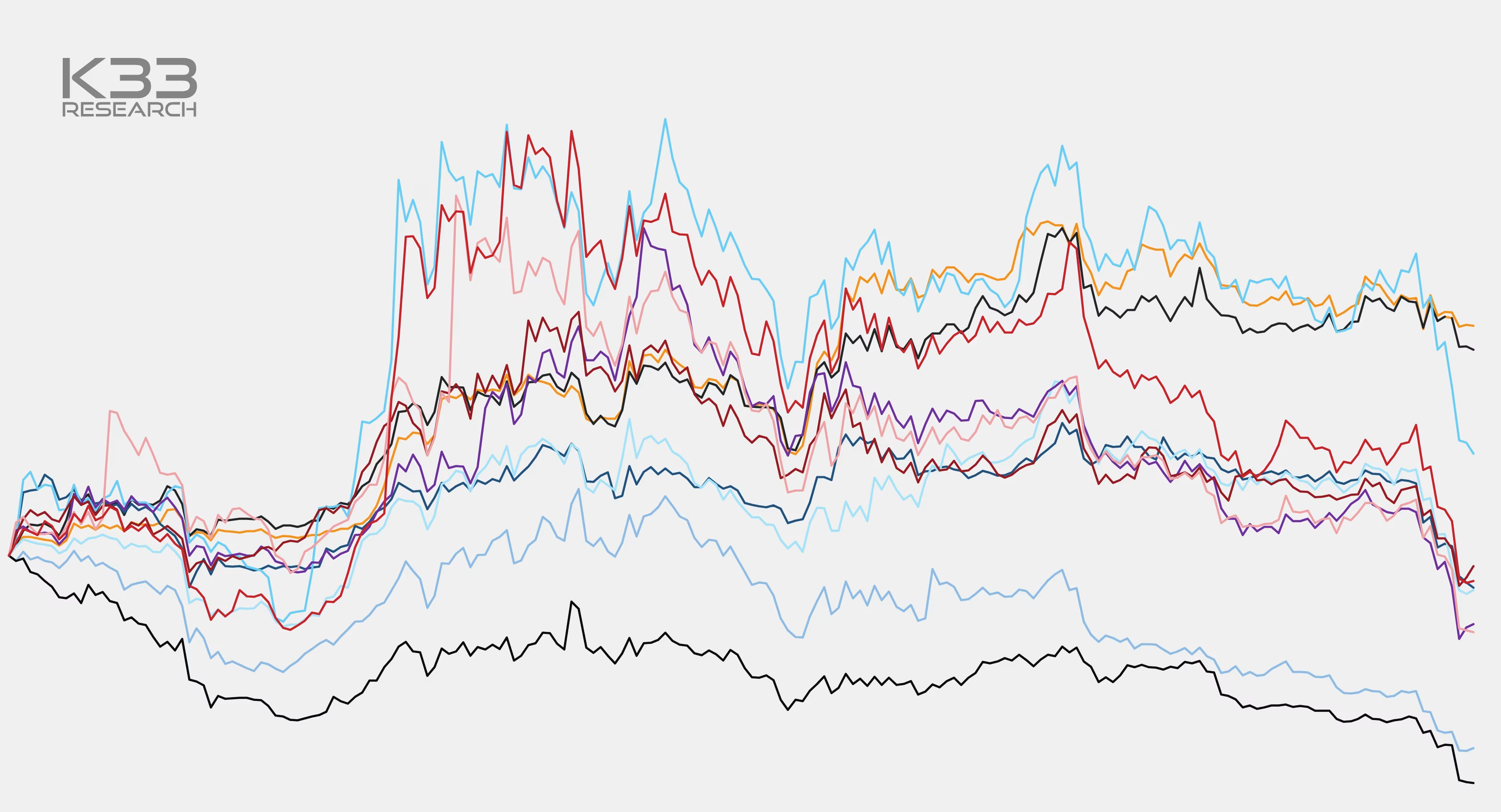

A flight to safety

This week's report explores the potential long-term effect on tokens implicated in SEC's recent charges, in addition to covering the feeble state of the market.

Preview

In Short

SEC's cases against Coinbase and Binance could have long-term implications for tokens implicated in the filings, as institutional investors shy the markets. At the same time, we see clear tendencies of rotation into BTC, ETH, and stablecoins.

Takeaways

- BTC+ETH+Stablecoin dominance above 80%

- Anemic derivatives activity in BTC