Preview

Lessons from the XRP case

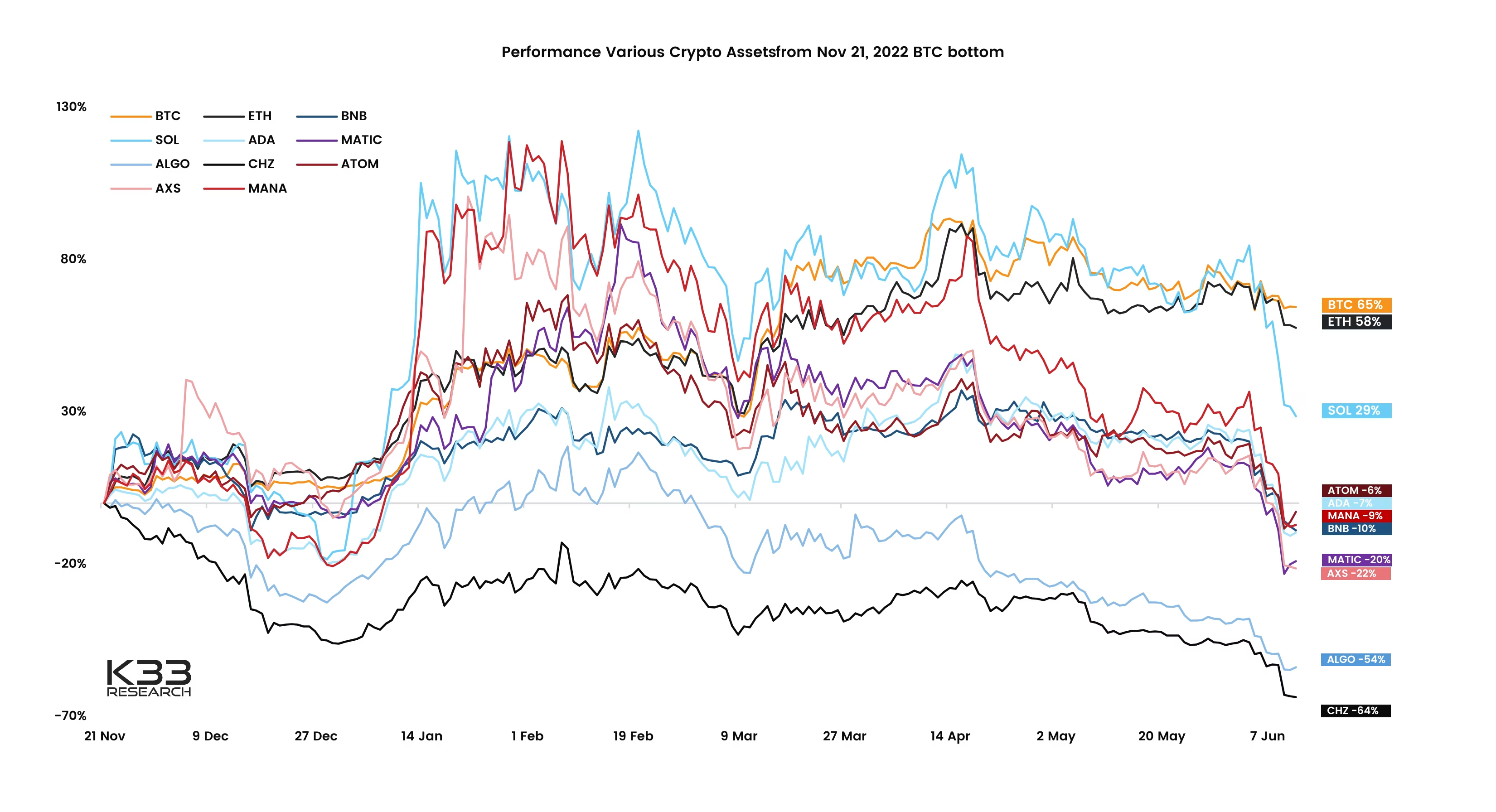

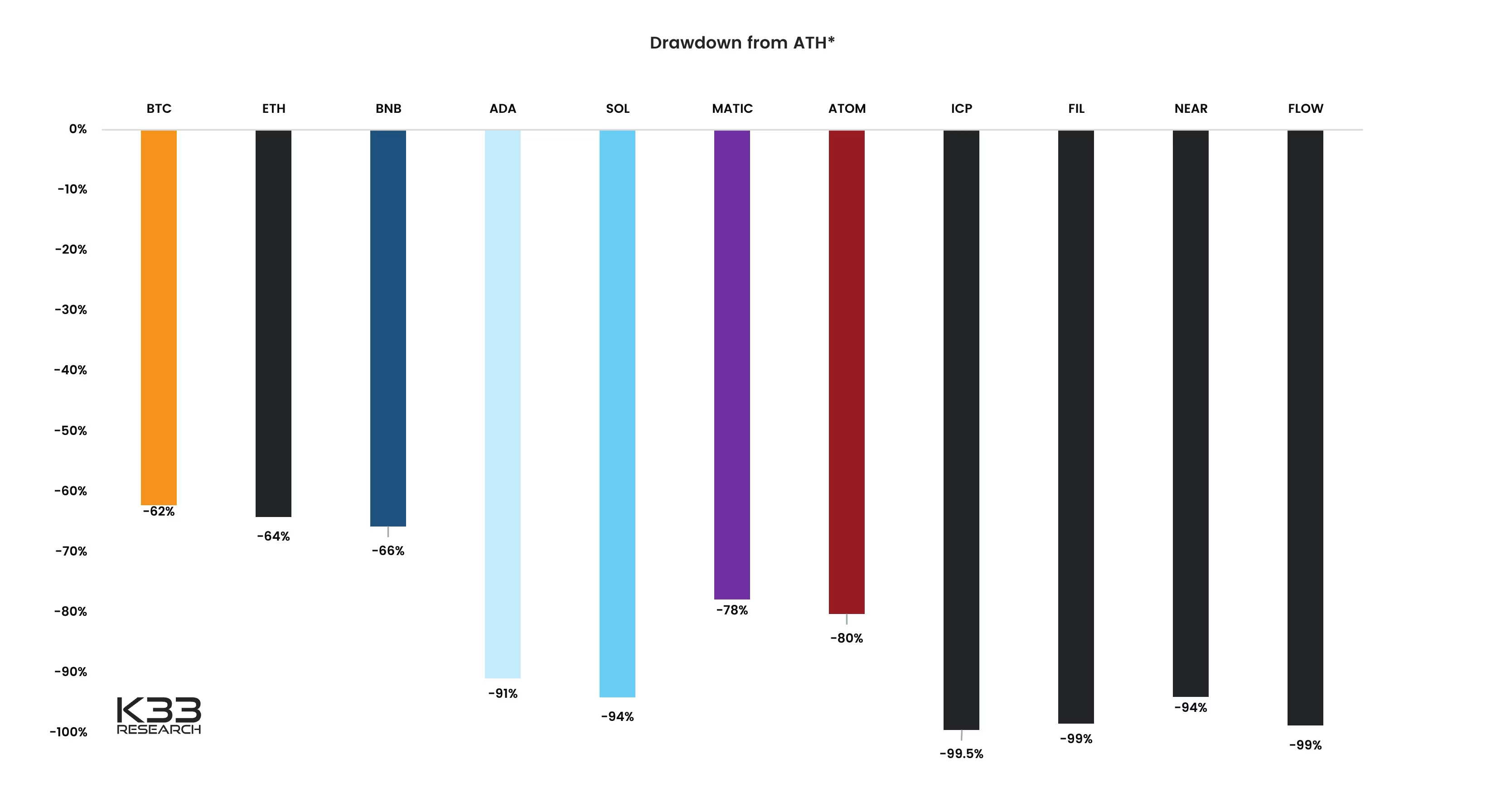

Although SEC’s current charges indirectly aim to implicate tokens as securities, in contrast to the direct charge against XRP and Ripple, we may use the XRP case as a proxy for potential long-term effects on the implicated tokens.

Preview