Preview

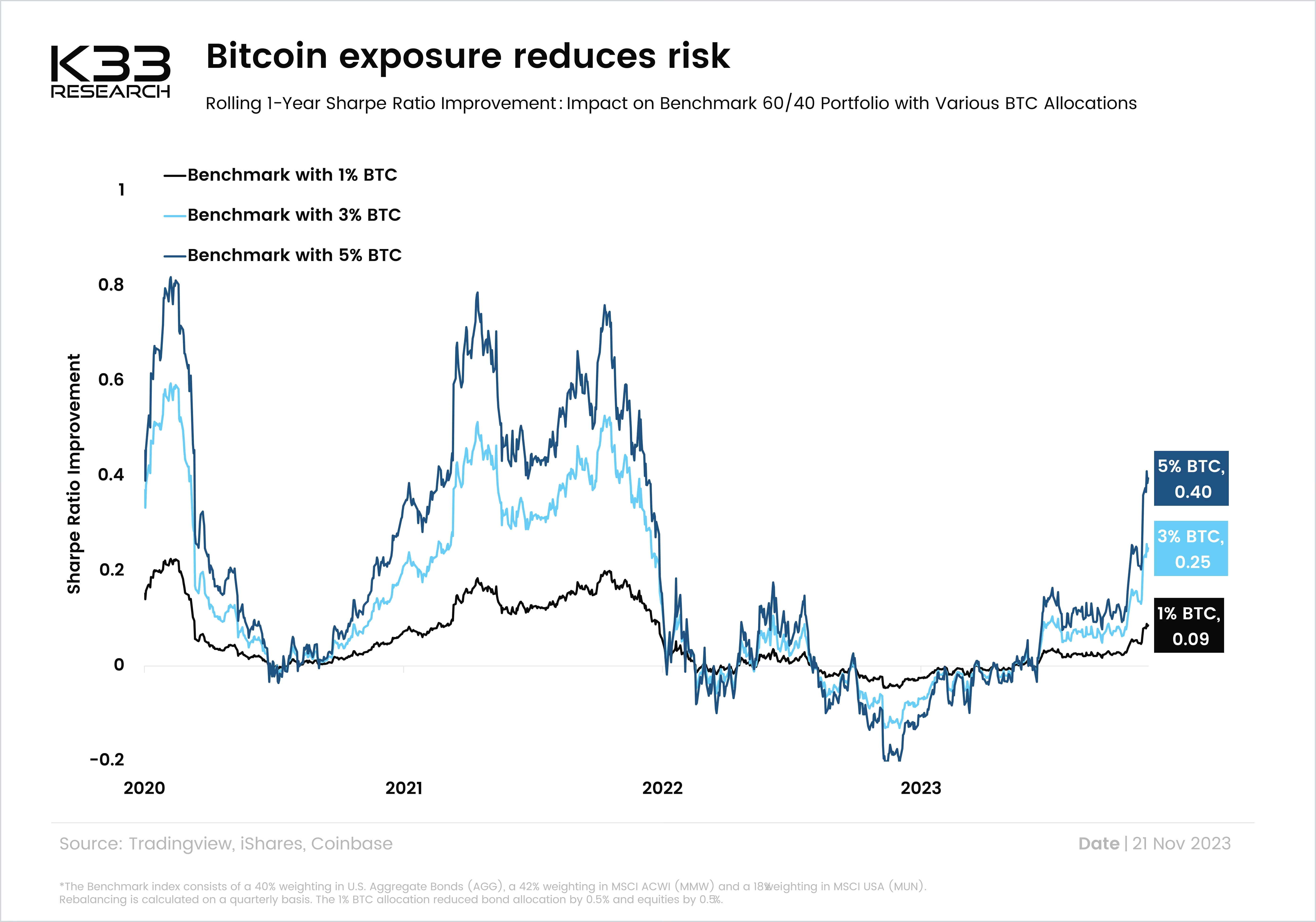

Moderate bitcoin exposure is not risky; it does in fact, reduce risk

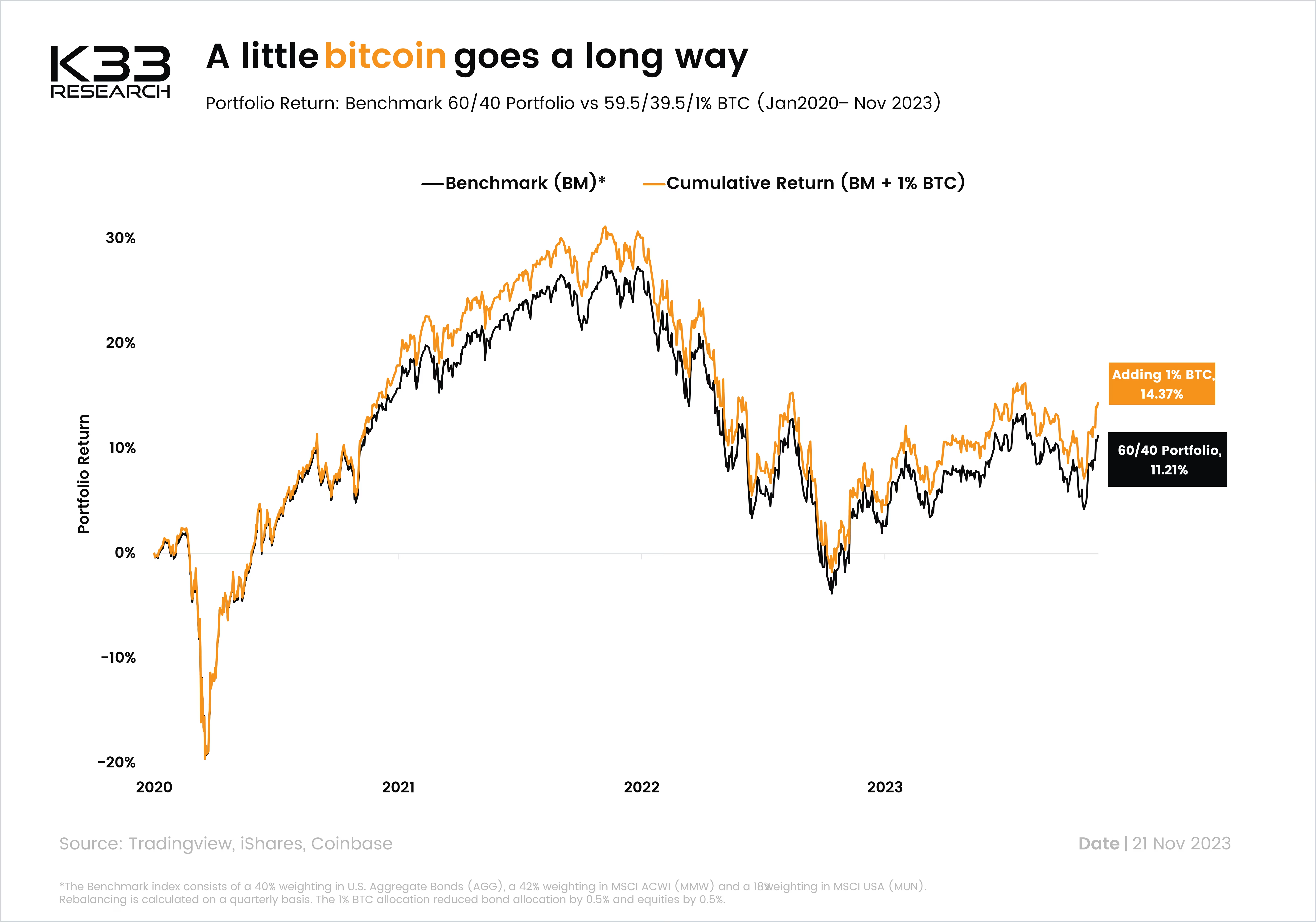

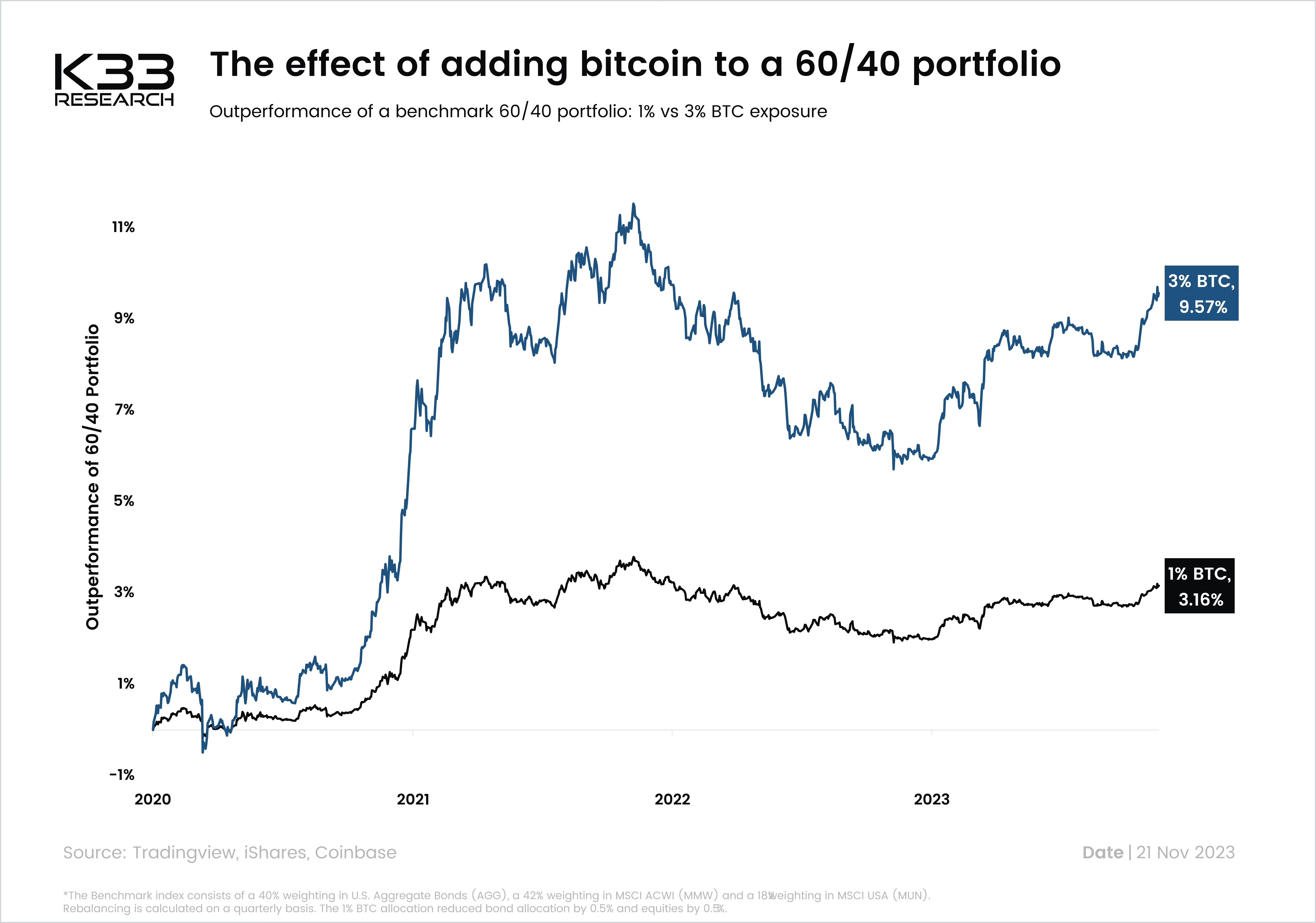

Bitcoin tends to improve risk-adjusted performance despite its vast volatility. The days of extreme correlations are behind us. BTC has resumed to a somewhat unpredictable path, independent of macroeconomic factors. This has implications as BTC again shines as a powerful portfolio diversifier. Defensive long-term savers could benefit from adding moderate BTC exposure to their savings. Out of the 978 days analyzed in our rolling Sharpe assessment, a 1% BTC allocation improved risk-adjusted returns 75% of the time. The period of underperformance was unsurprisingly in 2022, a period where BTC saw YTD returns of -68% while plunging in an unnaturally correlated environment.

Preview