Preview

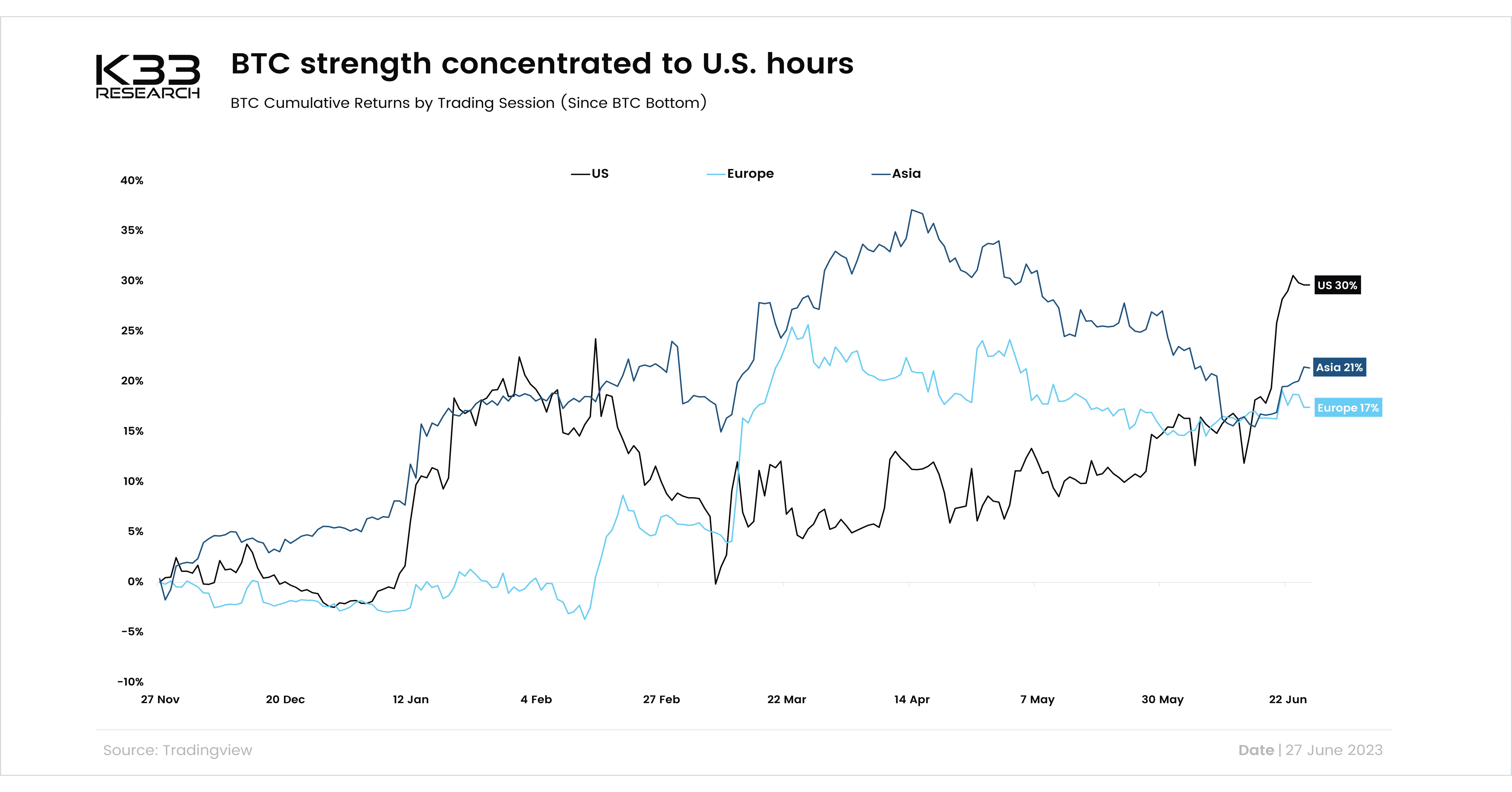

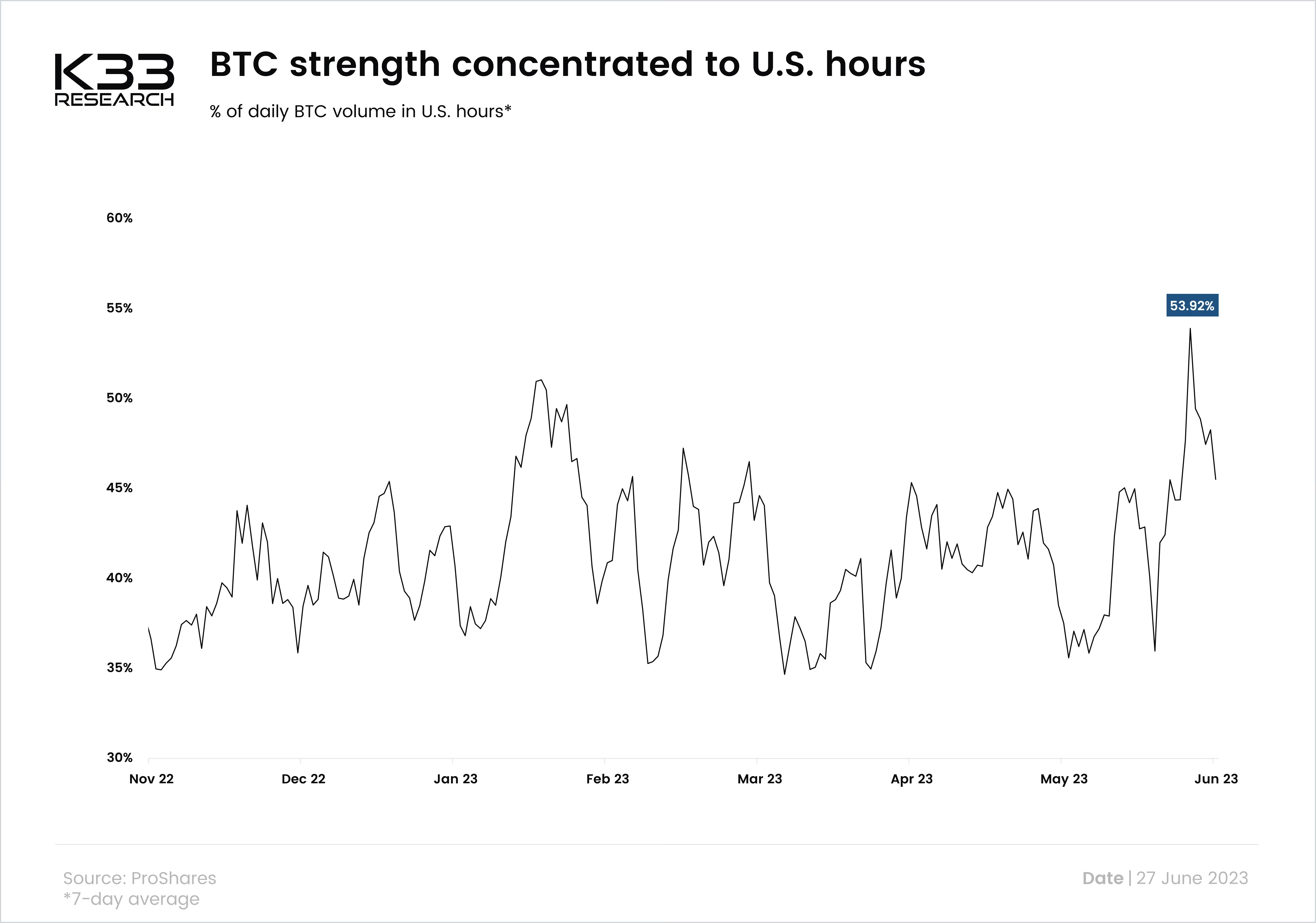

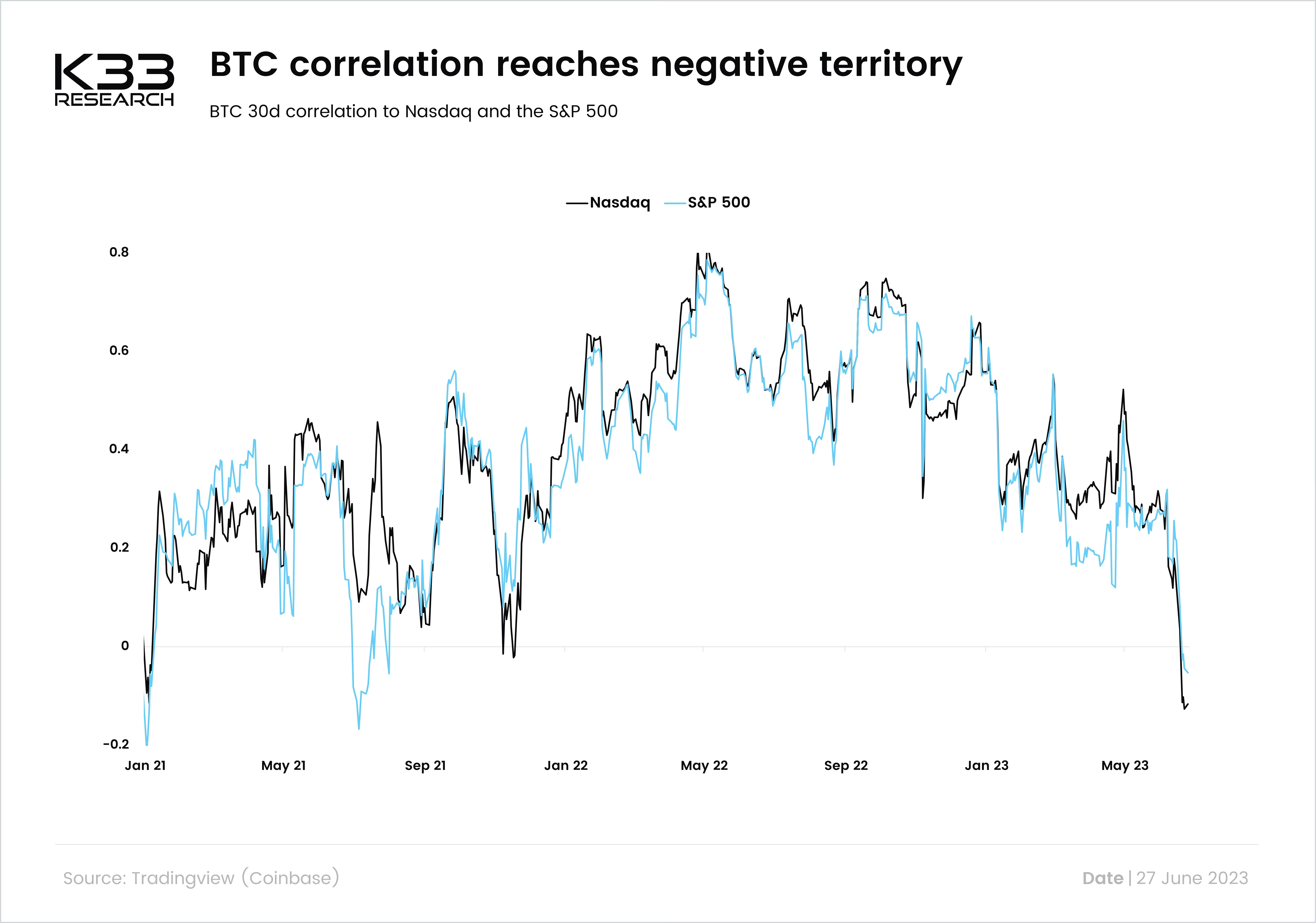

BTC correlation to U.S. indices reaches negative territory

Amidst the recent U.S. strength in BTC, bitcoin’s correlation to the U.S. stock market has fallen to negative territory. The 30-day correlation between BTC and Nasdaq has not been negative since January 2021, illuminating the significant regime change over the past few months. This changing regime rejuvenates the benefits of utilizing BTC as a portfolio diversifier.

Preview