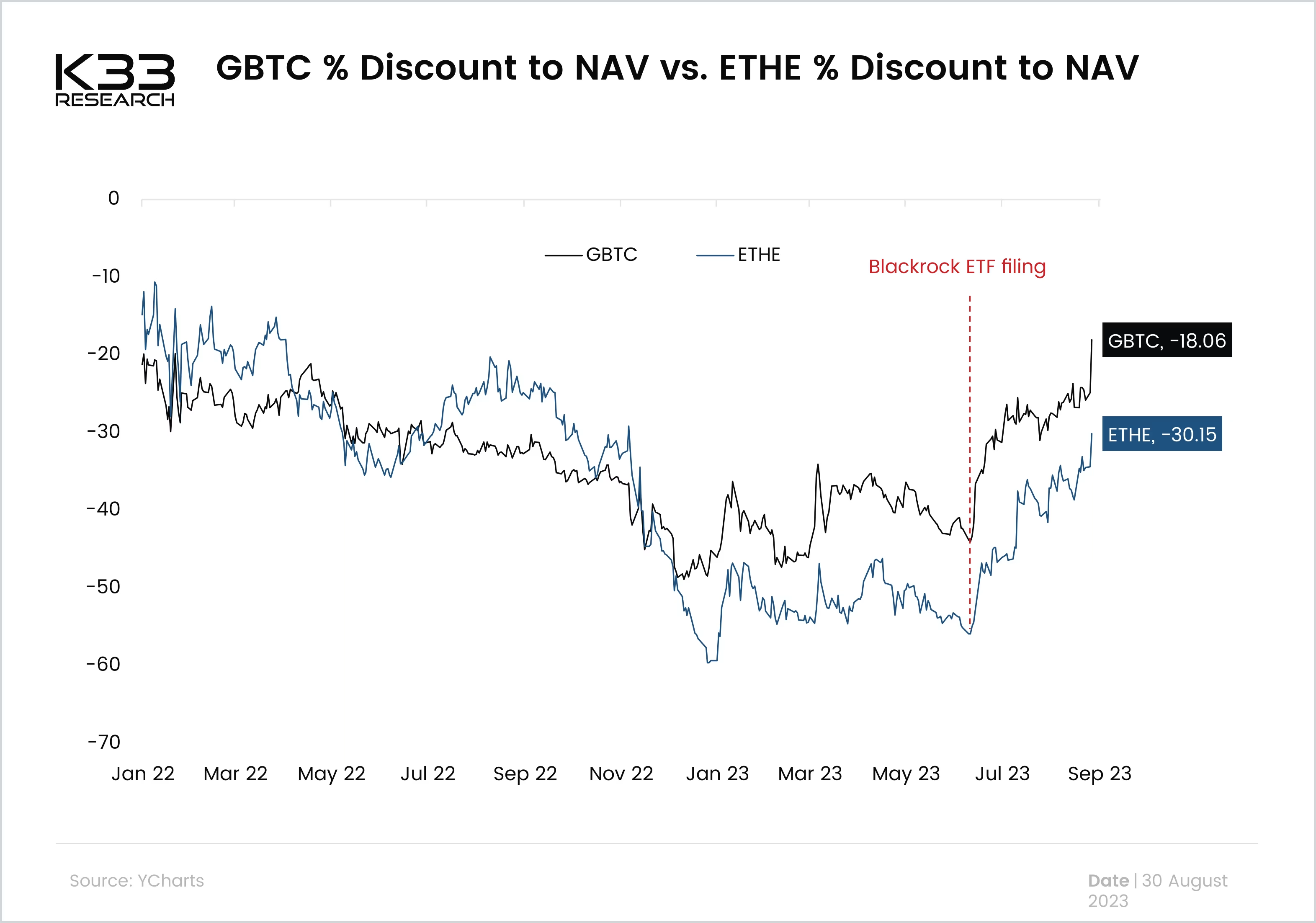

Enticing Discount on ETHE

We have long been advocates of using the Grayscale BTC Trust for BTC exposure due to its hefty discount. Now, we believe it is a good time to increase ETH exposure and with the ongoing ETF debacle, the Grayscale ETH trust can be a favourable way to do it.

Preview

Last week, we advised active traders to consider increasing Ether (ETH) exposure due to the low ETH/BTC ratio and the high likelihood of Ether futures-based ETFs in the U.S. by October. The spot market is the simplest and safest way to play that trade. Another way to play it, which introduces uncertainty but increases upside, is to increase exposure via the Grayscale Ether Trust (ETHE), which trades at a 30% discount. We have earlier pointed out to investors that they should consider the Grayscale Bitcoin Trust when it traded at close to a 50% discount to NAV. The current GBTC discount has narrowed to 18% due to increased expectations for an ETF conversion - with a sharp reduction in the discount following Tuesday's verdict in the Grayscale vs. SEC lawsuit. Now, we believe there is a good chance of the floodgates opening if Grayscale manages to turn the Bitcoin trust into an ETF. The larger discount of ETHE in 2023 has been driven by the question surrounding whether ETH is a security. CFTC has ruled ETH to be a commodity, which means it will be difficult to stop a spot ETH ETF if the spot BTC gets the greenlight. We must emphasize we are not dealing with certain things here. There is a substantial risk of ETHE not being converted to an ETF even though GBTC gets converted. We still believe the value proposition of ETHE to be good. If hopes of a GBTC conversion dwindle, the discounts of ETHE and GBTC should converge. On that premise, we only need an ETHE ETF approval chance of more than 40%, given that GBTC is converted for ETHE/GBTC to be a stronger play than ETH/BTC. We originally pointed towards this trade before the Grayscale vs. SEC ruling of Tuesday August 29. After the ruling, the implied probability of ETHE turning into an ETF has increased relatively more than GBTC, albeit still at a lower absolute probability. In that sense, some of the value in our suggested trade is gone but we still believe the case to be strong for more than a 40% chance of an ETHE ETF conversion given a GBTC conversion.