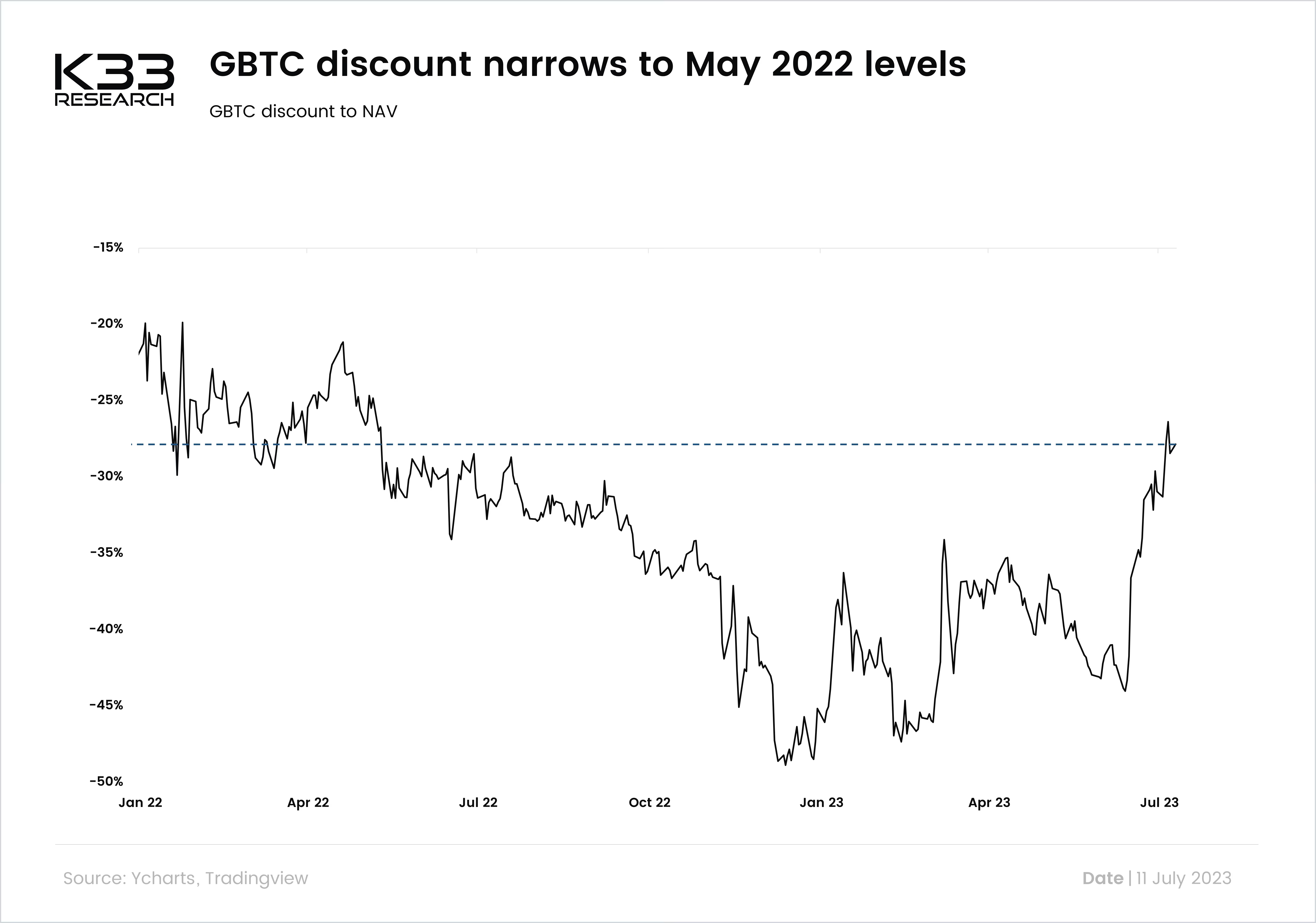

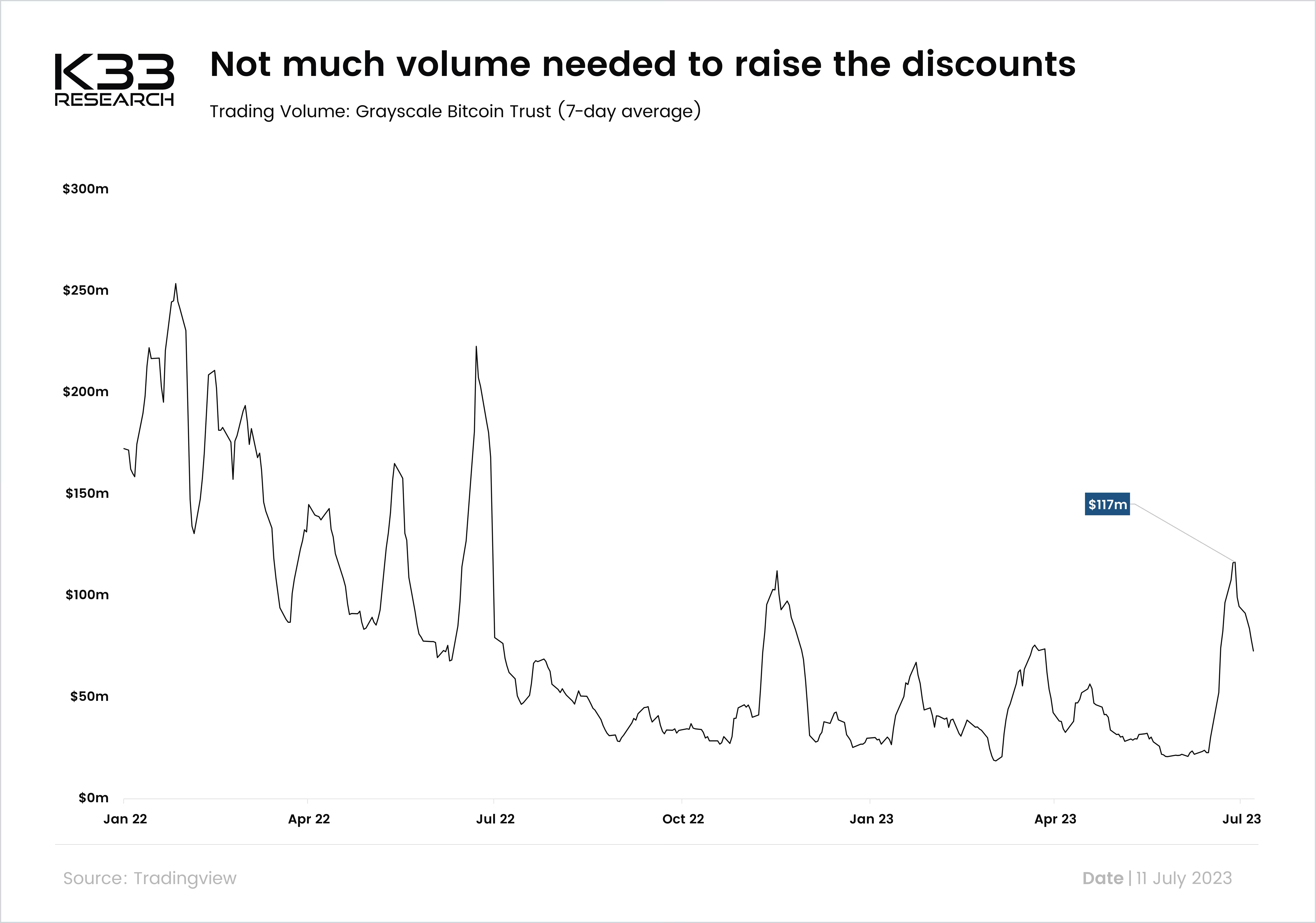

A dangerous arb?

The current discount represents a $5bn potential arbitrage, as we have mentioned previously, as 160,000 BTC as the value of 160k BTC is not reflected in the share price of GBTC. This could create an arbitrage dynamic in case of an ETF approval where market participants buy GBTC and sell BTC spot to take advantage of the discounts.

Preview