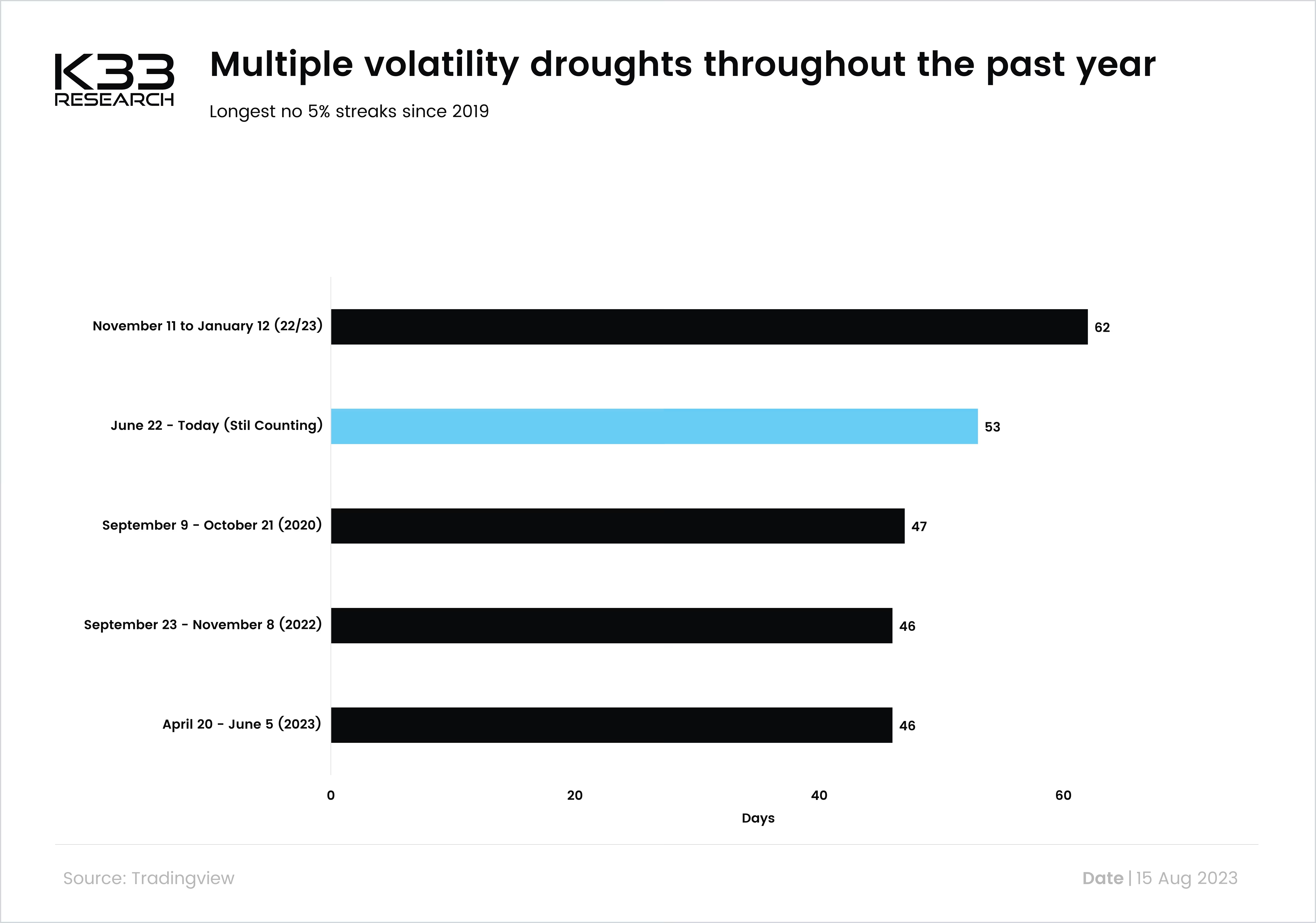

4 out of 5 low vol streaks since 2019 has occurred in the past 365 days

We define consecutive low volatility days as days in a row without a 5% move in BTC. The current streak sits at 53, with the longest low volatility period since 2019 lasting for 62 days, from November 11, 2022, to January 12, 2023.

Preview

Preview