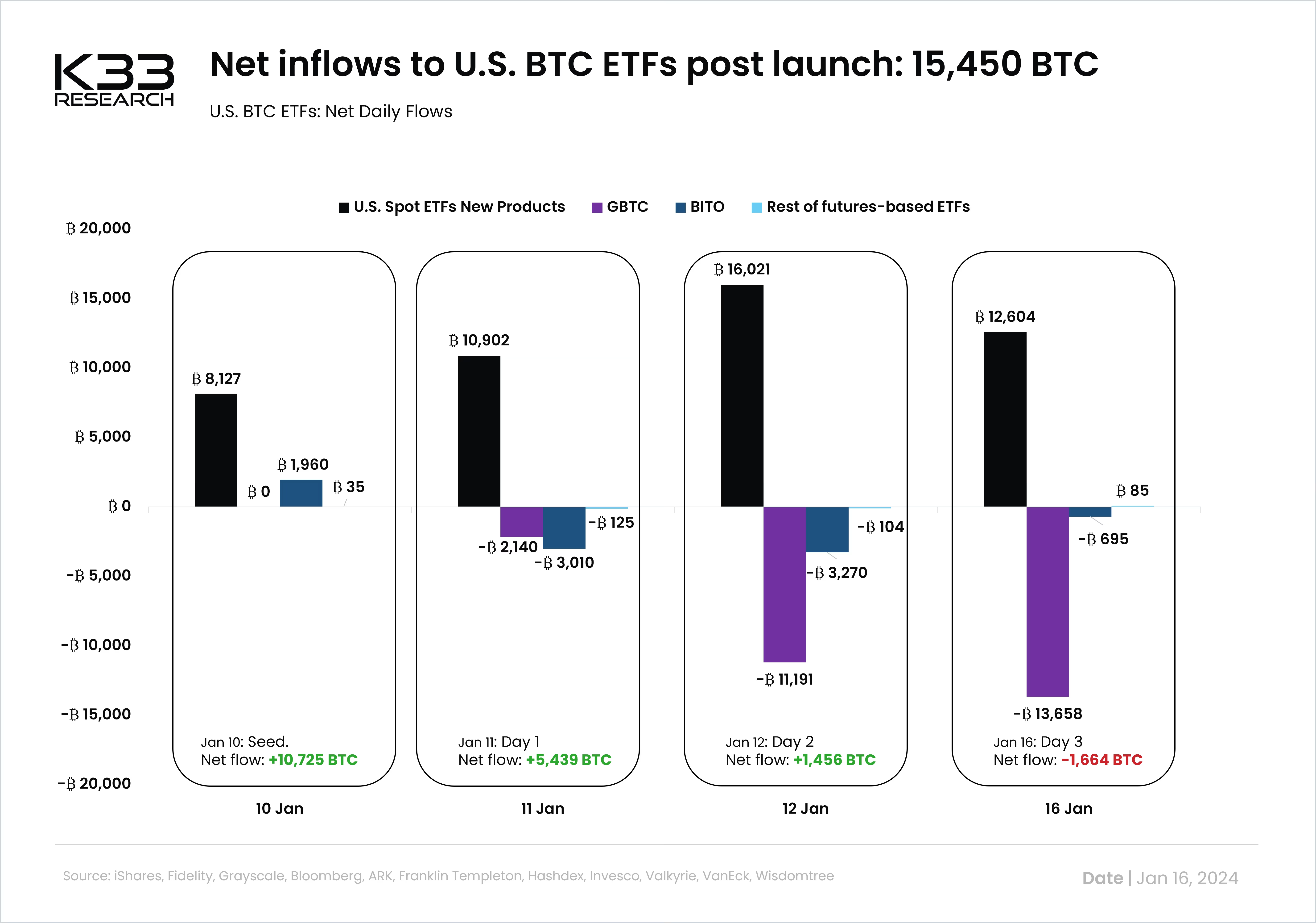

How could Bitcoin tumble on such a strong launch?

The answer is twofold: structural and basic market psychology. GBTC was one of 2023’s greatest trades. In the past seven months, GBTC’s discount to NAV has narrowed from -45% to 0%, gaining 170%, compared to BTC’s 57% in the same period. GBTC launched at significantly higher fees than its peers, incentivizing rotation from GBTC to other funds. Meanwhile, tactical traders trading the discount might view the conversion as an ideal time to realize profits. Further, expectations of a peak at the launch caused selling pressure from traders playing the ETF narrative, exaggerating the directional impact on BTC. Other costly U.S. products also faced post-spot launch outflows, with BITO seeing net outflows of 6,975 BTC after the launch of more straightforward spot products. BITO outflows cause selling pressure on CME, coinciding with profit realization on CME and market makers hedging pent-up flow exposure, all pushing CME’s futures premiums lower.One player had a slight AUM advantage ahead of launch

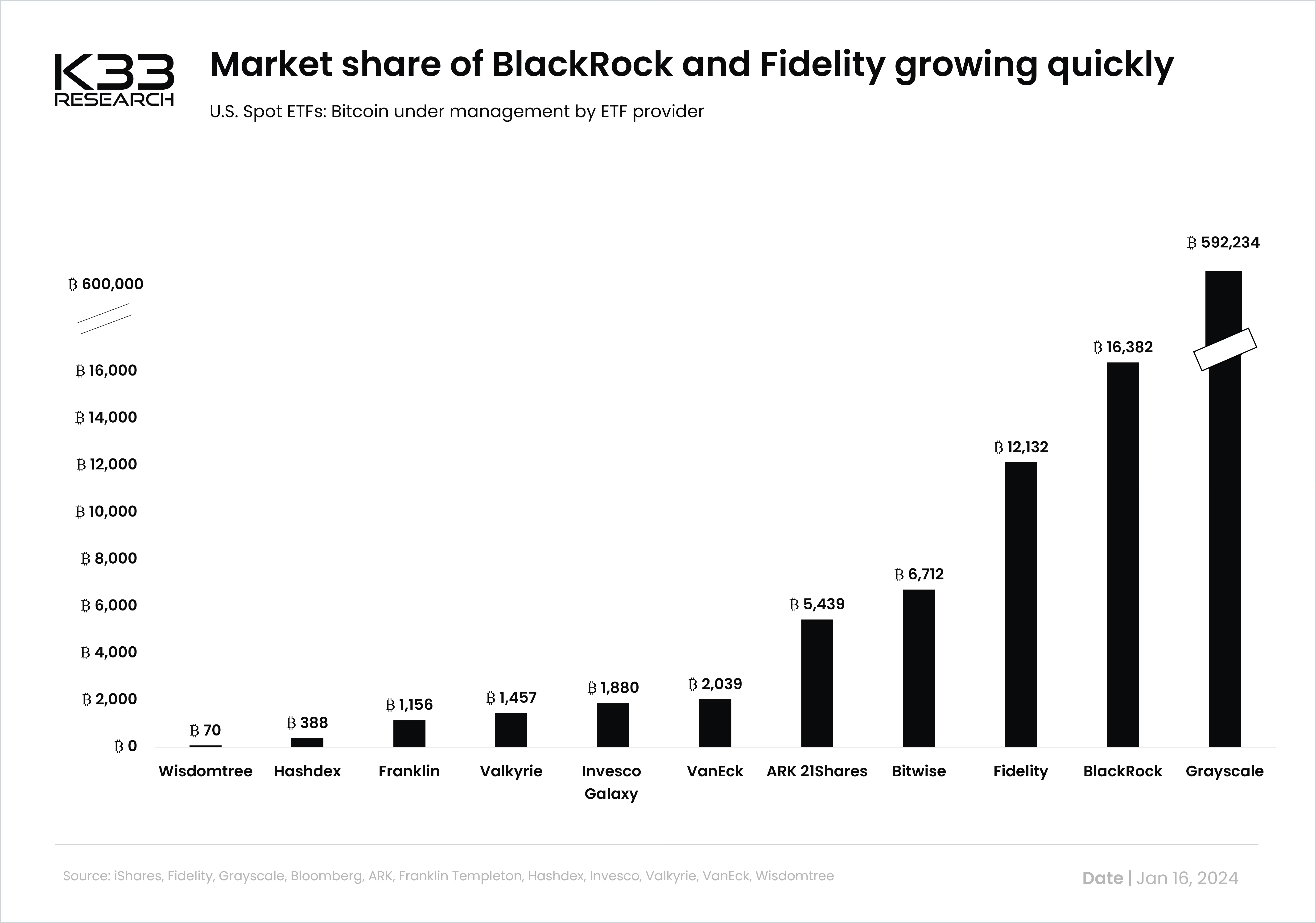

In its first three trading days, BlackRock’s iShares and Fidelity’s Wise Origin BTC ETFs amassed inflows of $710m (16,382 BTC) and $524m (12,132 BTC) respectively, after solid inflows. Grayscale, on the other hand, has seen outflows of $1.173bn after massive rotation out from Grayscale and profit realization as discussed above. We expect large structural flows from GBTC to other issuers to continue due to GBTC’s substantial fees compared to its peers.

Preview

Negative flows outside the U.S.

The portion of BTC held in exchange-traded products is material and a highly relevant price driver for Bitcoin – particularly in this period with material structural and strategic flows. Globally, Bitcoin ETPs hold 864,719 BTC – roughly 45% of the size of crypto exchange reserves. After last week's GBTC conversion, U.S. ETFs represent 80% of the global BTC ETP balances.

Preview

U.S. BTC ETFs now represent 80% of BTC ETP market

We expect ETF flows to remain a crucial price driver for bitcoin onwards, with U.S. flows being the most significant region, holding an 80% market share within BTC ETPs. 4.4% of the circulating bitcoin supply is currently held in BTC ETPs globally, a number we expect to increase in 2024.

Preview