Preview

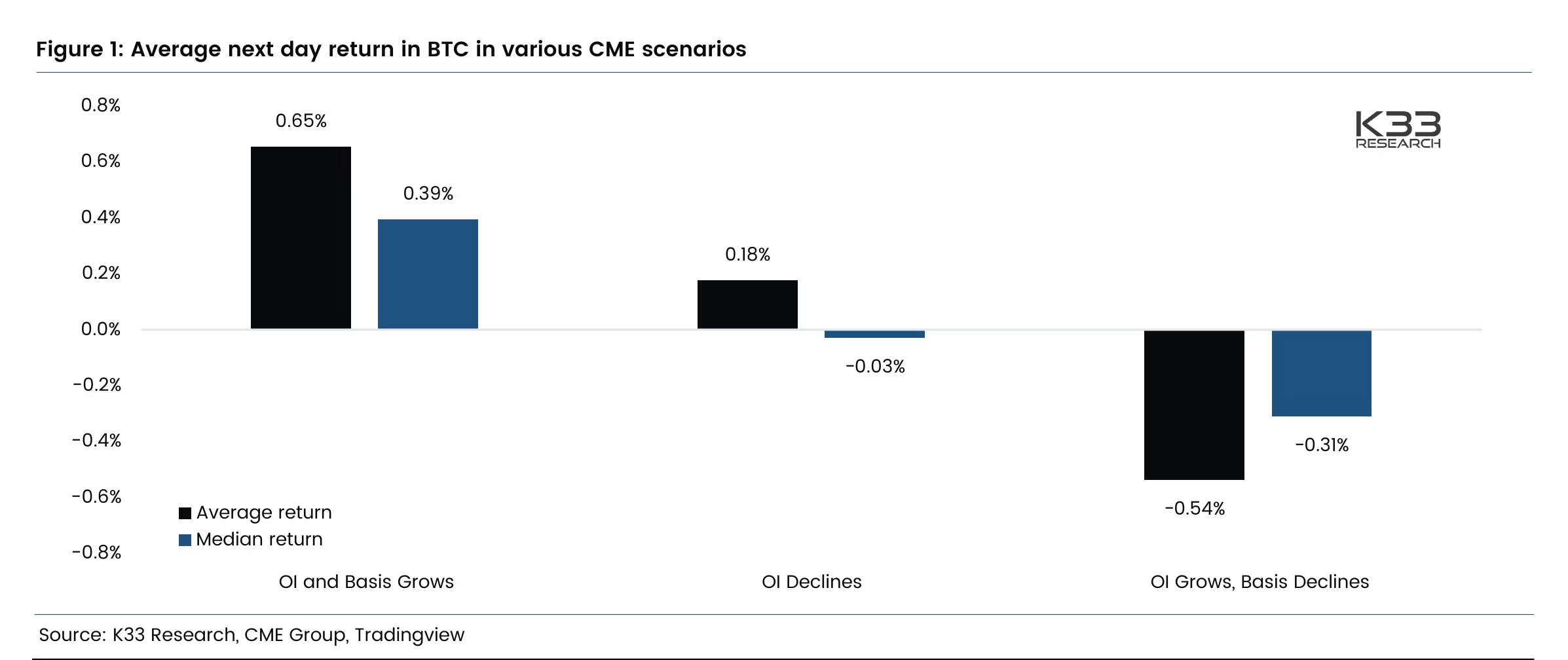

Using CME to forecast the price action of tomorrow

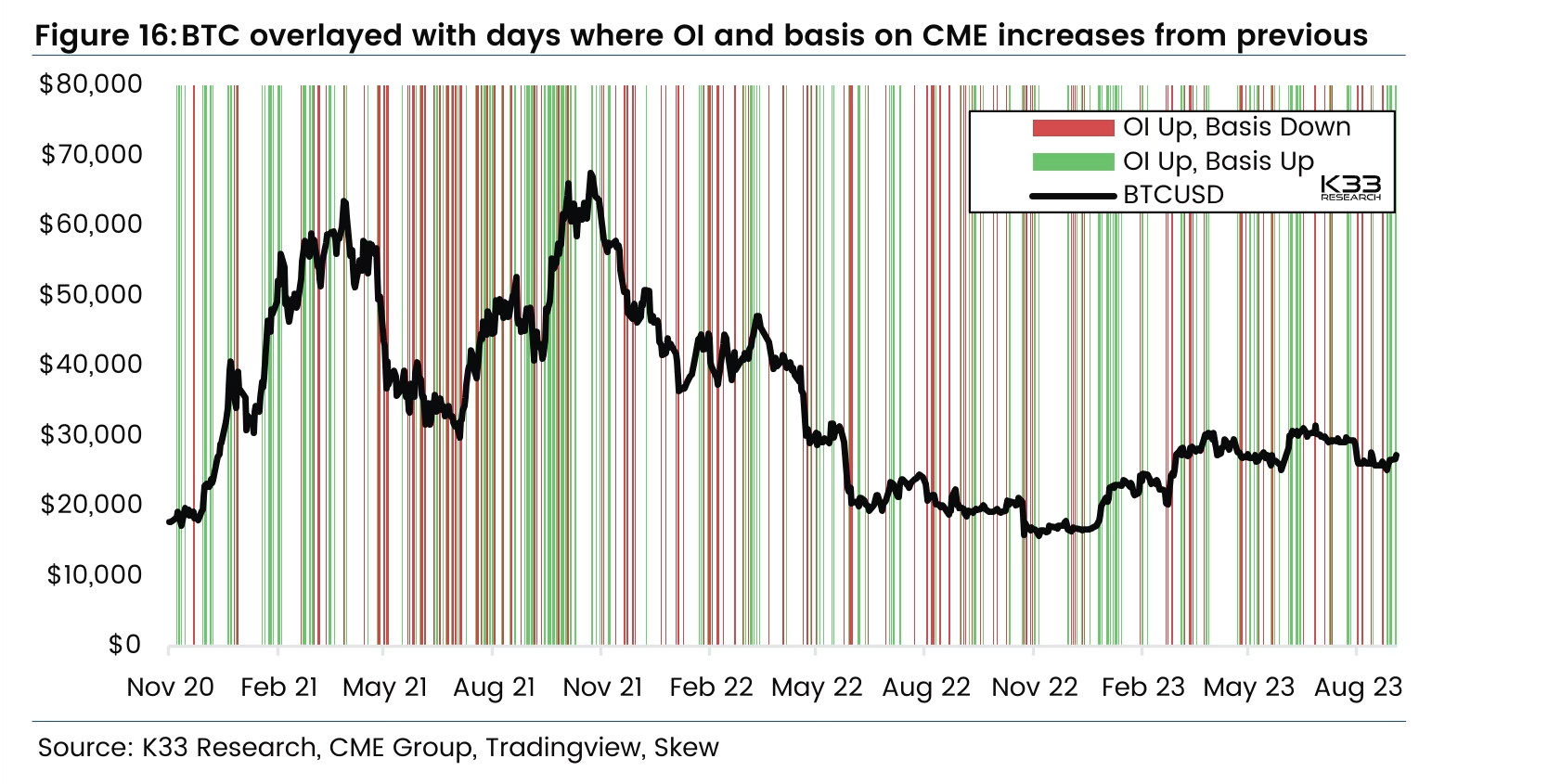

We use open interest as a proxy for CME exposure and the directional trend in futures premiums to pinpoint directional bias on CME. If the futures basis grows alongside growing open interest, CME traders have increased exposure, with longs being the key aggressor. Similarly, if open interest grows and premiums decline, traders have increased exposure, with shorts being the key aggressor.The relationship between directional aggression on CME and BTC price development is strong as evidenced above. Still, one must remember the relationship is not 1-to-1. Below, we illustrate the detailed data behind the findings above, with green representing bullish aggression on CME and red representing bearish aggression.

Preview