The market is wrong

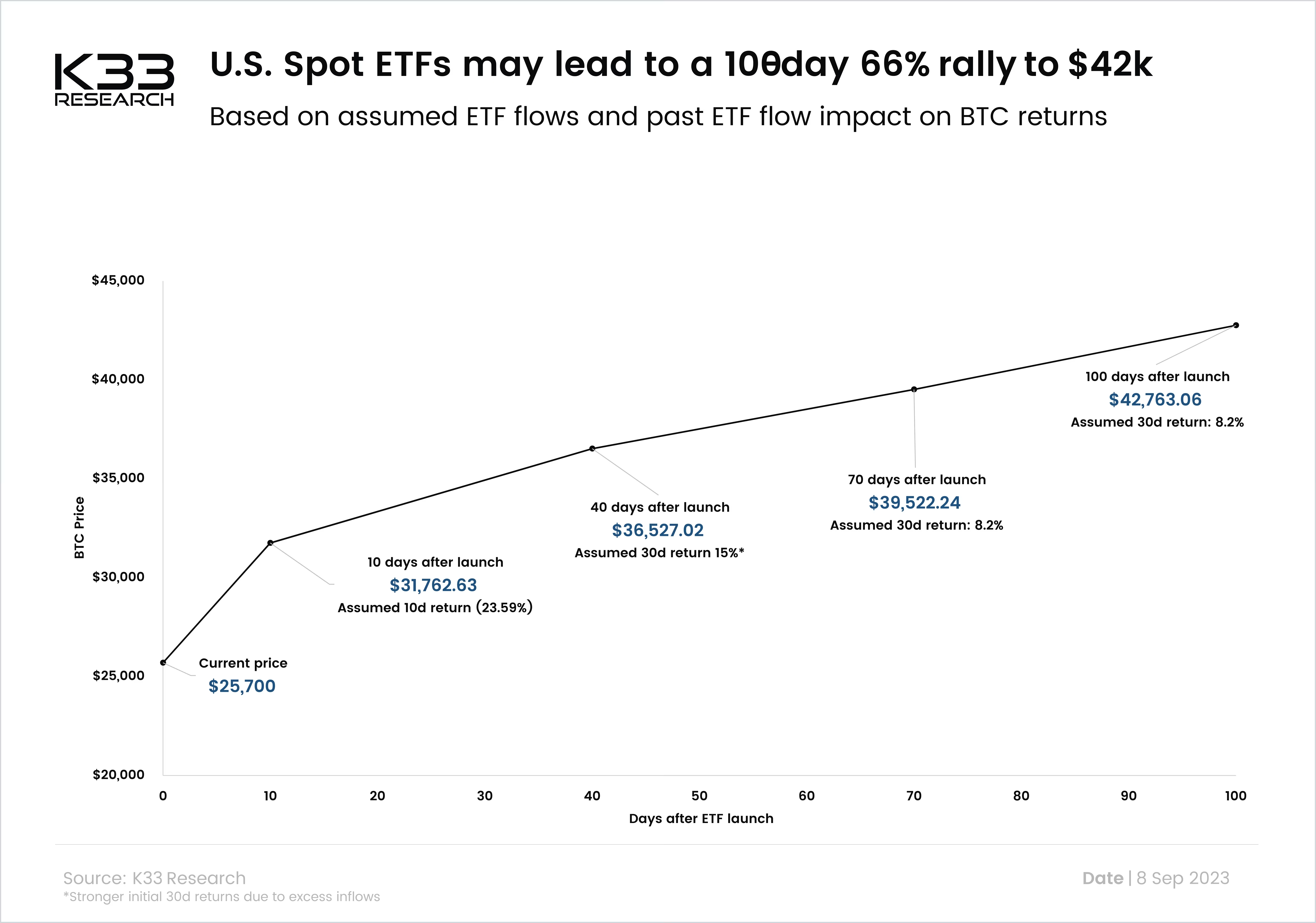

Bitcoin trades at three-month lows of $25,700. Three months ago, BlackRock’s ETF filing was not yet public. Fidelity and others had not re-filed their ETFs. Grayscale had yet to crush the SEC’s arbitrary and capricious disapproval in the DC Circuit. The last three months have greatly enhanced the odds of an ETF approval, yet prices are far from reflecting this. Based on these facts alone, I firmly believe the market is wrong. This is, by all accounts, a buyer’s market, and it’s reckless not to aggressively accumulate BTC at current levels.It is +EV to own BTC now

Scenario 1: Current filings are eventually denied

An ETF denial will have no material impact on the market structure. The crypto market will remain as is, Grayscale will stay close-ended, and market participants will have access to the same venues to trade as we do today. The initial market reaction to a denial will be negative, but over the medium to long-term horizons, rejections won't matter – new filings will continue to appear and will eventually be approved. It follows that the impact of an ETF denial on BTC should be negligible.Scenario 2: Current filings are eventually approved

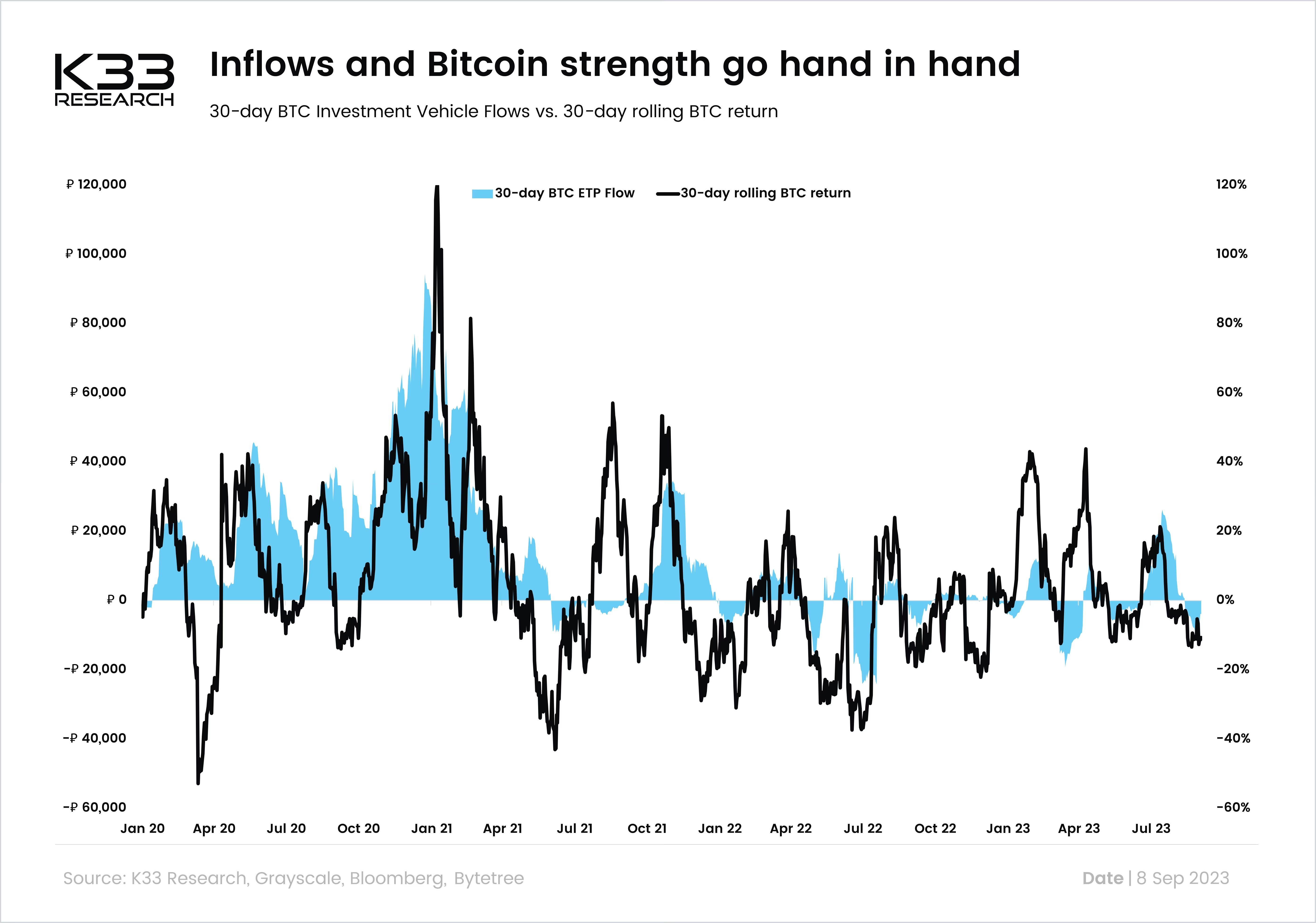

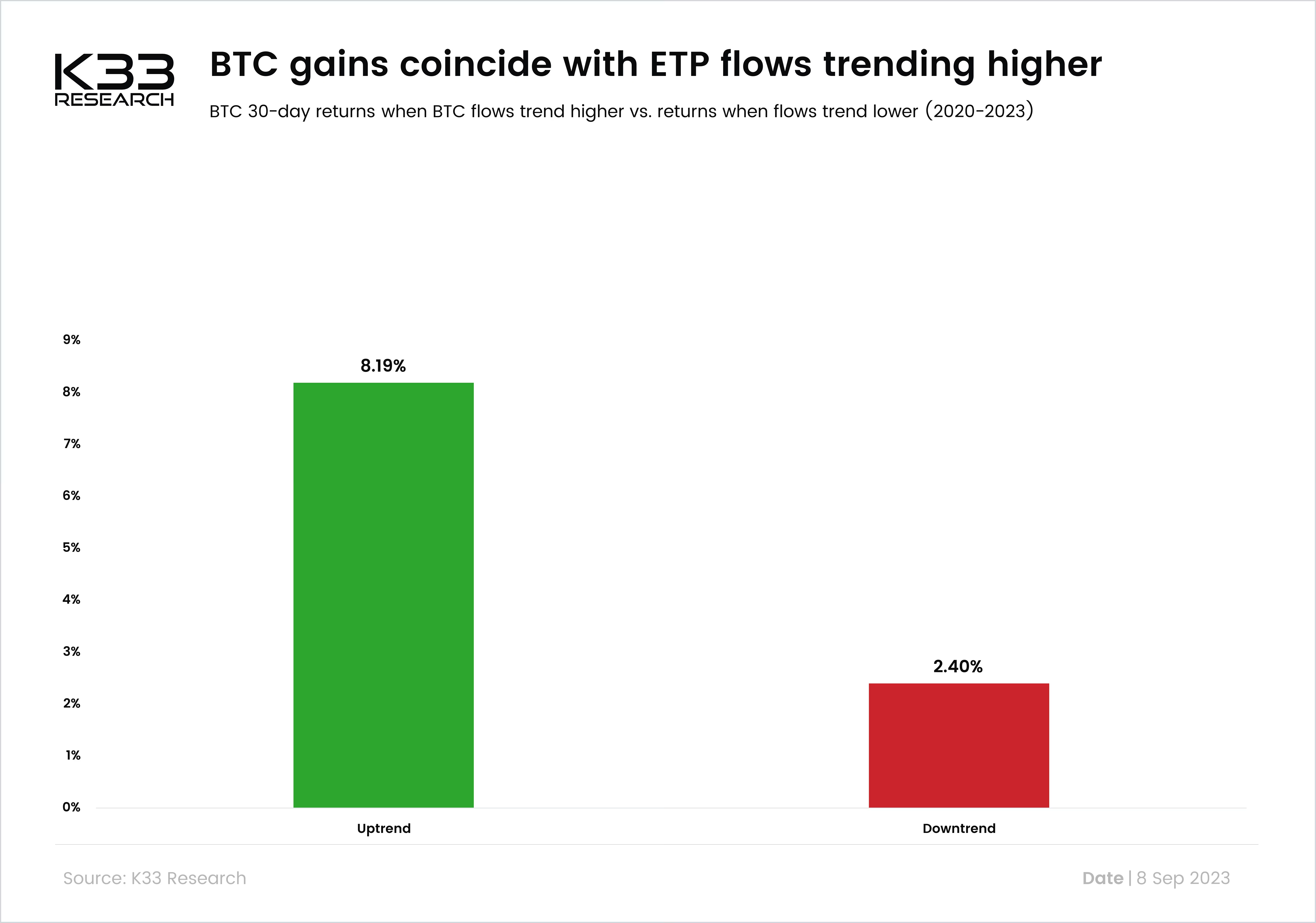

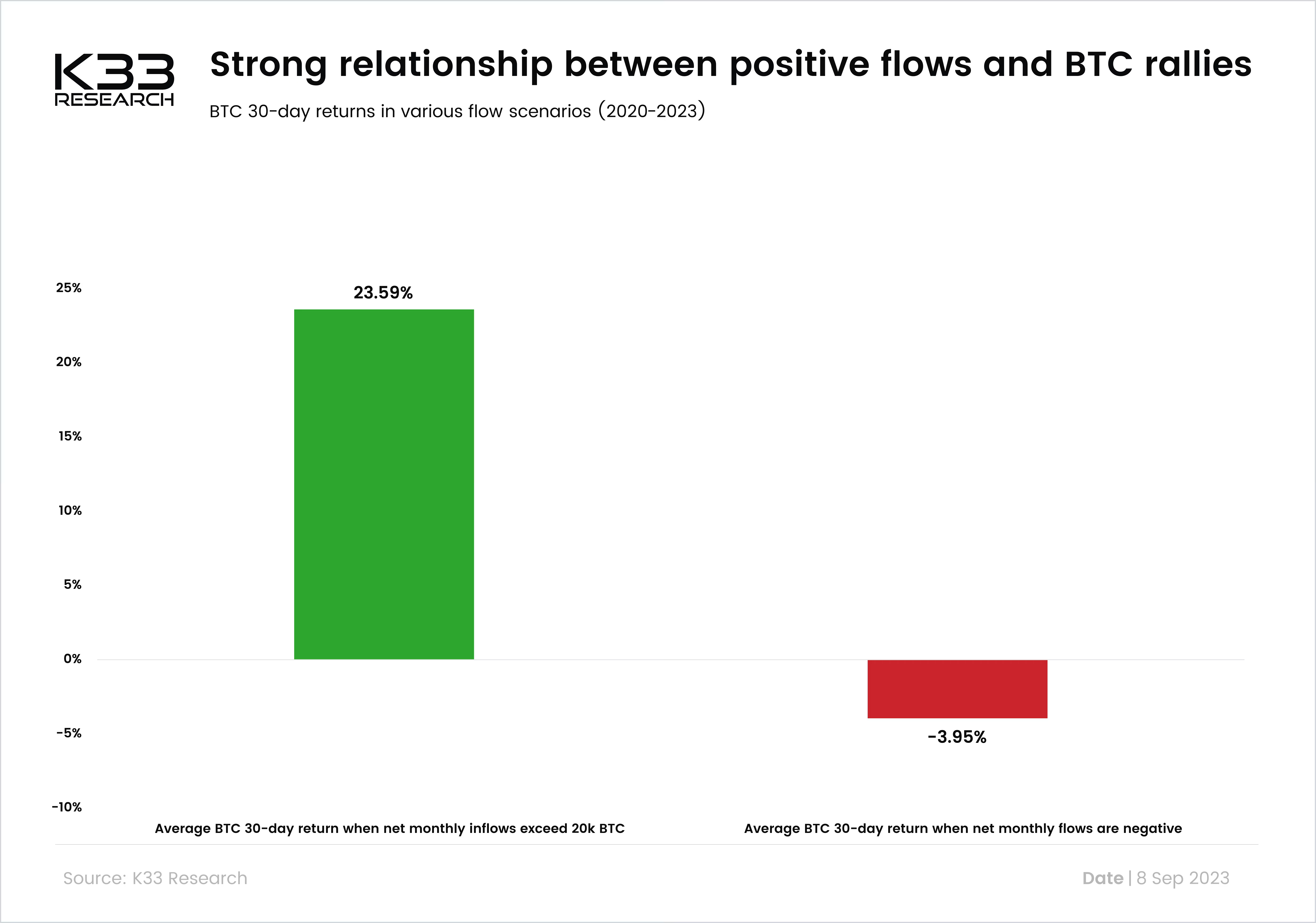

An immediate massive supply absorption will follow an ETF approval. The competitive environment from seven BTC ETFs, all launching simultaneously, will be immense. Flows are destined to be very bullish in case of approval. This is clear when comparing U.S. spot ETFs to flows from previously launched products. Costly futures-based ETFs with ProShares launching with a one-week head start against a far weaker competition managed to attract 20k BTC worth of inflows in its first ten trading days. With a far smaller addressable market than the U.S., Canadian ETFs managed to attract 60k BTC worth of inflows in its first four months after launching. Adding to that, BlackRock’s announcement in June was in itself sufficient to cause the largest global inflows to BTC ETPs since October 2021, and an actual launch would likely cause similar surges in global ETPs again. With the solid odds for ETF approvals, the market is fundamentally mispricing BTC. It is reasonable to assume that ETF approvals attract enormous inflows, absorb liquidity from the market, and be hugely positive for BTC prices. Do not underestimate either the ETF filings or Grayscale’s massive victory last week.Inflows and Bitcoin strength go hand in hand

Preview

Preview

Preview

Preview