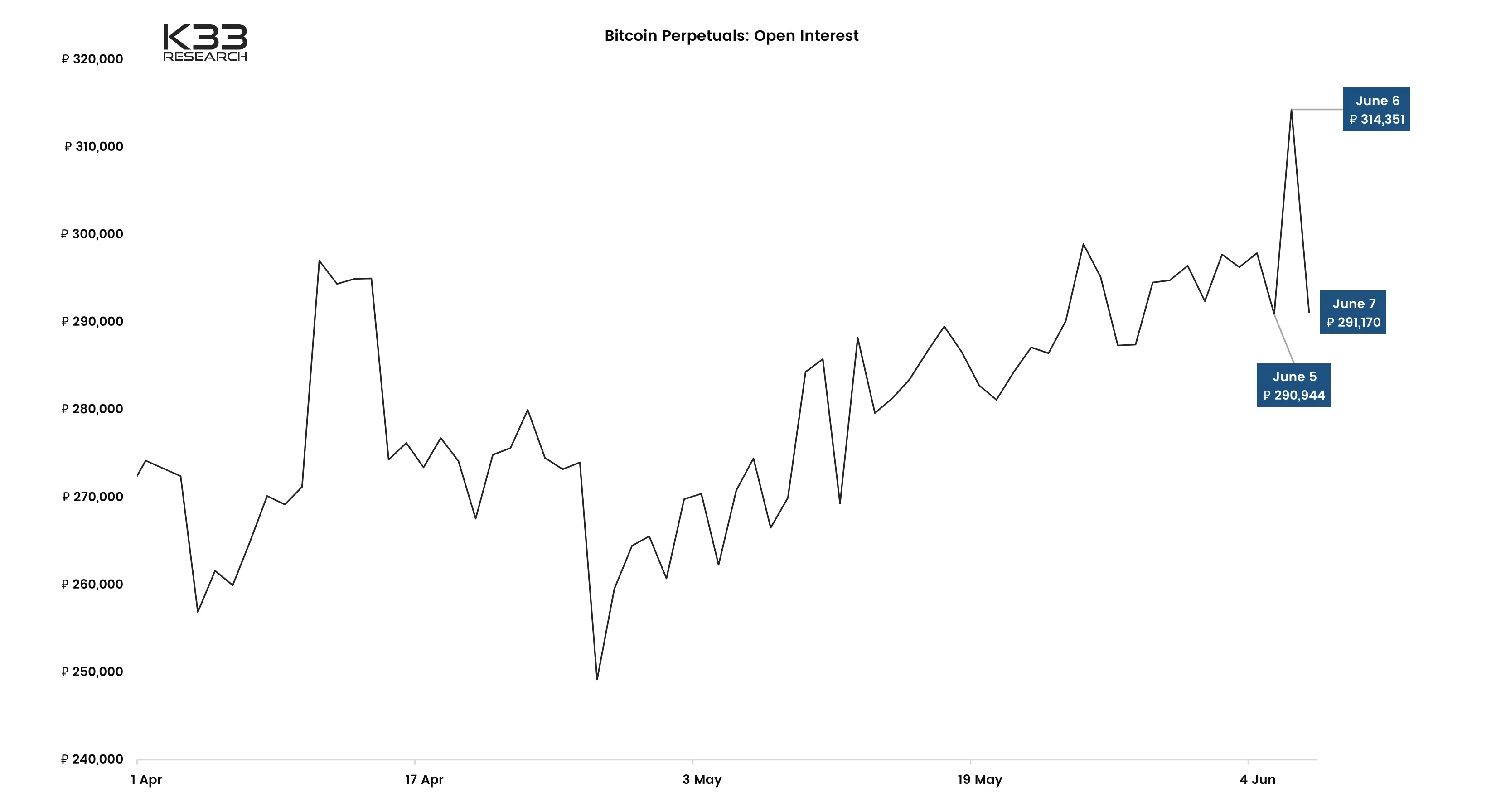

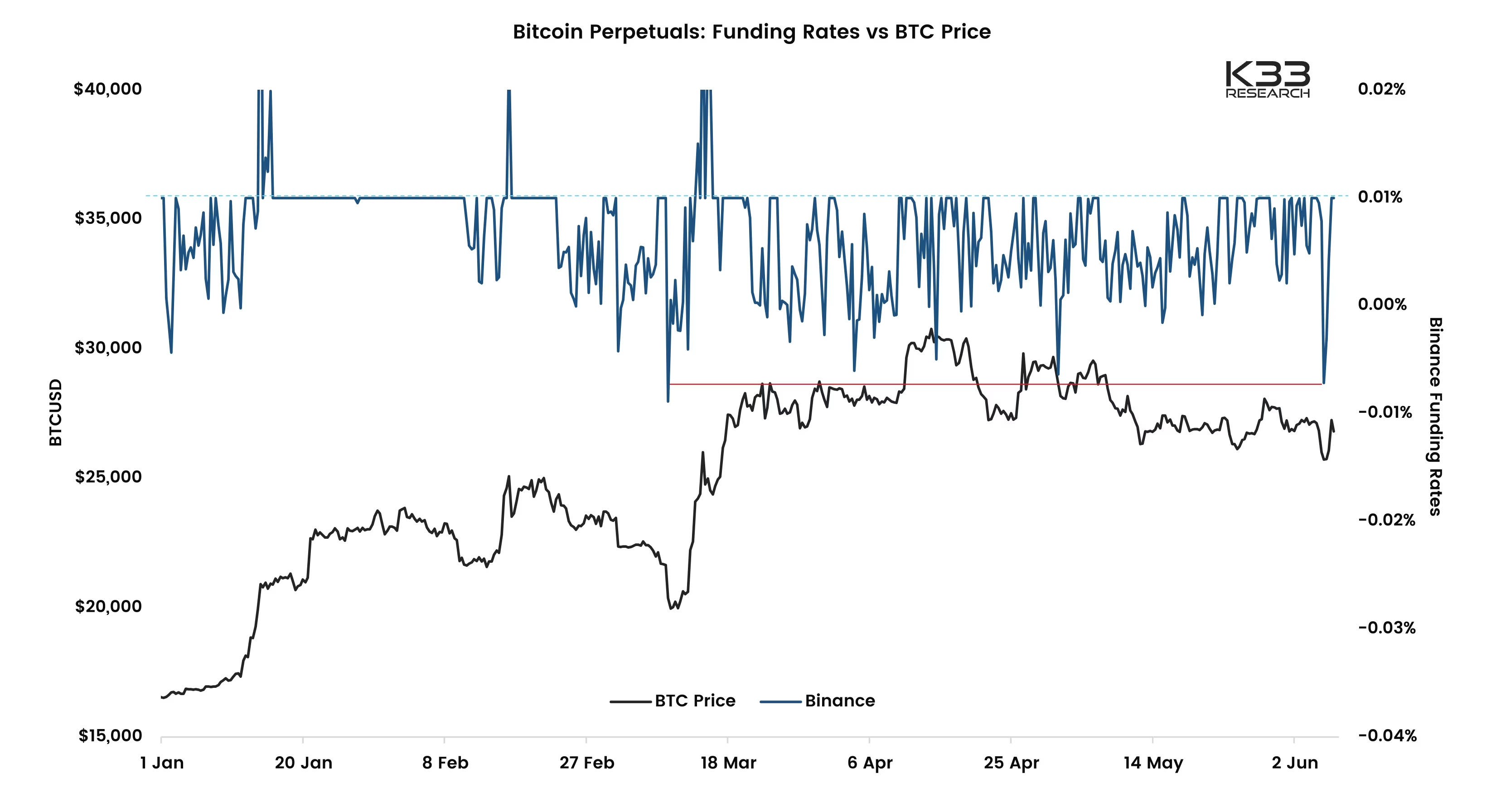

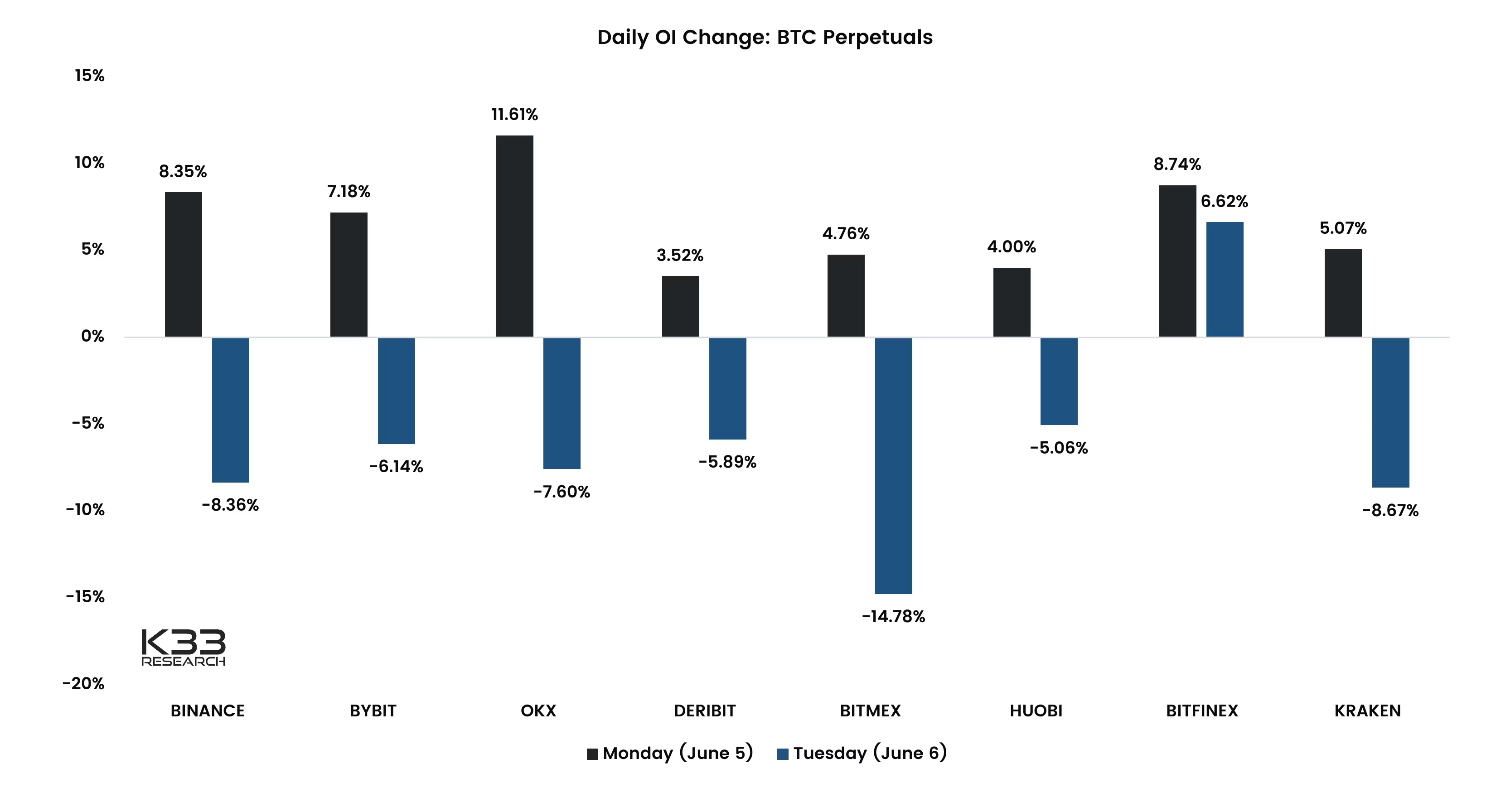

Despite being in the spotlight yesterday, Binance activity was the key contributor to the surging open interest, seeing a daily growth of 8.3%. The growth was accompanied by funding rates melting down toward March lows, an indication that a bearish bias may be an overcrowded consensus trade for the short term."

Bitcoin is classified as a commodity. Americans can purchase BTC through a plethora of exchanges, exchange-traded funds, payment apps, and more. Binance.US is not a significant loss. Liquidity could consolidate further towards Coinbase and Kraken, but the market should not crash 5% on these developments.

Perps

BTCUSDT funding reached March lows on Monday but recovered to neutral levels as BTC recovered.

Preview

Preview

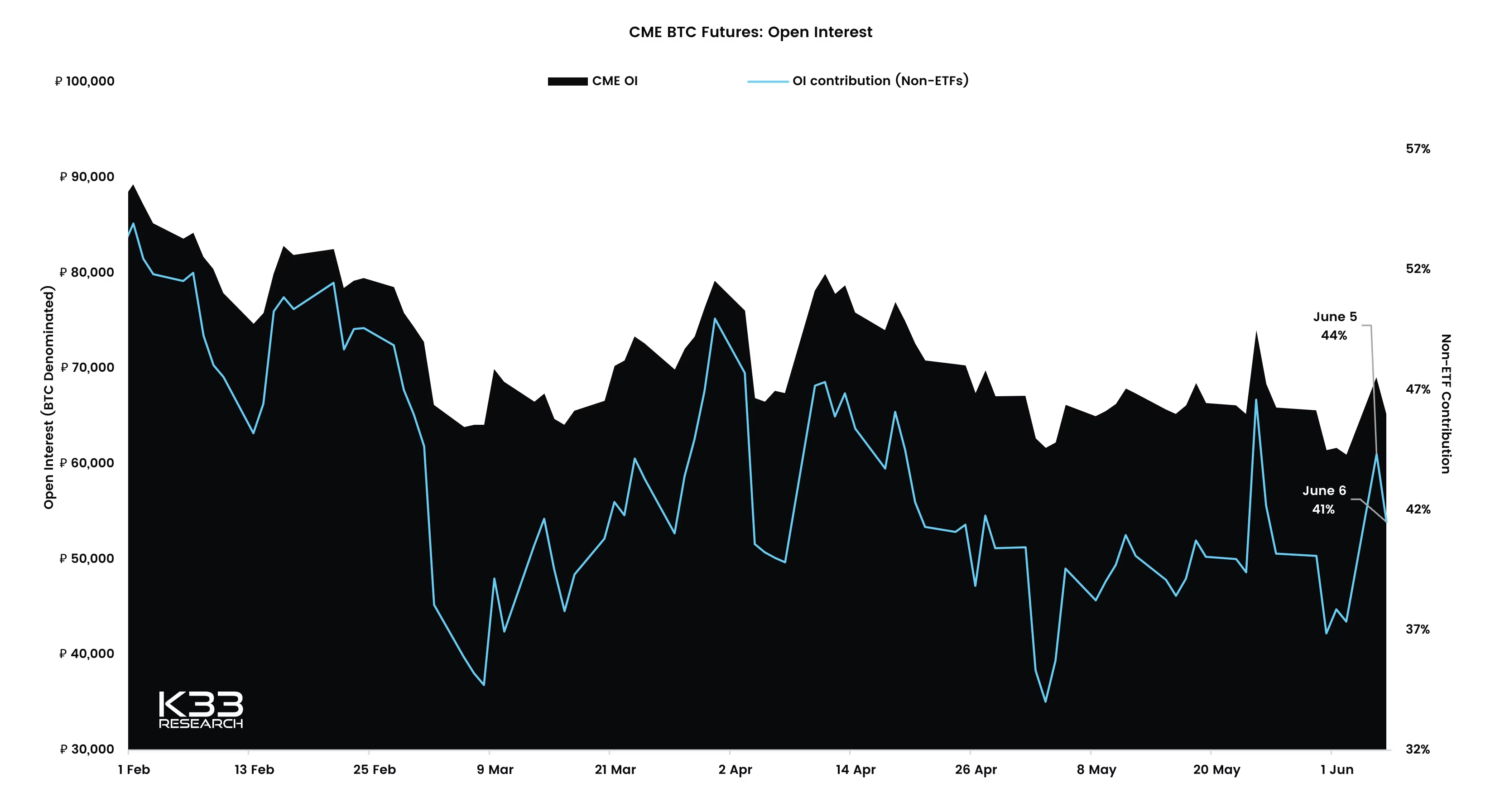

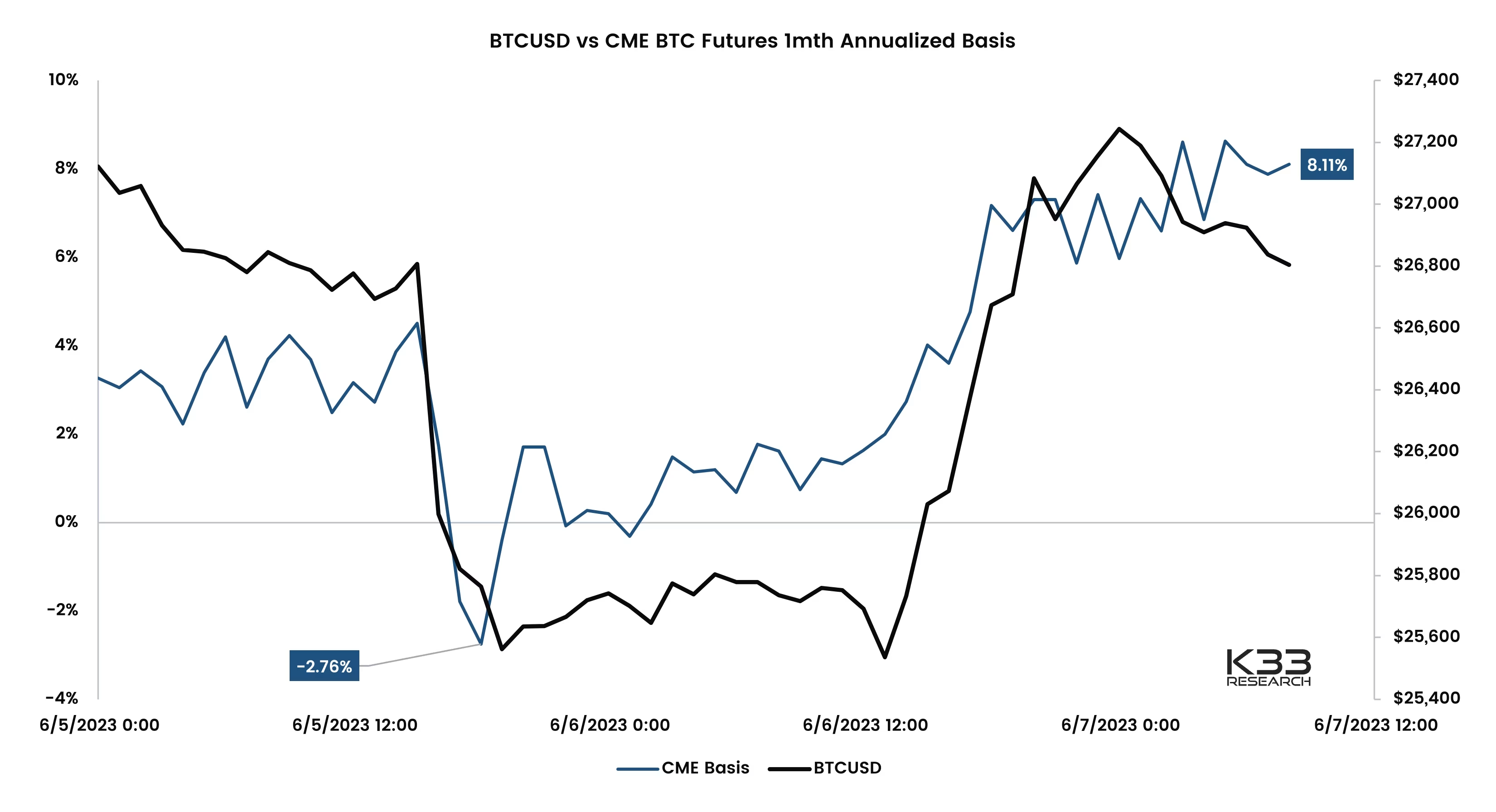

CME Bitcoin Futures

Non-ETF dominance on CME surged to 44% on Monday as OI grew by 13.3% amidst surging volumes and plunging basis. OI fell by 5.5% yesterday, 7% higher than the Friday close.

Preview

Preview

The range

BTC found support at Feb highs, and for now, I expect the 3mth trading range to hold firm and the chop to ensue.

Preview

Preview