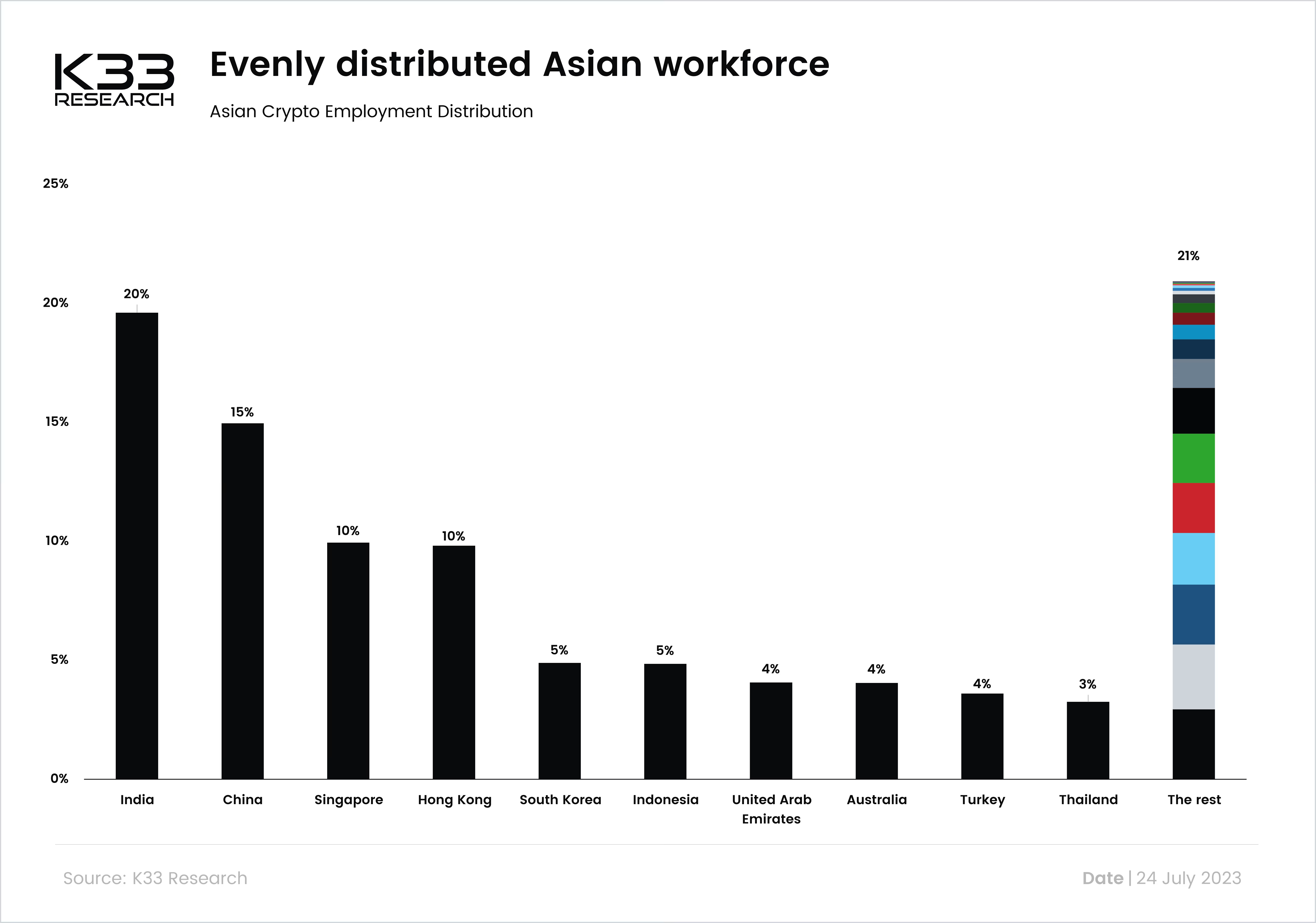

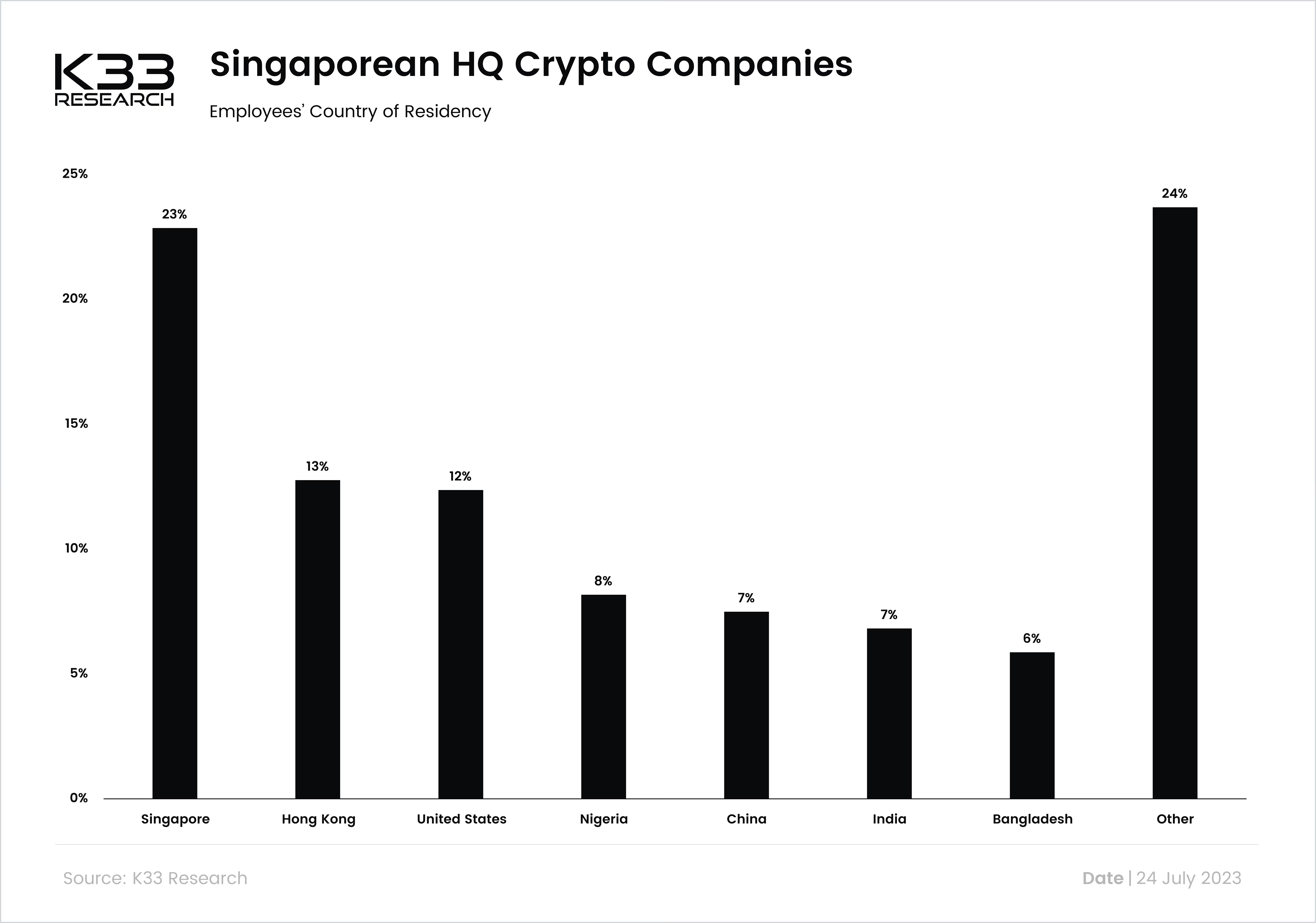

Singapore and Hong Kong are crypto hubs in Asia

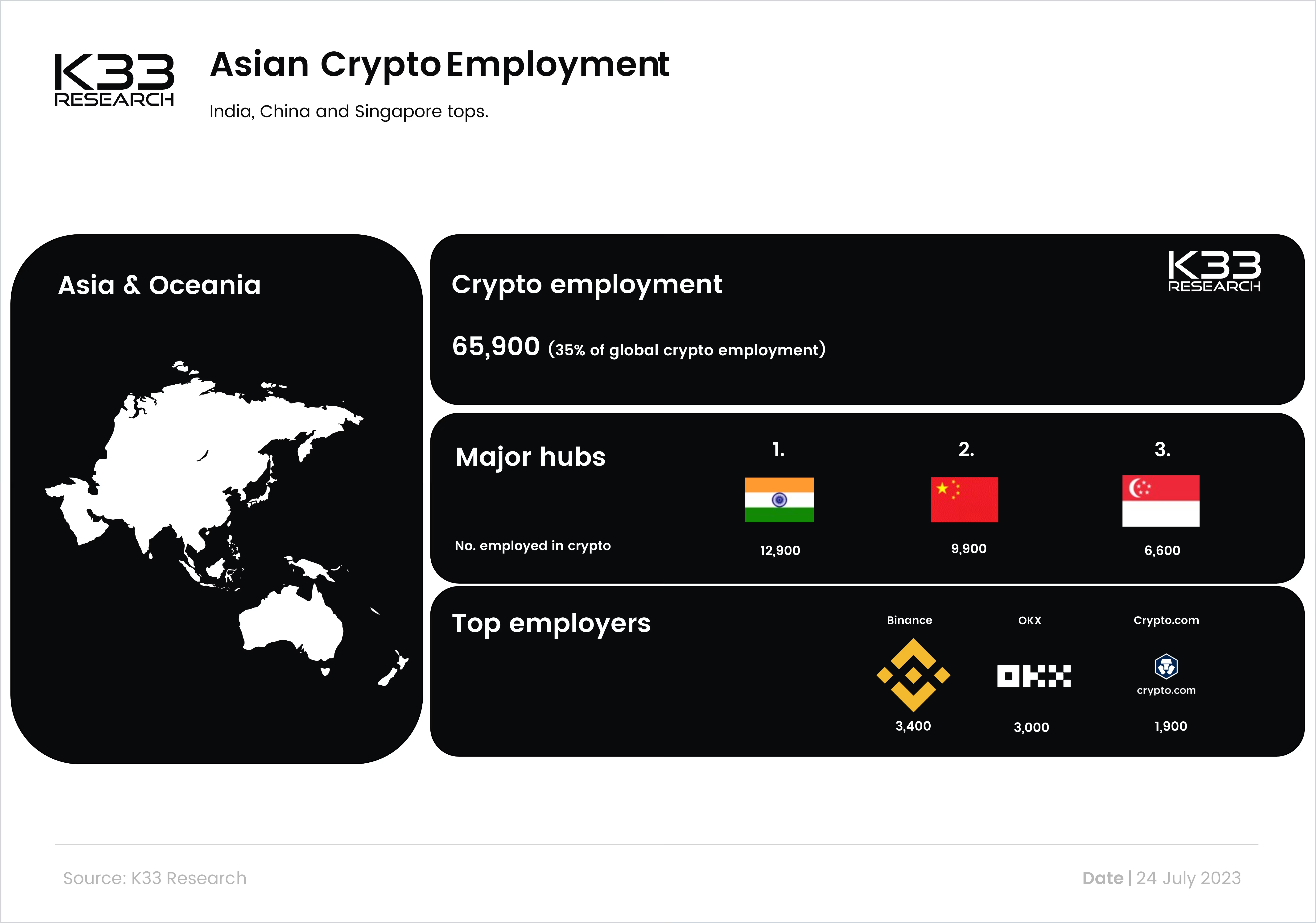

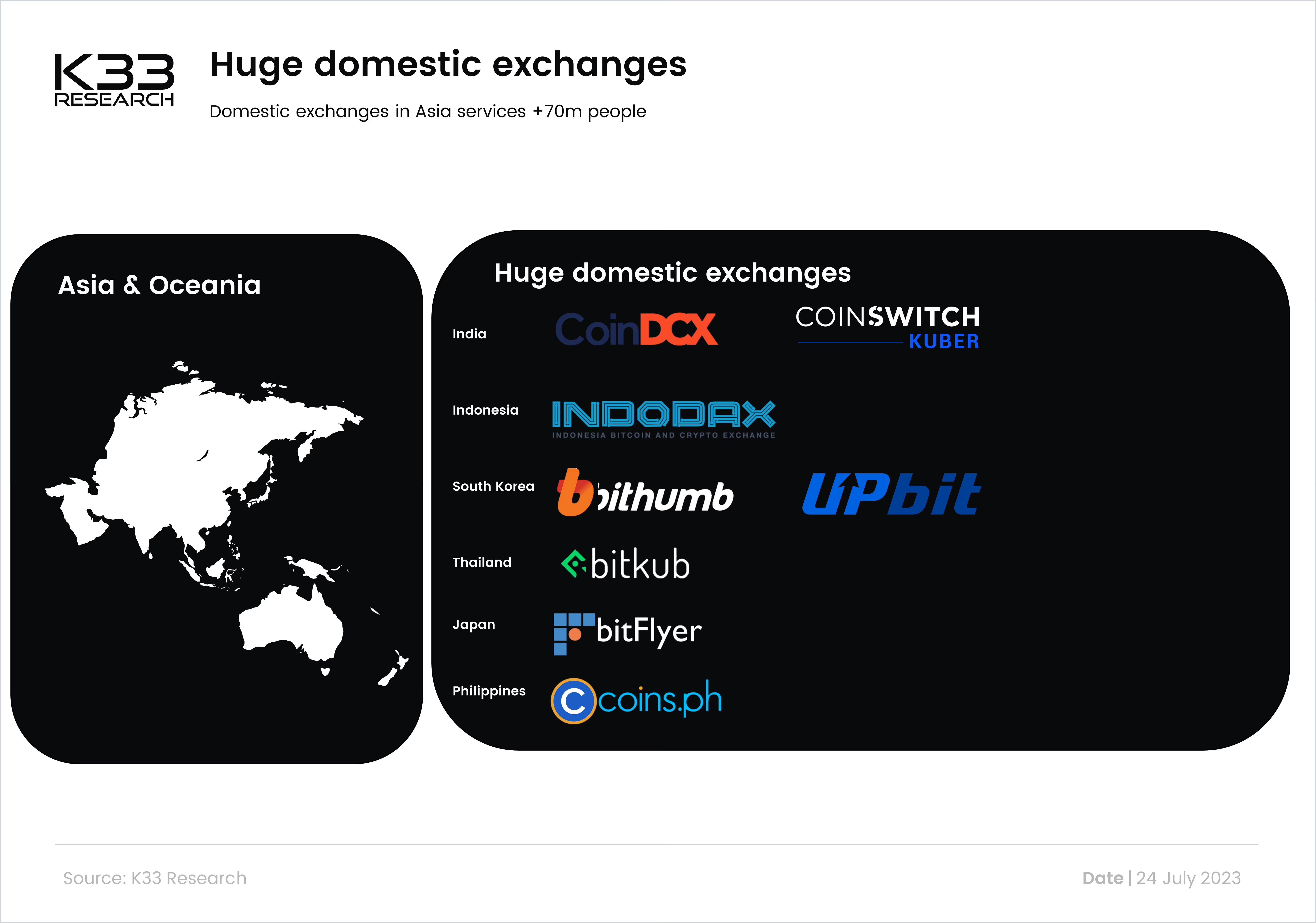

The two most populous countries dominate crypto employment in Asia. However, under the hood, Asia flourishes with uniqueness, with several countries seeing substantial employment within national exchanges and three distinct highly influential hubs facilitating infrastructure for the global crypto market.

Preview

Preview

Preview