Why file now?

The crypto industry is currently facing severe regulatory backlash, trading deeply below the peaks of 2021, while the current hands-on approach by the SEC has caused a standstill in terms of institutional activity in the market. At a glance, the timing seems odd. Nonetheless, there are multiple caveats to the timing of the filing.- The first mover advantage. The launch of ProShares BITO clearly illustrated the perks of being first to market. BITO saw inflows amounting to $1bn two days after launching, and to this day, BITO has a market share of 93% among the futures-based long BTC ETFs. We’re already seeing multiple participants re-filing their ETF applications following the BlackRock iShares filing.

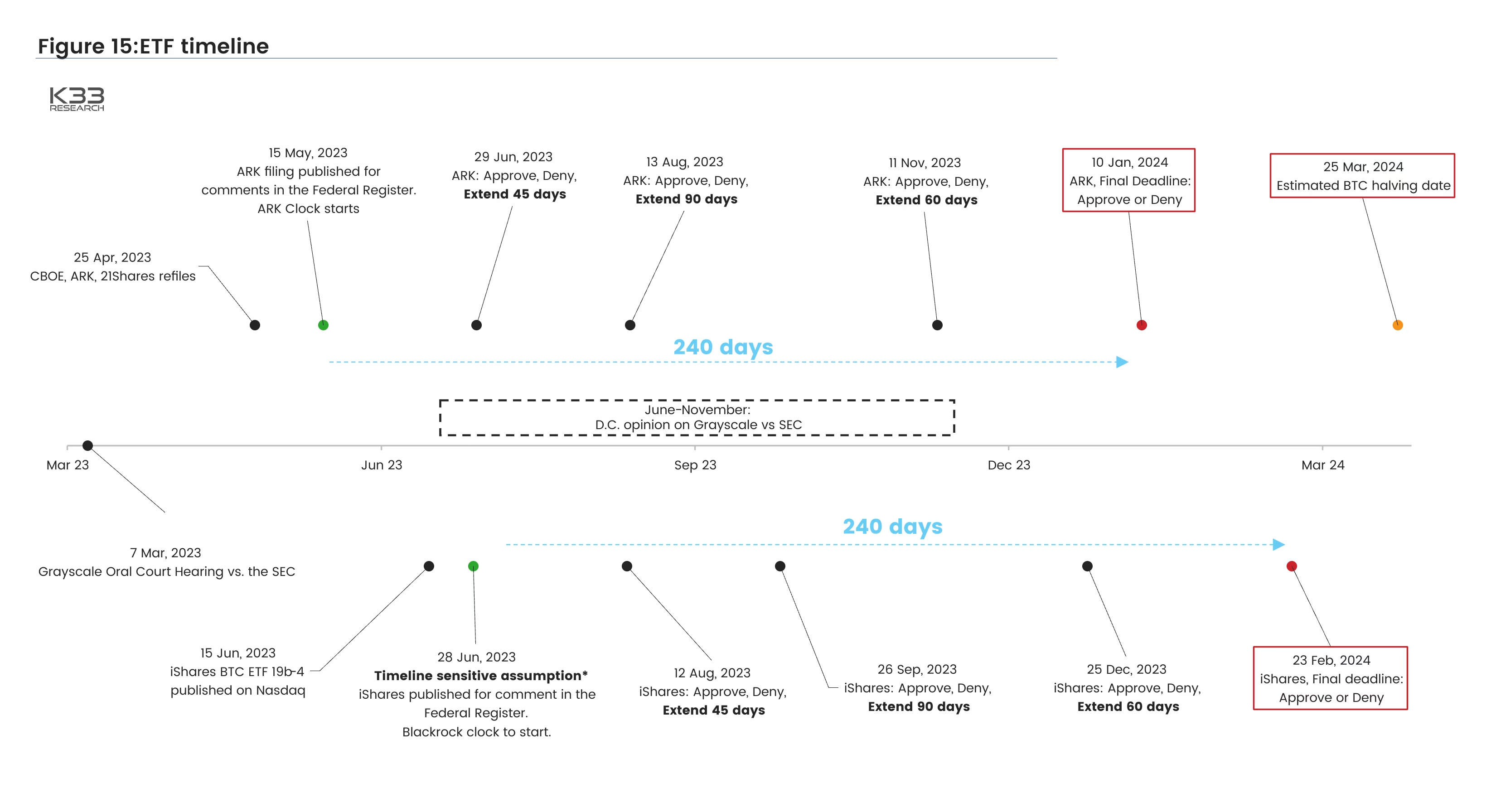

- The Grayscale vs. SEC lawsuit. A final verdict on Grayscale’s lawsuit against the SEC could come in the next few months. The core of Grayscale’s complaint is that the SEC acted capriciously and arbitrarily in approving futures-based ETFs while disapproving spot ETFs. The SEC was scrutinized in the D.C. court hearing, leading to enhanced expectations of a favorable Grayscale outcome. A Grayscale victory could reflect well on active ETF filings, albeit there is a chance that the SEC will find a way to moderate its arguments to disapprove the current filings. The final verdict is expected 3-6 months after the hearing. The hearing occurred on March 7, so a ruling could be near. With the recent BlackRock filing, all market participants should prepare for substantial volatility as the verdict is published.