September Outlook: The market is wronglg...

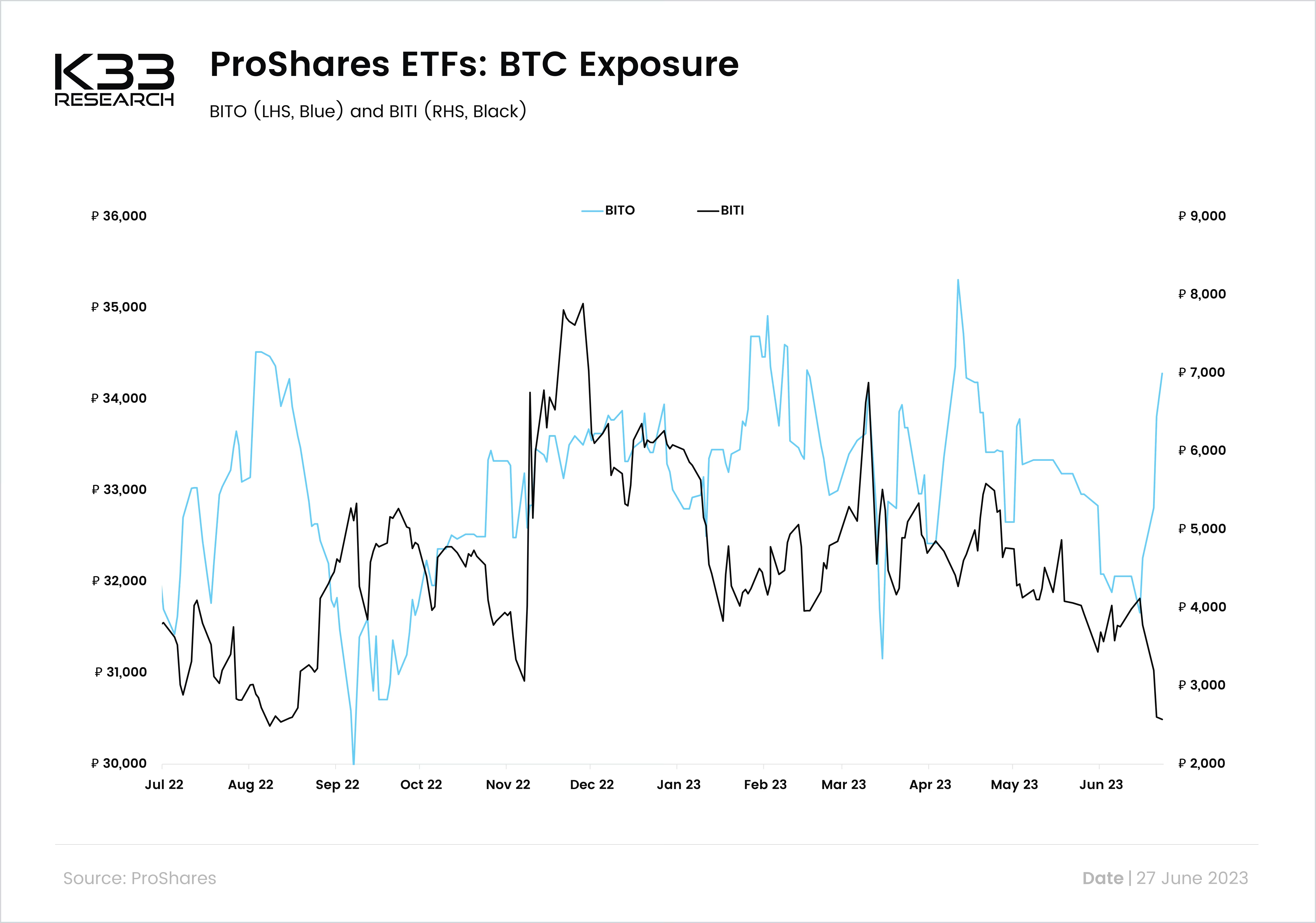

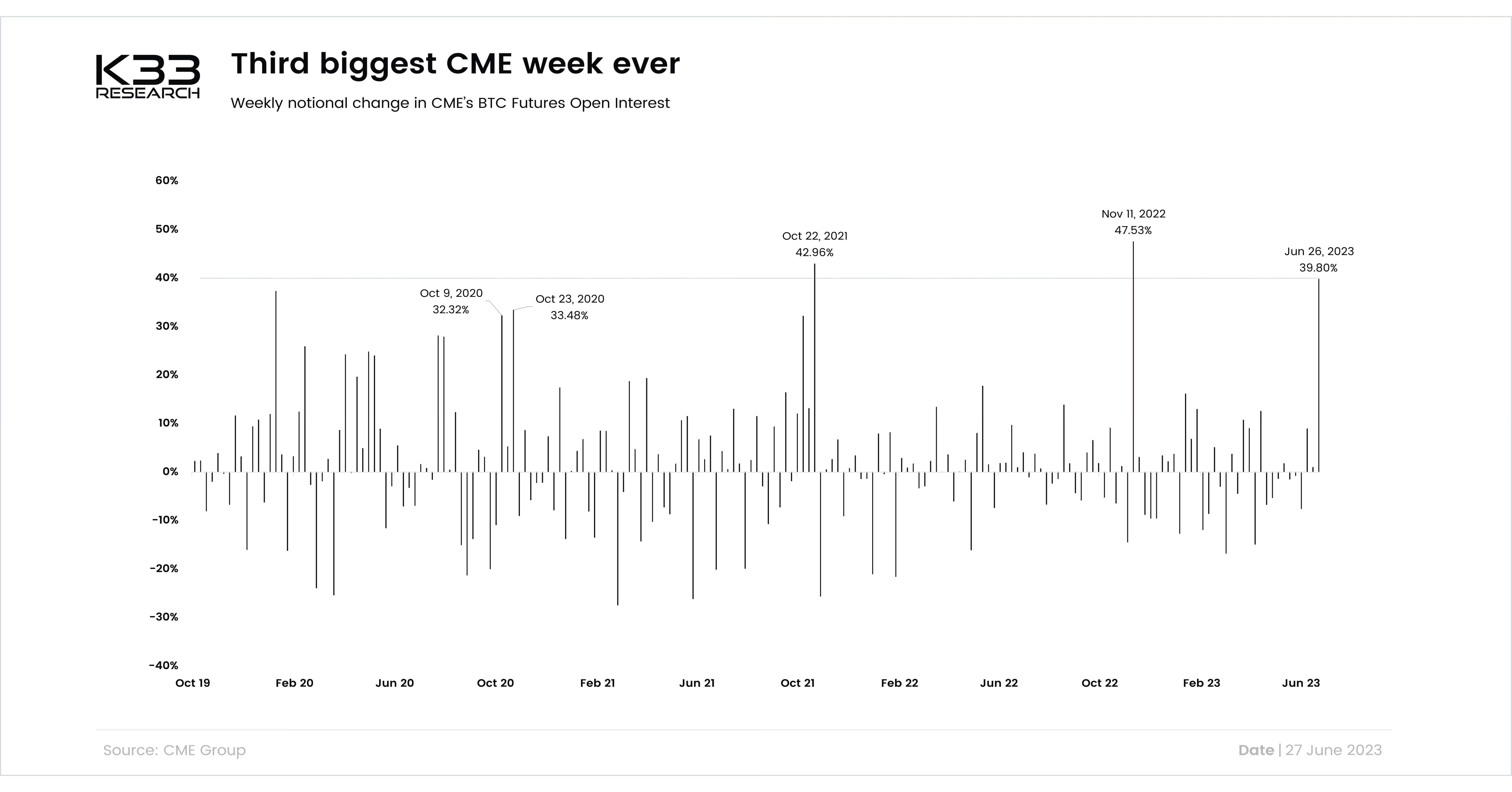

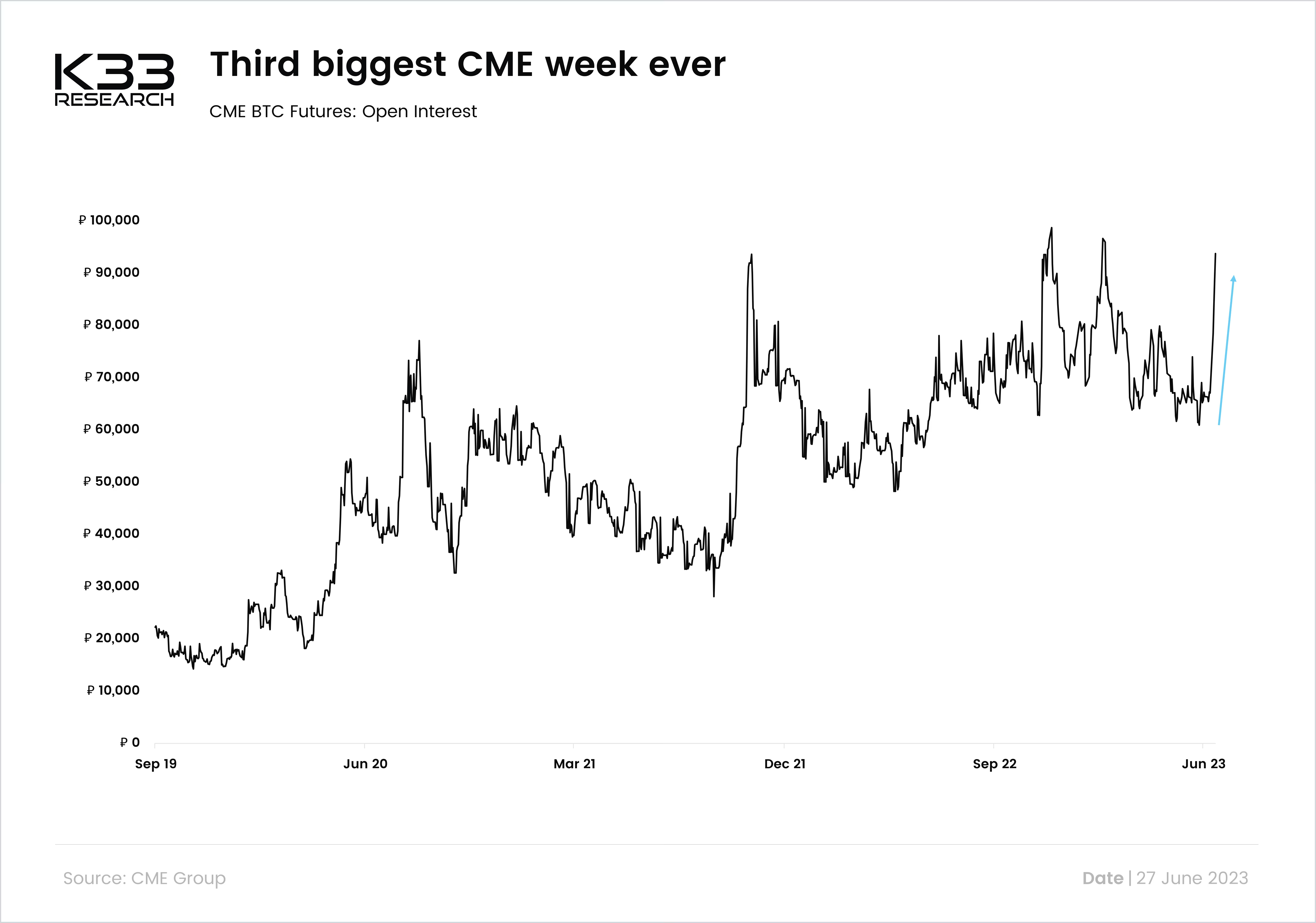

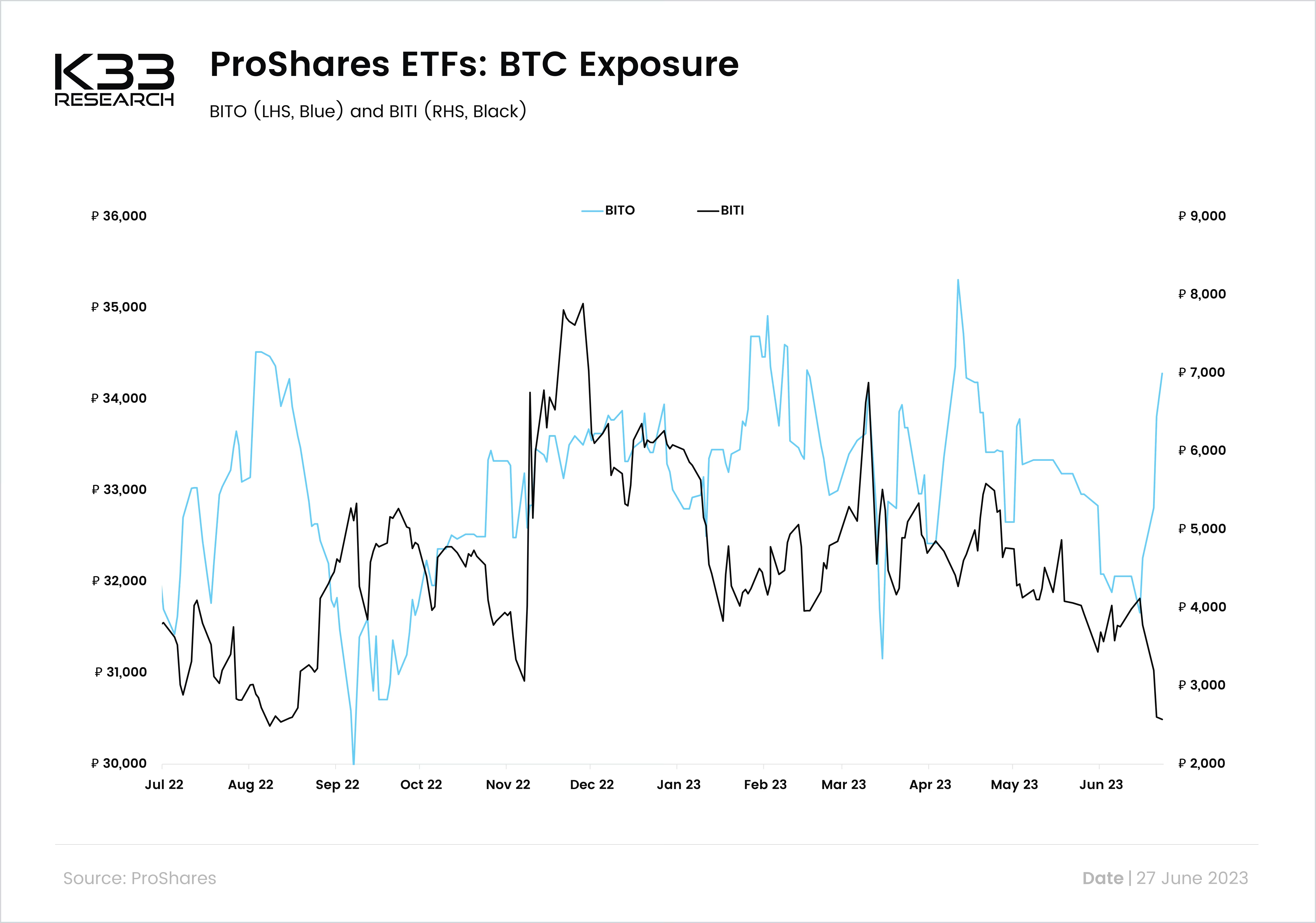

The market dramatically underestimates the impact of U.S. ETFs. A slow September favor strategic positioning ahead of an October packed with market-moving events. I favor a mix of increased ETH exposure and conservatively leveraged long exposure in BTC

lg...more