January Madness

We’re wrapping up an incredible and wild month. Trump launched a memecoin days before beginning his second term, and he has pulled forward initiatives to look into both regulation and a national digital asset stockpile. Bitcoin magically resurfaced to all-time highs on the inauguration day before facing rugged conditions in the following weeks. Markets, far broader than just the crypto markets, are coming to terms with the new administration, and frantic days of big volatility are upon us all.Trump = Volatile

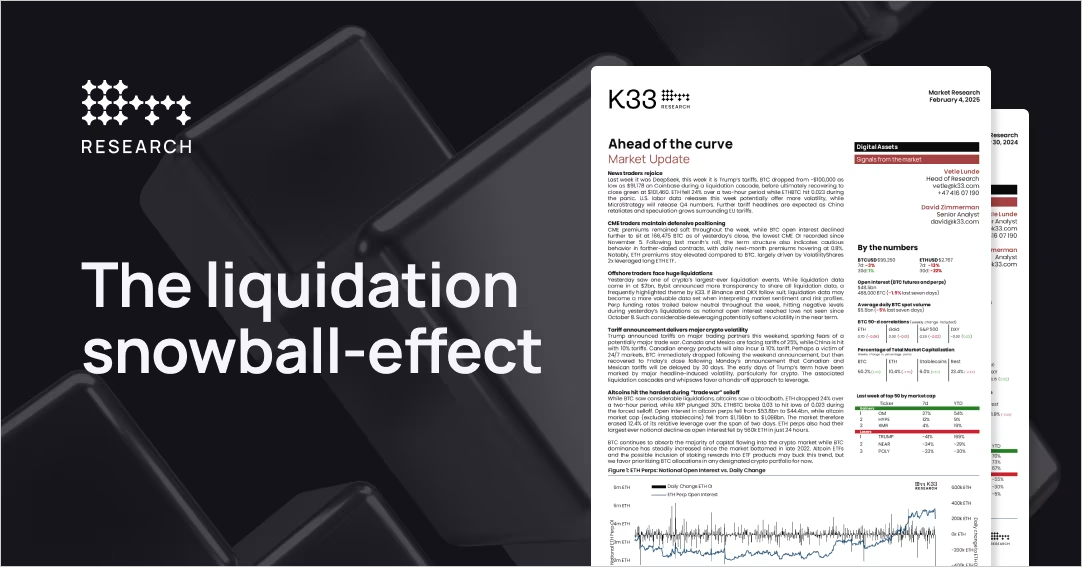

Volatility is a natural side effect of Trump’s return to the Oval Office. This weekend’s tariff developments made that abundantly clear. The market quickly resolved to panic mode and de-risked, as traders were uncomfortable taking on risk in unknown terrain. In all likelihood, global trade will stiffen further in the weeks to come with more tariffs in the books, and with that, traders should brace for new headline-related market swings in the foreseeable future.… but everything points toward Trump being positive for crypto

While we’ve seen a fair share of messy markets over the past weeks, the new administration cannot rationally be viewed as anything other than long-term bullish for the crypto sector. Virtually the entire administration holds a positive view of the crypto industry, and the regulatory outlook is very rosy. Further, the new administration has solidified the legitimacy of Bitcoin. Asset managers such as BlackRock made strides in improving the reputation of crypto in 2024. Now, a favorable policy outlook is making similar strides, leading the Czech central bank governor to aim for BTC reserves and Fed Chair Powell to remark that banks are perfectly able to serve crypto customers.We’ve already seen SAB 121 being revoked, and within the next half year, Trump’s digital asset working group will provide a report recommending regulatory steps ahead in addition to offering a recommendation on a national digital asset stockpile. Bitcoin is truly moving in a fundamentally positive direction, and advising anything other than holding long-term BTC exposure is ill-advised at best and ignorant at worst.Positive long term, but careful in the near term

Last month’s outlook was titled “Things Take Time”, and I stand by that message. The Digital Asset working group will spend 180 days sketching out its report; for now, we don’t know what they’ll recommend. There is an overlooked risk of U.S. BTC reserves shrinking from 198,109 BTC to 34,103 BTC between now and the report’s due date, as the treatment of current reserves has received no clarification from Trump. I land on this number simply by removing the 94,636 Bitfinex BTC, which may (should) be returned, and the 69,370 Silk Road BTC cleared for sale by the DOJ. Any movement of these coins is likely to be met by a furious market. In order to solidify a sizeable reserve upon the decision date, a public announcement on the status of the Silk Road coins would be both timely and reassuring.This is definitely not the time to be leveraged

Further, 180 days is a long period in any market and an eternity in the crypto market. Trump causes two phenomena in global markets: friction and unpredictability. Tariffs spilled over to crypto, leading ETH to see a brief and violent crash of 24% in 2 hours, with altcoin open interest imploding by 12% within the same window.Headlines, sentiment, and leverage are extreme volatility catalysts for the time being, and the crypto market is extremely sensitive. Intraday reversals are frequent, and within the jerky price pattern rests liquidated ghosts falling under the burden of bad risk management. In light of the current neurotic state of markets, you want to avoid marching into the unknown with liquidation risks hanging above you. Stay wise and chill in spot.Personally, I took it a step beyond avoiding leverage on inauguration day, selling BTC for USD. I’ve added some exposure back but intend to wait and see before deploying more capital. A temporary reversal toward former all-time highs of $75,000 is fully within reach in the coming months. It would be archetypical crypto, and also fill the post-Trump election CME gap.Simply put, I am not fond of the near-term uncertainty from tariffs and other potential policy curveballs and aim to hold my risk at moderate levels. While Trump was consistent in his first term, pointing fingers at the S&P 500 to showcase his success, the time for him to impose measures that spook markets is now, as he can still blame inheriting issues from the old administration. That said, through lenses longer than the coming months, the situation looks rosier than ever for BTC, and this is not the time to sit un-exposed.