In Short

BTC reclaimed $30k after a steady Easter ending with a strong push on Monday accompanied by burgeoning CME activity and offshore liquidations. The stage is set for a volatile Wednesday as Shanghai, CPI, and FOMC minutes all await.

Takeaways

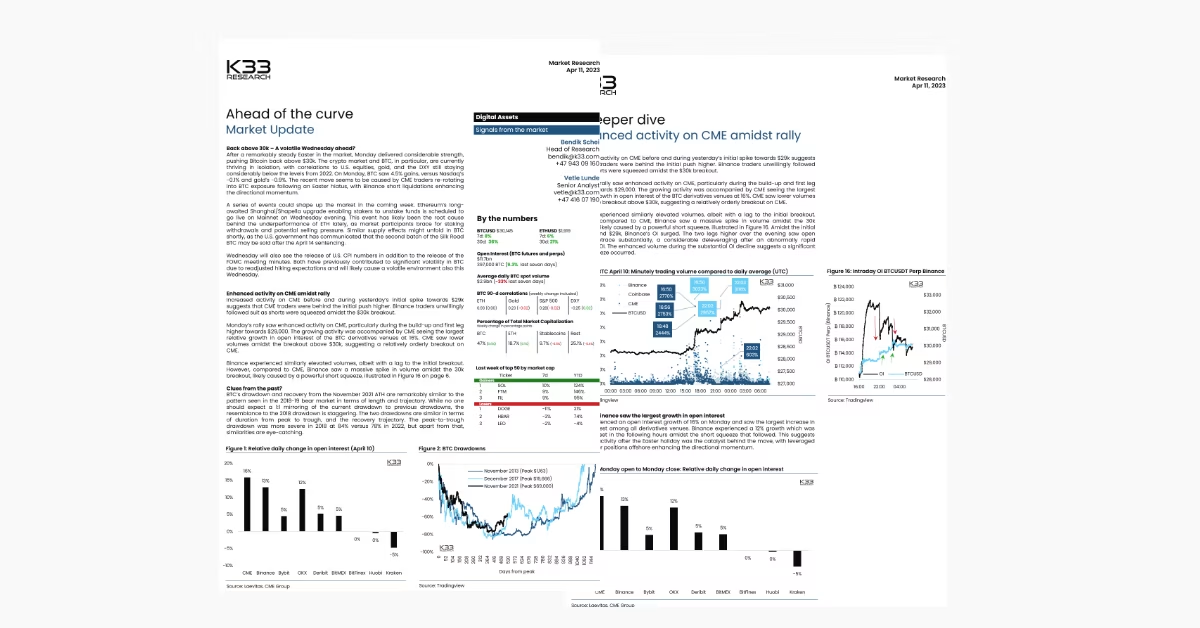

- Spot volumes near 1-year lows

- BTC surpasses $30k

- CME OI up 16% on Monday

- Funding rates still neutral

- Striking similarities between the current cycle and the 2018-19 cycle

After a remarkably steady Easter in the market, Monday delivered considerable strength, pushing Bitcoin back above $30k. The crypto market and BTC, in particular, are currently thriving in isolation, with correlations to U.S. equities, gold, and the DXY still staying considerably below the levels from 2022. On Monday, BTC saw 4.5% gains, versus Nasdaq’s -0.1% and gold’s -0.9%. The recent move seems to be caused by CME traders re-rotating into BTC exposure following an Easter hiatus, with Binance short liquidations enhancing the directional momentum.A volatile Wednesday ahead?