October Outlook: More Chop Ahead

A lackluster futures-based ETH ETF launch and a dearth of compelling narratives in Ethereum favor reduced ETH exposure. I anticipate ongoing October consolidation, extending the BTC accumulation window as medium-term fundamentals remain solid.After an underwhelming futures-based ETH ETF launch, continuously poor momentum, and a lack of compelling medium-term narratives in Ethereum, I no longer favor overweight ETH exposure. The gravitational pull in crypto for the time being stays in BTC, with a promising event horizon down the line, still favoring aggressive accumulation. However, early spot ETF delays and shallow activity point towards a prolonged consolidation period and a less hectic October than initially anticipated.

No longer overweight ETH

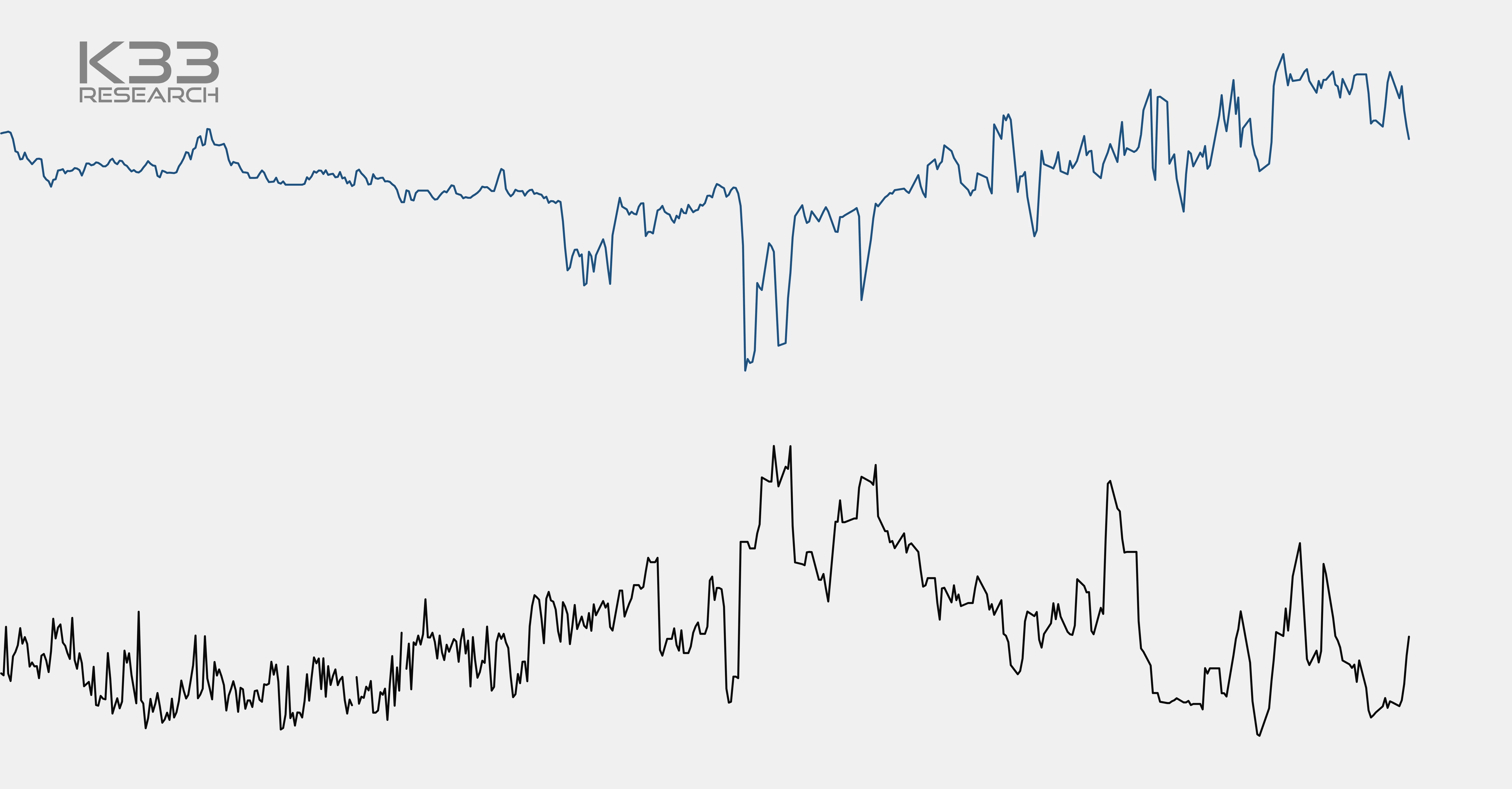

Crypto momentum has originated from BTC throughout 2023. Incidents of ETH outperformance have been few and far between. This is caused by many factors, such as collapsing NFT activity, increased L2 usage (reducing gas consumption and natural ETH demand), dampened DeFi activity, and a lack of compelling narratives after ETH’s PoS transition. As a consequence, ETHBTC has continuously bled throughout the year. Per my September thesis, ETH ETF launches represented a key opportunity for ETH to exhibit relative outperformance after its yearlong bleed versus BTC due to idiosyncratic ETH flows. From a risk-reward perspective, this led me to favor overweight ETH exposure for the short term, with ETHBTC trading at 0.063.

The constructive ETH view was firmly demolished by yesterday’s underwhelming Bakkt-esque ETF launch day, strongly missing my expectations. To contextualize, the launch of BITI – a short BTC ETF – attracted four times the trading volume of yesterday’s six ETH ETF launches combined. In other words, the market was four times more interested in shorting Bitcoin at $20,500 through hostile leveraged products than they were at allocating capital to ETH through an accessible but somewhat costly and inefficient futures-based wrapper at $1,700.

Arguments may correctly be presented that BITO and BITI launched amidst peak euphoria and despair, greatly enhancing their respective launch day volumes. To that regard, ETH’s apathetic launch strikes out as resolutely healthy for the market onwards, with no imminent signs of any form of exuberance present – an omen of prolonged chop if you like.Nevertheless, underwhelming flows shattered my ETF thesis, and while ETFs should be a long-term positive development for ETH, I no longer favor overweight ETH exposure for the short-term, taking the loss at 0.06 ETHBTC.

Gary Gensler cleared October’s event calendar – in September

October is shaping up to be calmer than expected, which sets the stage for more consolidation ahead. The SEC delayed all its BTC spot ETF decisions two weeks ahead of its deadline last week, drastically reducing the previously densely packed event calendar for October. October 13 remains the one date mark in your calendars this week, as it represents the SEC’s deadline to appeal to Grayscale’s court win, which again could alter spot ETF expectations.

Expanding the time window to accumulate BTC

A lack of near-term catalysts and devastating investment vehicle flows point towards consolidating markets remaining a key theme. An extended accumulation window should be useful for long-term investors as there is a clear asymmetry present between short-term fundamentals and long-term fundamentals. Spot ETF hearsay remains positive, and BTC is now half a year from its quadrennial halving event, both solid cases for building more BTC exposure while apathy reigns as the dominating market emotion.